Wix Results Presentation Deck

leverage our relationships with third party cloud hosting providers to quickly

and efficiently scale our capacity against the demands from our rapidly

growing user base. Further, because we do not operate data centers internally,

we do not have any depreciation expenses in cost of revenue for server

hardware. As a result, we continue to deliver best in class gross margins.

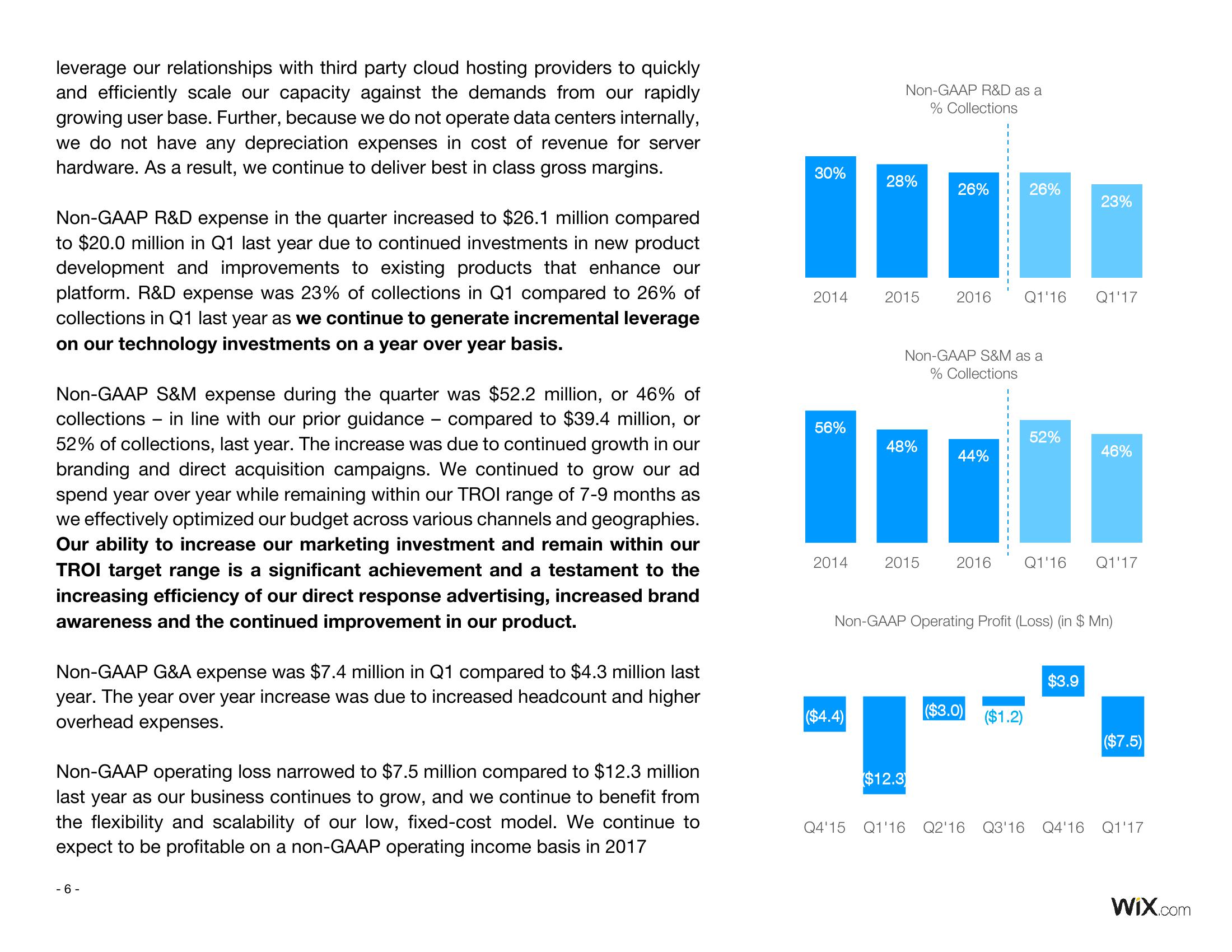

Non-GAAP R&D expense in the quarter increased to $26.1 million compared

to $20.0 million in Q1 last year due to continued investments in new product

development and improvements to existing products that enhance our

platform. R&D expense was 23% of collections in Q1 compared to 26% of

collections in Q1 last year as we continue to generate incremental leverage

on our technology investments on a year over year basis.

-

Non-GAAP S&M expense during the quarter was $52.2 million, or 46% of

collections in line with our prior guidance – compared to $39.4 million, or

52% of collections, last year. The increase was due to continued growth in our

branding and direct acquisition campaigns. We continued to grow our ad

spend year over year while remaining within our TROI range of 7-9 months as

we effectively optimized our budget across various channels and geographies.

Our ability to increase our marketing investment and remain within our

TROI target range is a significant achievement and a testament to the

increasing efficiency of our direct response advertising, increased brand

awareness and the continued improvement in our product.

-

Non-GAAP G&A expense was $7.4 million in Q1 compared to $4.3 million last

year. The year over year increase was due to increased headcount and higher

overhead expenses.

Non-GAAP operating loss narrowed to $7.5 million compared to $12.3 million

last year as our business continues to grow, and we continue to benefit from

the flexibility and scalability of our low, fixed-cost model. We continue to

expect to be profitable on a non-GAAP operating income basis in 2017

- 6-

30%

2014

56%

2014

($4.4)

Non-GAAP R&D as a

% Collections

28%

2015

48%

2015

$12.3

26%

Non-GAAP S&M as a

% Collections

Q4'15 Q1'16

26%

2016 Q1'16 Q1'17

44%

52%

Non-GAAP Operating Profit (Loss) (in $ Mn)

($3.0) ($1.2)

23%

2016 Q1'16 Q1'17

46%

$3.9

($7.5)

Q2'16 Q3'16 Q4'16 Q1'17

WIX.comView entire presentation