Stem SPAC Presentation Deck

stem Valuation Benchmarking (cont'd)

Valuation benchmarking (cont'd)

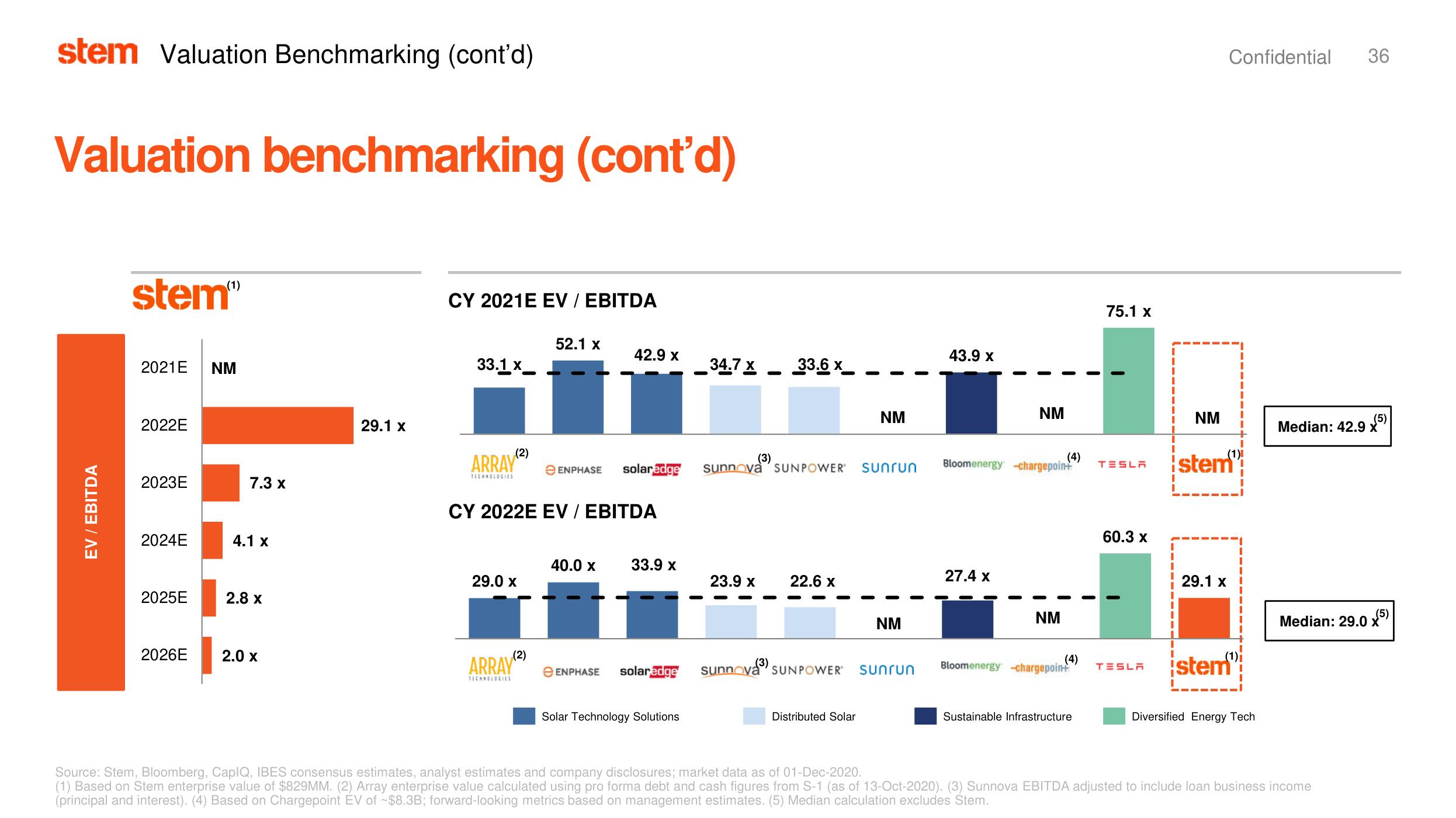

EV / EBITDA

stem"

2021E NM

2022E

2023E

2024E

2025E

2026E

7.3 x

4.1 x

2.8 x

2.0 x

29.1 x

CY 2021E EV / EBITDA

33.1 x

(2)

ARRAY

TECHNOLOGIES

29.0 x

(2)

52.1 x

ARRAY

TECHNOLOGIES

e ENPHASE

CY 2022E EV / EBITDA

40.0 X

42.9 x

e ENPHASE

solaredge

33.9 x

solaredge

Solar Technology Solutions

34.7 X

●

23.9 x

(3)

sunnova SUNPOWER

33.6 x

(3)

22.6 x

NM

Distributed Solar

sunrun

NM

sunnova SUNPOWER' sunrun

43.9 x

NM

27.4 x

Bloomenergy chargepoint

(4)

NM

(4)

Bloomenergy-chargepoint

Sustainable Infrastructure

75.1 x

TESLA

60.3 x

TESLA

NM

Confidential 36

stem

29.1 x

(1)

istem

Diversified Energy Tech

(5)

Median: 42.9 x

(5)

Median: 29.0 x

Source: Stem, Bloomberg, CapIQ, IBES consensus estimates, analyst estimates and company disclosures; market data as of 01-Dec-2020.

(1) Based on Stem enterprise value of $829MM. (2) Array enterprise value calculated using pro forma debt and cash figures from S-1 (as of 13-Oct-2020). (3) Sunnova EBITDA adjusted to include loan business income

(principal and interest). (4) Based on Chargepoint EV of ~$8.3B; forward-looking metrics based on management estimates. (5) Median calculation excludes Stem.View entire presentation