KKR Real Estate Finance Trust Results Presentation Deck

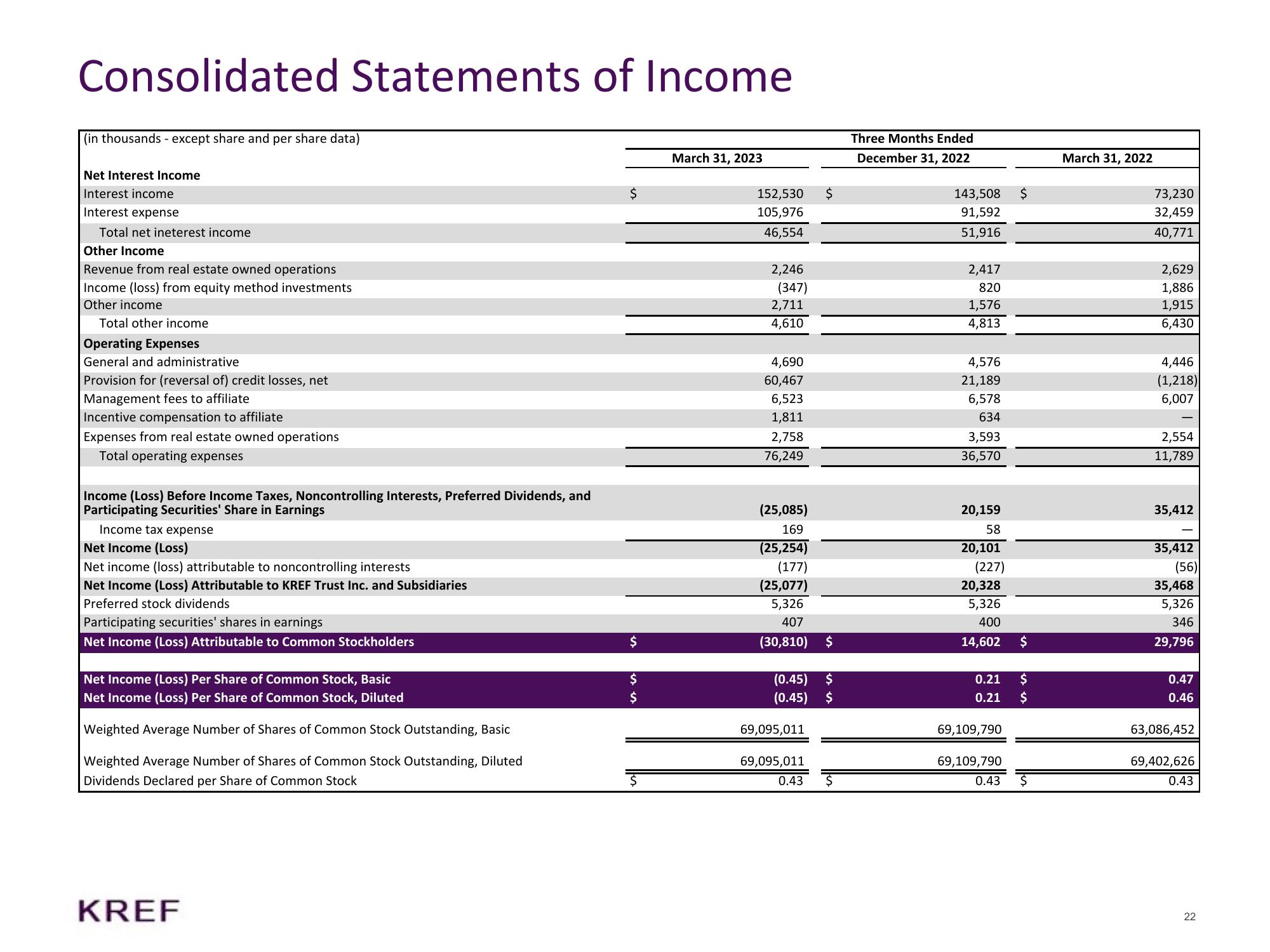

Consolidated Statements of Income

(in thousands - except share and per share data)

Net Interest Income

Interest income

Interest expense

Total net ineterest income

Other Income

Revenue from real estate owned operations

Income (loss) from equity method investments

Other income

Total other income

Operating Expenses

General and administrative

Provision for (reversal of) credit losses, net

Management fees to affiliate

Incentive compensation to affiliate

Expenses from real estate owned operations

Total operating expenses

Income (Loss) Before Income Taxes, Noncontrolling Interests, Preferred Dividends, and

Participating Securities' Share in Earnings

Income tax expense

Net Income (Loss)

Net income (loss) attributable to noncontrolling interests

Net Income (Loss) Attributable to KREF Trust Inc. and Subsidiaries

Preferred stock dividends

Participating securities' shares in earnings

Net Income (Loss) Attributable to Common Stockholders

Net Income (Loss) Per Share of Common Stock, Basic

Net Income (Loss) Per Share of Common Stock, Diluted

Weighted Average Number of Shares of Common Stock Outstanding, Basic

Weighted Average Number of Shares of Common Stock Outstanding, Diluted

Dividends Declared per Share of Common Stock

KREF

$

$

$

$

March 31, 2023

152,530

105,976

46,554

2,246

(347)

2,711

4,610

4,690

60,467

6,523

1,811

2,758

76,249

$

(25,085)

169

(25,254)

(177)

(25,077)

5,326

407

(30,810) $

(0.45) $

(0.45) $

69,095,011

69,095,011

0.43

Three Months Ended

December 31, 2022

143,508

91,592

51,916

2,417

820

1,576

4,813

4,576

21,189

6,578

634

3,593

36,570

20,159

58

20,101

(227)

20,328

5,326

400

14,602 $

0.21

0.21

69,109,790

69,109,790

0.43

$

$

March 31, 2022

73,230

32,459

40,771

2,629

1,886

1,915

6,430

4,446

(1,218)

6,007

2,554

11,789

35,412

35,412

(56)

35,468

5,326

346

29,796

0.47

0.46

63,086,452

69,402,626

0.43

22View entire presentation