Ocado Results Presentation Deck

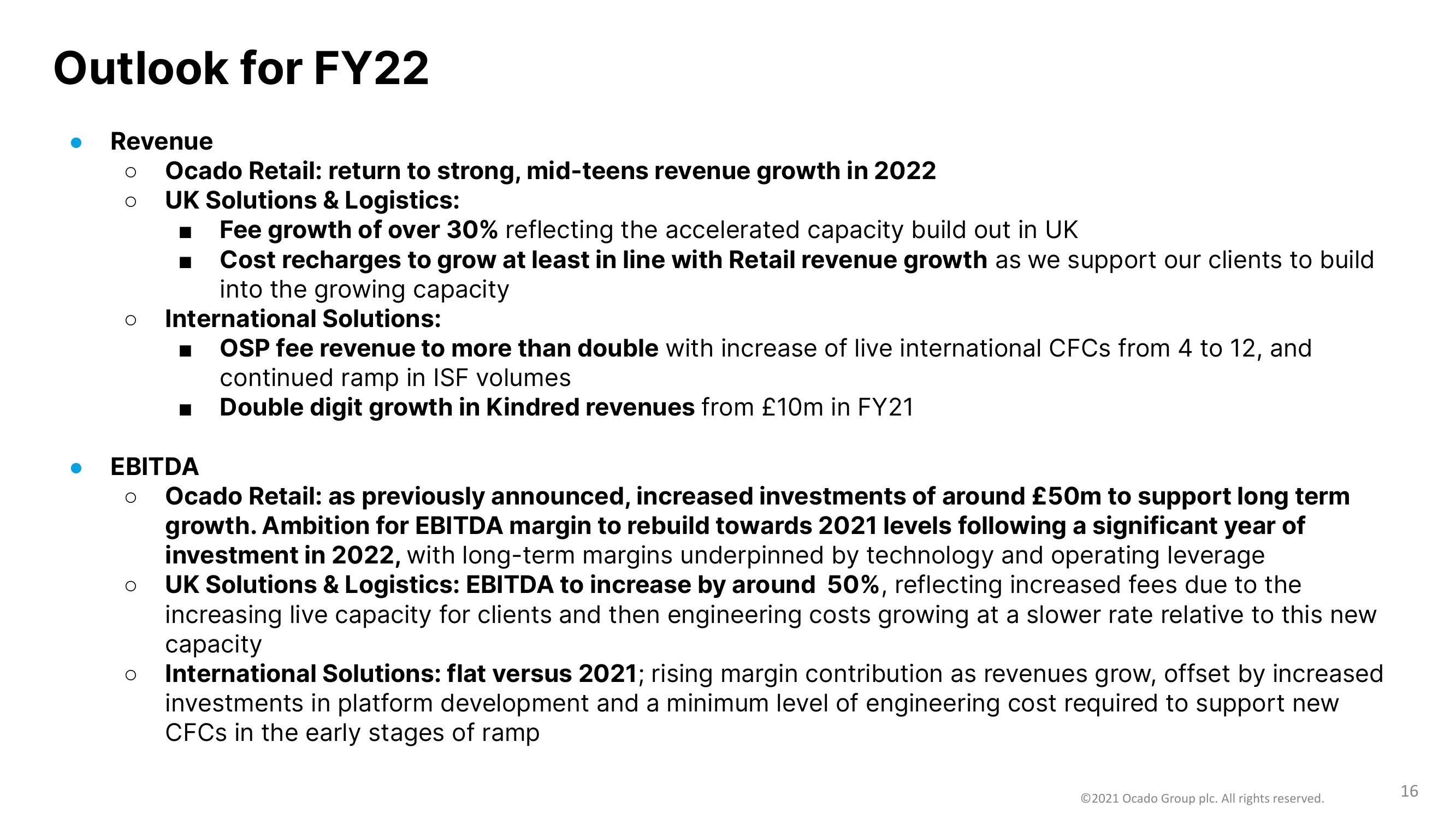

Outlook for FY22

Revenue

Ocado Retail: return to strong, mid-teens revenue growth in 2022

UK Solutions & Logistics:

Fee growth of over 30% reflecting the accelerated capacity build out in UK

Cost recharges to grow at least in line with Retail revenue growth as we support our clients to build

into the growing capacity

International Solutions:

EBITDA

O

OSP fee revenue to more than double with increase of live international CFCs from 4 to 12, and

continued ramp in ISF volumes

Double digit growth in Kindred revenues from £10m in FY21

Ocado Retail: as previously announced, increased investments of around £50m to support long term

growth. Ambition for EBITDA margin to rebuild towards 2021 levels following a significant year of

investment in 2022, with long-term margins underpinned by technology and operating leverage

UK Solutions & Logistics: EBITDA to increase by around 50%, reflecting increased fees due to the

increasing live capacity for clients and then engineering costs growing at a slower rate relative to this new

capacity

International Solutions: flat versus 2021; rising margin contribution as revenues grow, offset by increased

investments in platform development and a minimum level of engineering cost required to support new

CFCs in the early stages of ramp

Ⓒ2021 Ocado Group plc. All rights reserved.

16View entire presentation