Meyer Burger Investor Presentation

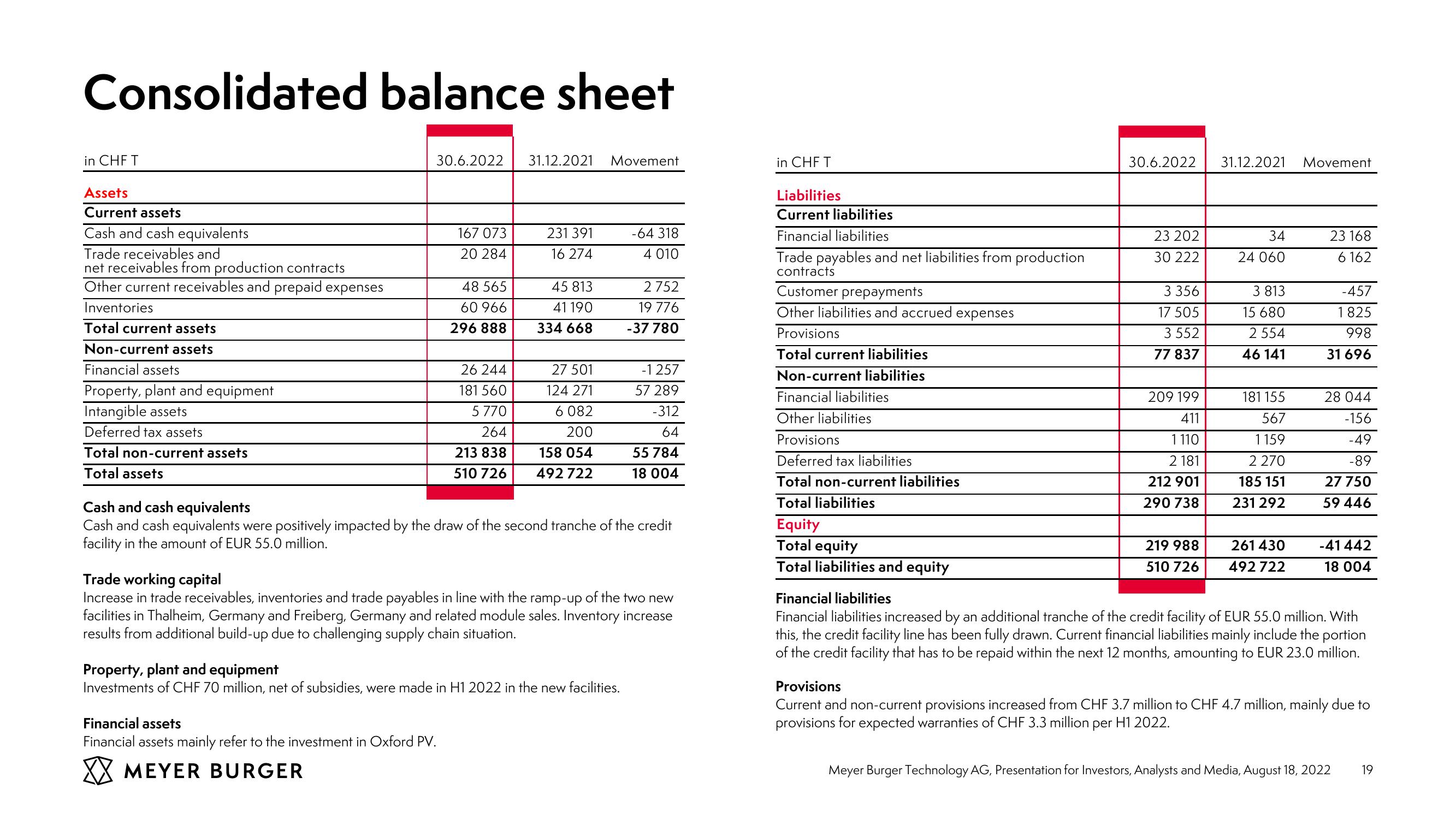

Consolidated balance sheet

in CHF T

Assets

Current assets

30.6.2022

31.12.2021 Movement

in CHF T

Liabilities

Current liabilities

30.6.2022

31.12.2021 Movement

Cash and cash equivalents

167 073

Trade receivables and

20 284

231 391

16 274

-64 318

Financial liabilities

23 202

34

23 168

4 010

net receivables from production contracts

Trade payables and net liabilities from production

contracts

30 222

24 060

6162

Other current receivables and prepaid expenses

48 565

45 813

2752

Customer prepayments

3 356

3 813

-457

Inventories

60 966

Total current assets

296 888

41 190

334 668

19 776

Other liabilities and accrued expenses

17 505

15 680

1825

-37 780

Provisions

3 552

2.554

998

Non-current assets

Financial assets

Property, plant and equipment

Intangible assets

Total current liabilities

Non-current liabilities

Financial liabilities

Other liabilities

77 837

46 141

31 696

Deferred tax assets

Total non-current assets

Total assets

26 244

181 560

27 501

124 271

-1 257

57 289

209 199

181 155

28 044

5 770

264

213 838

510 726

6082

200

158 054

492 722

-312

411

567

-156

64

Provisions

1110

1159

-49

55 784

18 004

Deferred tax liabilities

2 181

2 270

-89

Total non-current liabilities

212 901

185 151

27 750

Total liabilities

290 738

231 292

59 446

Equity

Cash and cash equivalents

Cash and cash equivalents were positively impacted by the draw of the second tranche of the credit

facility in the amount of EUR 55.0 million.

Trade working capital

Increase in trade receivables, inventories and trade payables in line with the ramp-up of the two new

facilities in Thalheim, Germany and Freiberg, Germany and related module sales. Inventory increase

results from additional build-up due to challenging supply chain situation.

Property, plant and equipment

Investments of CHF 70 million, net of subsidies, were made in H1 2022 in the new facilities.

Financial assets

Financial assets mainly refer to the investment in Oxford PV.

MEYER BURGER

Total equity

Total liabilities and equity

219 988

510 726

261 430

492 722

-41442

18 004

Financial liabilities

Financial liabilities increased by an additional tranche of the credit facility of EUR 55.0 million. With

this, the credit facility line has been fully drawn. Current financial liabilities mainly include the portion

of the credit facility that has to be repaid within the next 12 months, amounting to EUR 23.0 million.

Provisions

Current and non-current provisions increased from CHF 3.7 million to CHF 4.7 million, mainly due to

provisions for expected warranties of CHF 3.3 million

per H1 2022.

Meyer Burger Technology AG, Presentation for Investors, Analysts and Media, August 18, 2022

19View entire presentation