OpenText Investor Day Presentation Deck

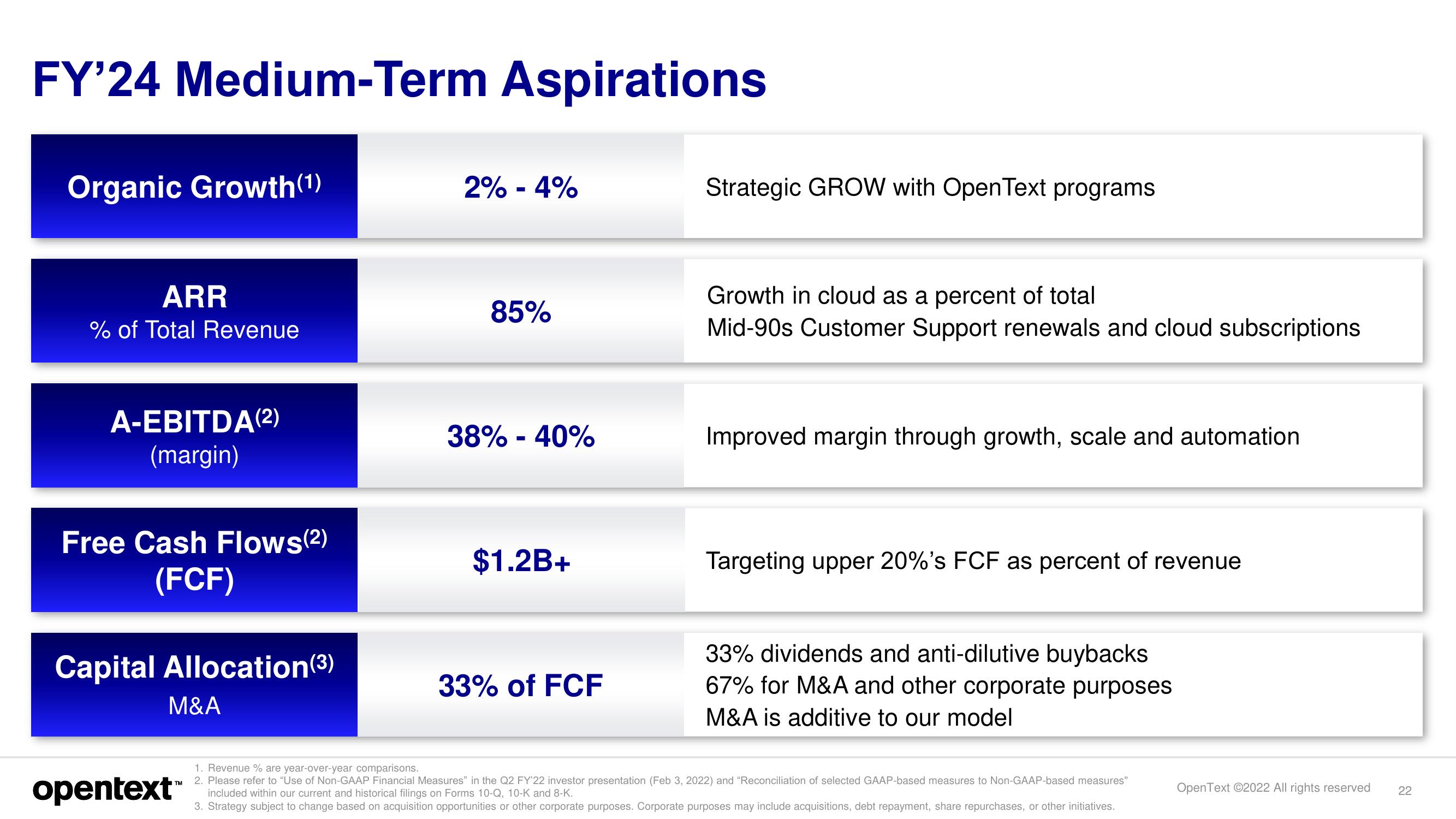

FY'24 Medium-Term Aspirations

Organic Growth(1)

ARR

% of Total Revenue

A-EBITDA(2)

(margin)

Free Cash Flows(2)

(FCF)

Capital Allocation (3)

M&A

opentext™

2% -4%

85%

38% -40%

$1.2B+

33% of FCF

Strategic GROW with OpenText programs

Growth in cloud as a percent of total

Mid-90s Customer Support renewals and cloud subscriptions

Improved margin through growth, scale and automation

Targeting upper 20%'s FCF as percent of revenue

33% dividends and anti-dilutive buybacks

67% for M&A and other corporate purposes

M&A is additive to our model

1. Revenue % are year-over-year comparisons.

2. Please refer to "Use of Non-GAAP Financial Measures" in the Q2 FY'22 investor presentation (Feb 3, 2022) and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures"

included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

3. Strategy subject to change based on acquisition opportunities or other corporate purposes. Corporate purposes may include acquisitions, debt repayment, share repurchases, or other initiatives.

OpenText ©2022 All rights reserved

22View entire presentation