Embark Investor Presentation Deck

FINANCIAL FRAMEWORK

1)

2)

3)

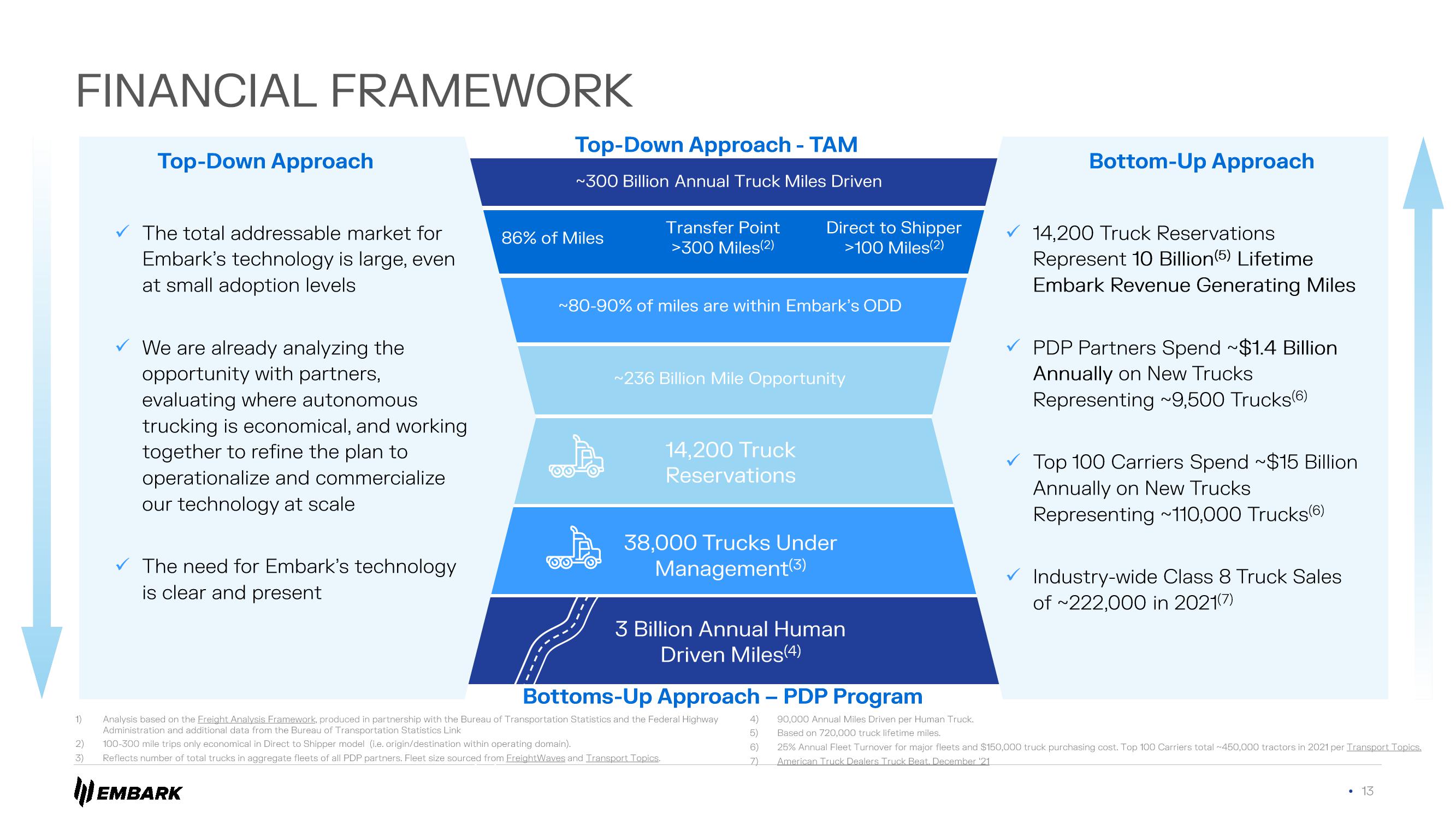

Top-Down Approach

The total addressable market for

Embark's technology is large, even

at small adoption levels

We are already analyzing the

opportunity with partners,

evaluating where autonomous

trucking is economical, and working

together to refine the plan to

operationalize and commercialize

our technology at scale.

The need for Embark's technology

is clear and present

Top-Down Approach - TAM

~300 Billion Annual Truck Miles Driven

EMBARK

86% of Miles

Transfer Point

>300 Miles(2)

~80-90% of miles are within Embark's ODD

Direct to Shipper

>100 Miles(2)

~236 Billion Mile Opportunity

14,200 Truck

Reservations

38,000 Trucks Under

Management (3)

3 Billion Annual Human

Driven Miles(4)

Analysis based on the Freight Analysis Framework, produced in partnership with the Bureau of Transportation Statistics and the Federal Highway

Administration and additional data from the Bureau of Transportation Statistics Link

100-300 mile trips only economical in Direct to Shipper model (i.e. origin/destination within operating domain).

Reflects number of total trucks in aggregate fleets of all PDP partners. Fleet size sourced from FreightWaves and Transport Topics.

Bottoms-Up Approach - PDP Program

4) 90,000 Annual Miles Driven per Human Truck.

(5)

Based on 720,000 truck lifetime miles.

6)

7)

Bottom-Up Approach

14,200 Truck Reservations

Represent 10 Billion(5) Lifetime

Embark Revenue Generating Miles

PDP Partners Spend ~$1.4 Billion

Annually on New Trucks

Representing ~9,500 Trucks(6)

Top 100 Carriers Spend ~$15 Billion

Annually on New Trucks

Representing ~110,000 Trucks(6)

Industry-wide Class 8 Truck Sales

of ~222,000 in 2021(7)

25% Annual Fleet Turnover for major fleets and $150,000 truck purchasing cost. Top 100 Carriers total ~450,000 tractors in 2021 per Transport Topics.

American Truck Dealers Truck Beat. December ¹21

• 13View entire presentation