Melrose Results Presentation Deck

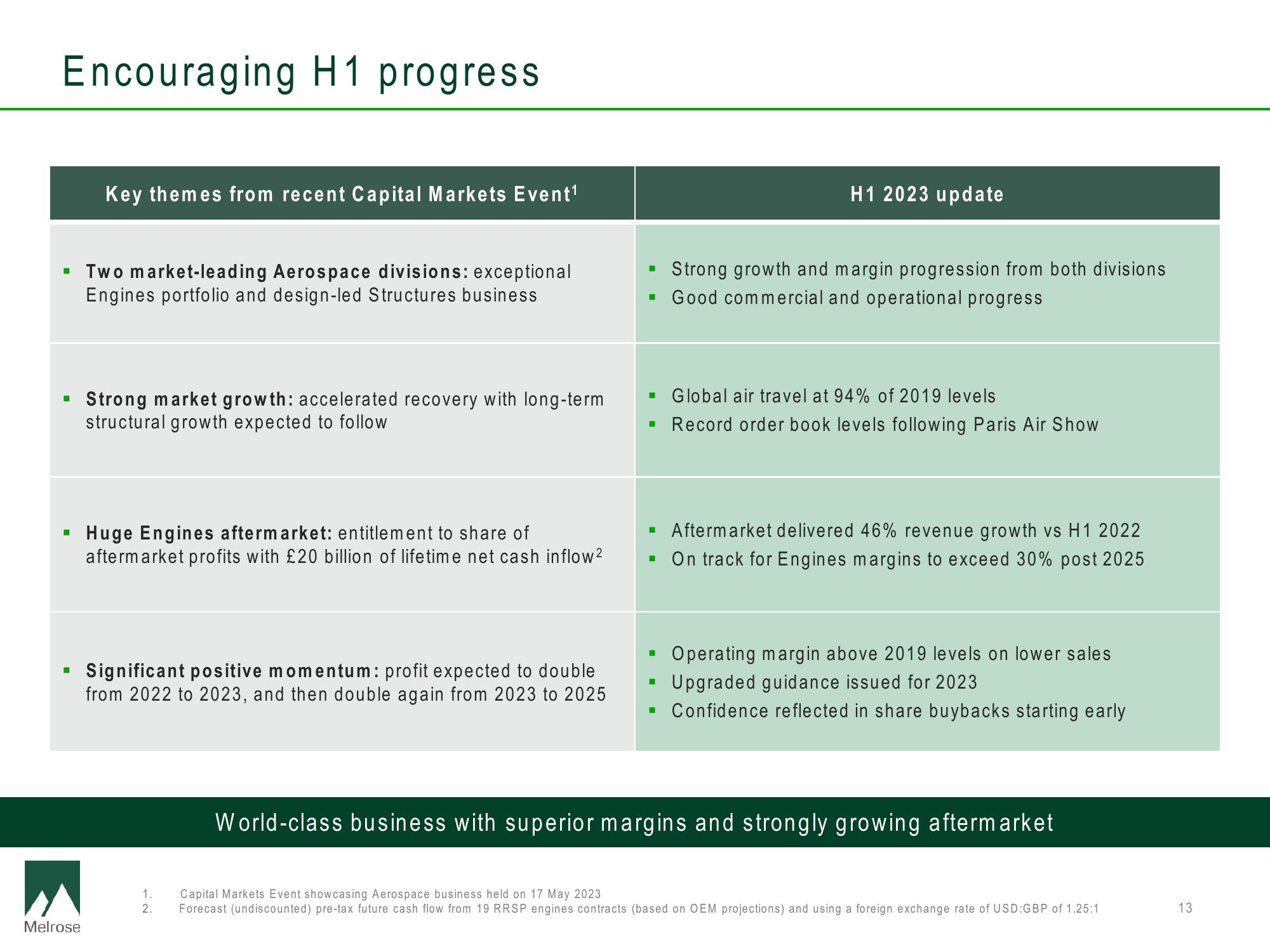

Encouraging H1 progress

▪ Two market-leading Aerospace divisions: exceptional

Engines portfolio and design-led Structures business

■

■

Key themes from recent Capital Markets Event¹

Melrose

Strong market growth: accelerated recovery with long-term

structural growth expected to follow

Huge Engines aftermarket: entitlement to share of

aftermarket profits with £20 billion of lifetime net cash inflow²

Significant positive momentum: profit expected to double

from 2022 to 2023, and then double again from 2023 to 2025

1.

2.

I

Strong growth and margin progression from both divisions

▪ Good commercial and operational progress

■

■

H1 2023 update

■

Aftermarket delivered 46% revenue growth vs H1 2022

▪ On track for Engines margins to exceed 30% post 2025

■

Global air travel at 94% of 2019 levels

Record order book levels following Paris Air Show

Operating margin above 2019 levels on lower sales

Upgraded guidance issued for 2023

Confidence reflected in share buybacks starting early

World-class business with superior margins and strongly growing aftermarket

Capital Markets Event showcasing Aerospace business held on 17 May 2023

Forecast (undiscounted) pre-tax future cash flow from 19 RRSP engines contracts (based on OEM projections) and using a foreign exchange rate of USD GBP of 1.25:1

13View entire presentation