Ares US Real Estate Opportunity Fund III

Hudson Rive

Frying Pan

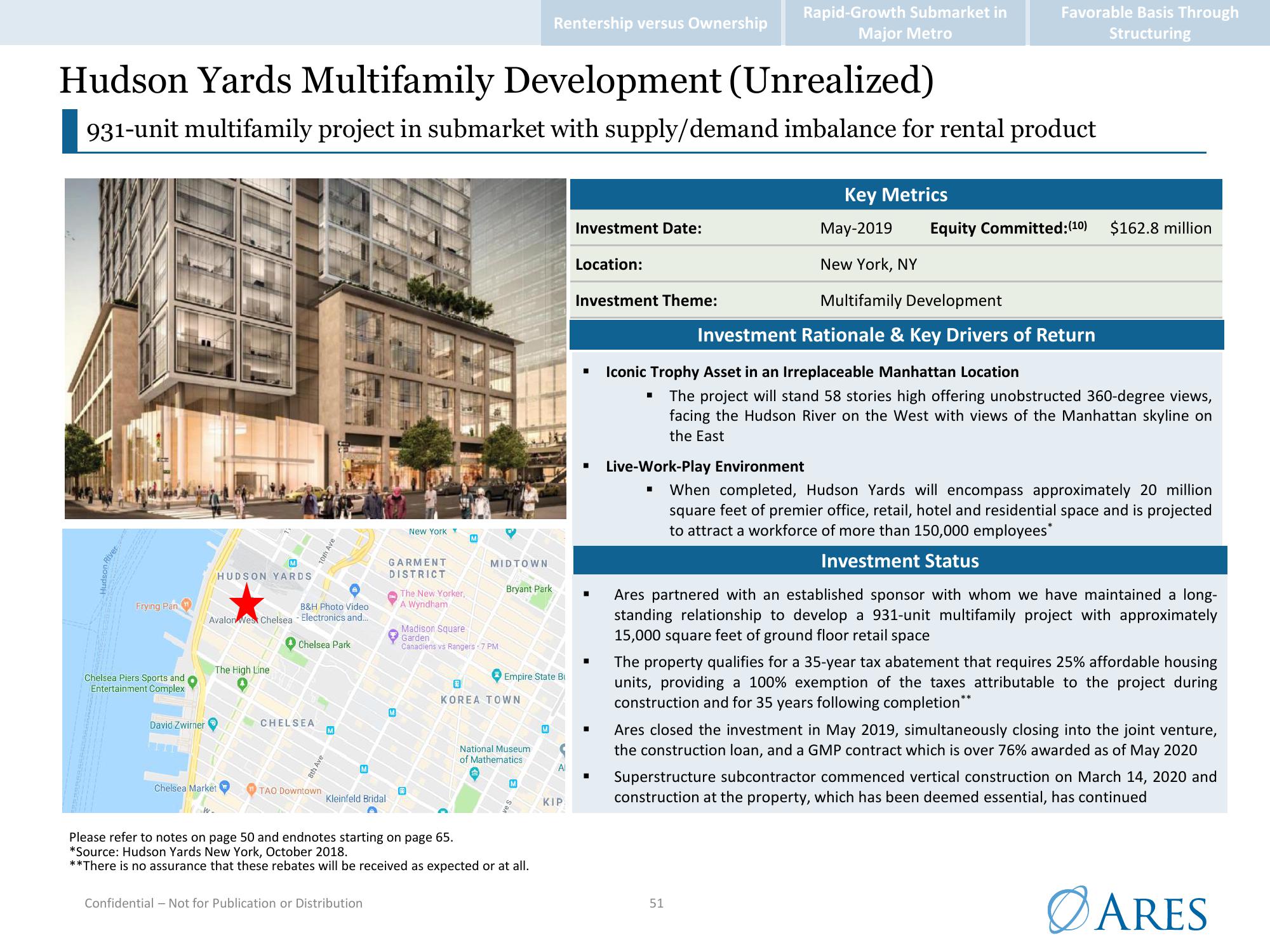

Hudson Yards Multifamily Development (Unrealized)

931-unit multifamily project in submarket with supply/demand imbalance for rental product

Chelsea Piers Sports and

Entertainment Complex

David Zwirner

M

HUDSON YARDS

B&H Photo Video

Avalon West Chelsea - Electronics and...

✪ Chelsea Park

The High Line

Chelsea Market

CHELSEA

8th Ave

10th Ave

TAO Downtown

M

M

Kleinfeld Bridal

Confidential - Not for Publication or Distribution

GARMENT

DISTRICT

M

New York

The New Yorker,

A Wyndham

Ⓡ

M

MIDTOWN

Madison Square

Garden

Canadiens vs Rangers 7 PM

Bryant Park

Empire State B

Ⓡ

KOREA TOWN

National Museum

of Mathematics

M

S

Please refer to notes on page 50 and endnotes starting on page 65.

*Source: Hudson Yards New York, October 2018.

**There is no assurance that these rebates will be received as expected or at all.

Rentership versus Ownership

M

Al

KIP

Investment Date:

Location:

Investment Theme:

■

■

■

■

■

Rapid-Growth Submarket in

Major Metro

■

Key Metrics

May-2019

New York, NY

Multifamily Development

Investment Rationale & Key Drivers of Return

Iconic Trophy Asset in an Irreplaceable Manhattan Location

Favorable Basis Through

Structuring

Live-Work-Play Environment

Equity Committed: (10)

51

$162.8 million

The project will stand 58 stories high offering unobstructed 360-degree views,

facing the Hudson River on the West with views of the Manhattan skyline on

the East

When completed, Hudson Yards will encompass approximately 20 million

square feet of premier office, retail, hotel and residential space and is projected

to attract a workforce of more than 150,000 employees*

Investment Status

Ares partnered with an established sponsor with whom we have maintained a long-

standing relationship to develop a 931-unit multifamily project with approximately

15,000 square feet of ground floor retail space

The property qualifies for a 35-year tax abatement that requires 25% affordable housing

units, providing a 100% exemption of the taxes attributable to the project during

construction and for 35 years following completion**

Ares closed the investment in May 2019, simultaneously closing into the joint venture,

the construction loan, and a GMP contract which is over 76% awarded as of May 2020

Superstructure subcontractor commenced vertical construction on March 14, 2020 and

construction at the property, which has been deemed essential, has continued

ARESView entire presentation