Melrose Results Presentation Deck

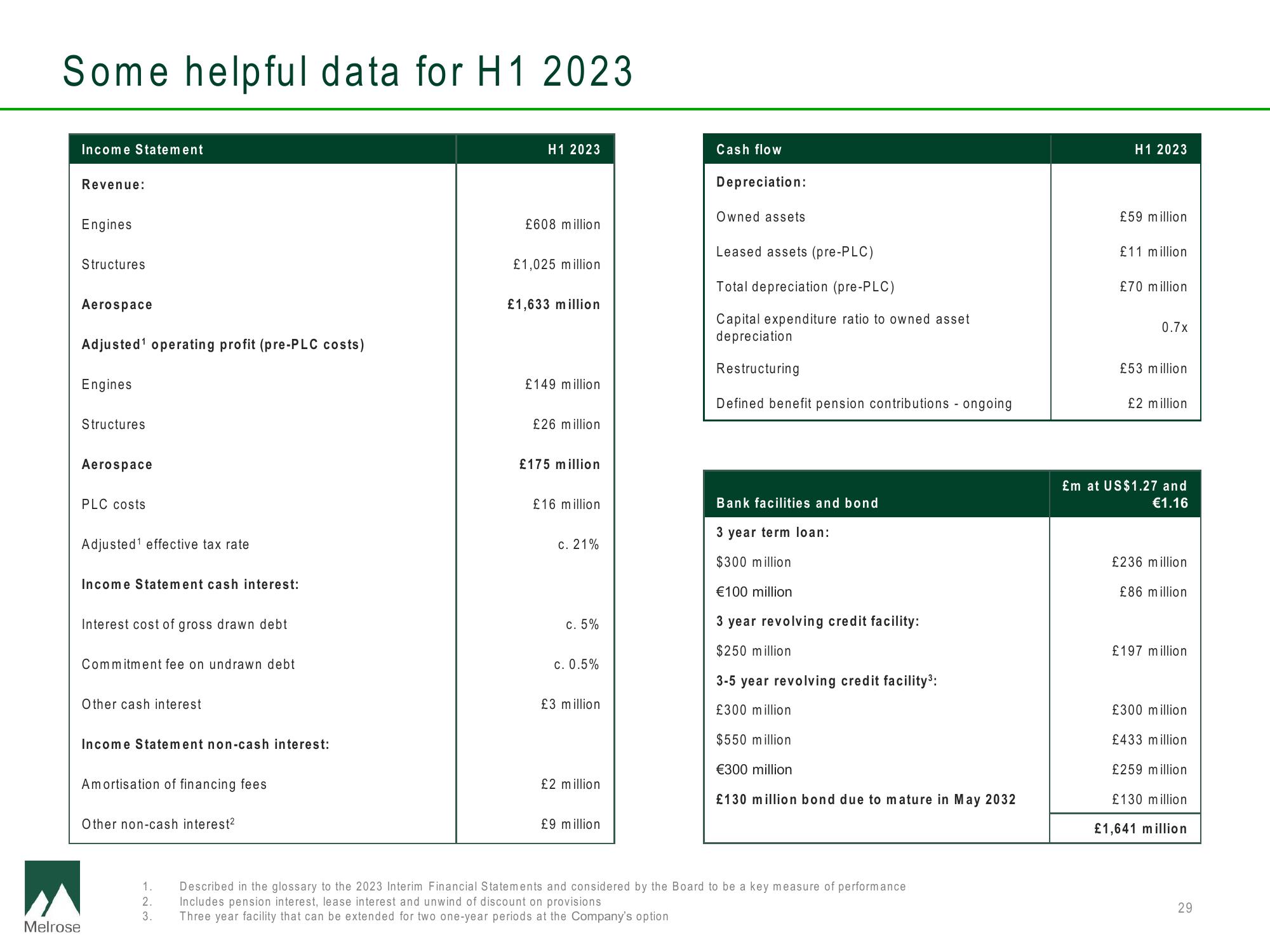

Some helpful data for H1 2023

Melrose

Income Statement

Revenue:

Engines

Structures

Aerospace

Adjusted¹ operating profit (pre-PLC costs)

Engines

Structures

Aerospace

PLC costs

Adjusted¹ effective tax rate

Income Statement cash interest:

Interest cost of gross drawn debt

Commitment fee on undrawn debt

Other cash interest

Income Statement non-cash interest:

Amortisation of financing fees

Other non-cash interest²

1.

2.

3.

H1 2023

£608 million

£1,025 million

£1,633 million

£149 million

£26 million

£175 million

£16 million

c. 21%

c. 5%

c. 0.5%

£3 million

£2 million

£9 million

Cash flow

Depreciation:

Owned assets.

Leased assets (pre-PLC)

Total depreciation (pre-PLC)

Capital expenditure ratio to owned asset

depreciation

Restructuring

Defined benefit pension contributions - ongoing

Bank facilities and bond

3 year term loan:

$300 million.

€100 million

3 year revolving credit facility:

$250 million

3-5 year revolving credit facility³:

£300 million

$550 million

€300 million

£130 million bond due to mature in May 2032

Described in the glossary to the 2023 Interim Financial Statements and considered by the Board to be a key measure of performance

Includes pension interest, lease interest and unwind of discount on provisions

Three year facility that can be extended for two one-year periods at the Company's option

H1 2023

£59 million

£11 million

£70 million

0.7x

£53 million

£2 million.

£m at US$1.27 and

€1.16

£236 million

£86 million

£197 million

£300 million

£433 million

£259 million

£130 million

£1,641 million

29View entire presentation