Pershing Square Activist Presentation Deck

III. Pershing's Proposal to McDonald's:

McOpCo IPO

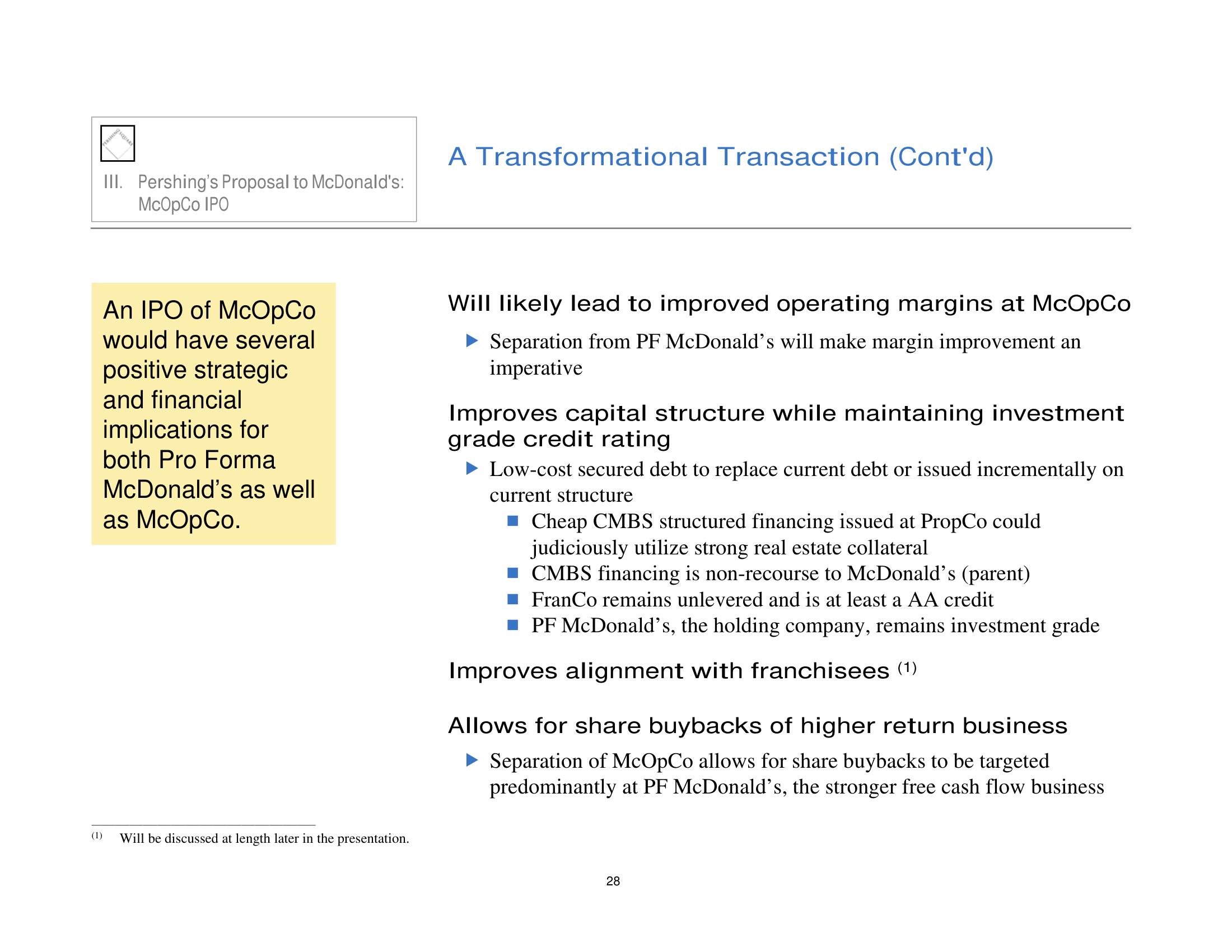

An IPO of McOpCo

would have several

positive strategic

and financial

implications for

both Pro Forma

McDonald's as well

as McOpCo.

(1) Will be discussed at length later in the presentation.

A Transformational Transaction (Cont'd)

Will likely lead to improved operating margins at McOpCo

Separation from PF McDonald's will make margin improvement an

imperative

Improves capital structure while maintaining investment

grade credit rating

► Low-cost secured debt to replace current debt or issued incrementally on

current structure

■ Cheap CMBS structured financing issued at PropCo could

judiciously utilize strong real estate collateral

CMBS financing is non-recourse to McDonald's (parent)

FranCo remains unlevered and is at least a AA credit

PF McDonald's, the holding company, remains investment grade

Improves alignment with franchisees (1)

Allows for share buybacks of higher return business

► Separation of McOpCo allows for share buybacks to be targeted

predominantly at PF McDonald's, the stronger free cash flow business

28View entire presentation