Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

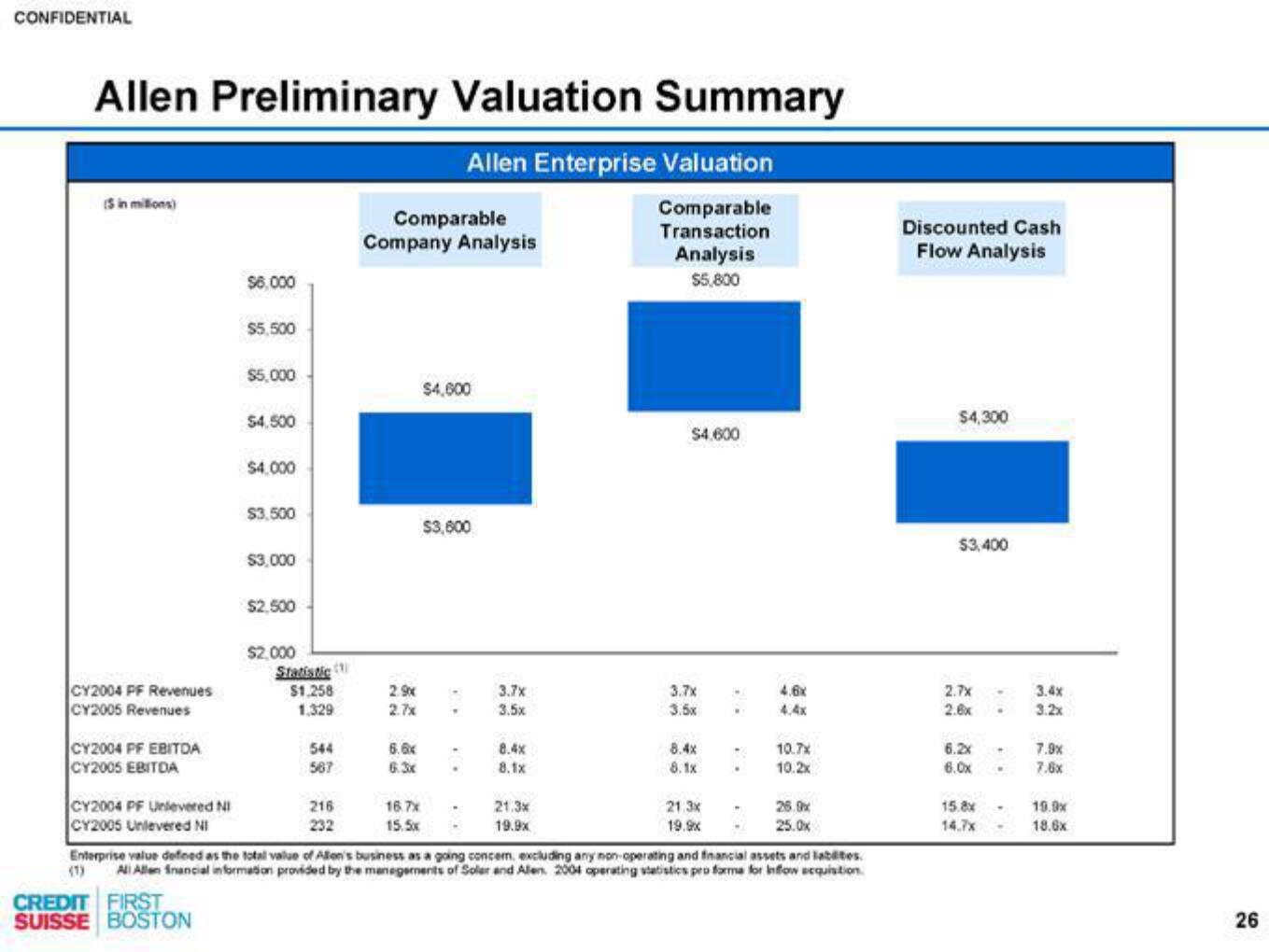

Allen Preliminary Valuation Summary

Allen Enterprise Valuation

Comparable

Transaction

Analysis

$5,800

(5 in millions)

CY2004 PF Revenues

CY2005 Revenues

CY2004 PF EBITDA

CY2005 EBITDA

CY2004 PF Unlevered Ni

CY2005 Unlevered NI

$6,000

$5,500

$5,000

$4.500

$4,000

$3,500

$3,000

$2,500

$2.000

Statistic

$1.258

1.329

544

567

216

232

Comparable

Company Analysis

2.9x

2.7x

6.6x

16.7x

155

$4,600

$3,600

.

3.7x

3.5x

8.4x

8.1x

21.3x

19.9x

$4,600

3.7x

3.5x

8.4x

8.1x

21.3x

19.9x

.

4.6x

4.4x

10.7x

10.2x

26.9x

25.0x

Enterprise value defined as the total value of Allen's business as a going concem, excluding any non-operating and financial assets and labates.

All Allen financial information provided by the managements of Soler and Alen. 2004 operating statistics pro forma for Infow acquisition

CREDIT FIRST

SUISSE BOSTON

Discounted Cash

Flow Analysis

$4,300

$3,400

2.7x

2.6x

6.2x

6.0x

15.8x

14.7x

3.4x

3.2x

7.9x

7.6x

19.9x

18.6x

26View entire presentation