BlackRock Global Long/Short Credit Absolute Return Credit

How to Implement GLSC

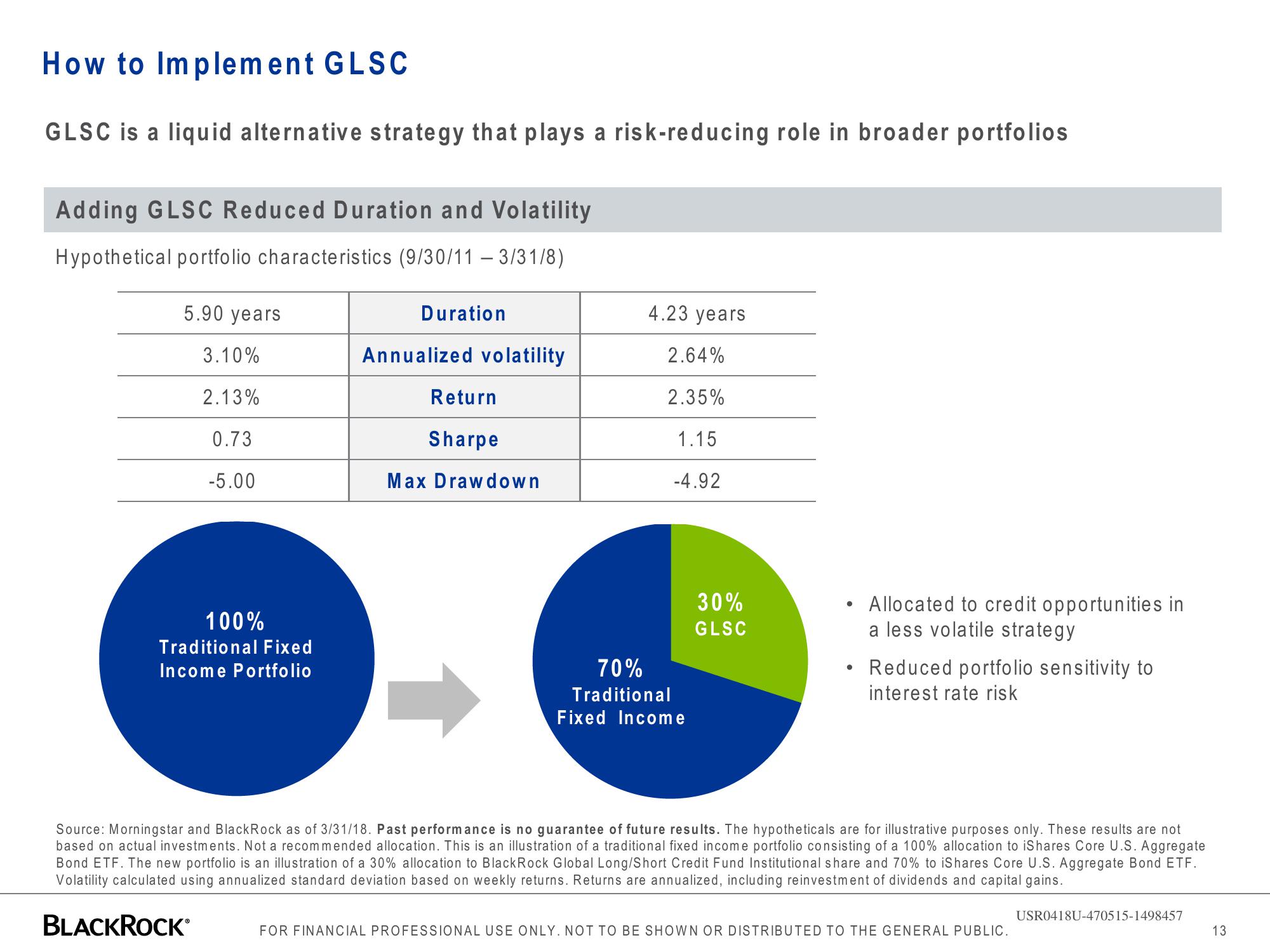

GLSC is a liquid alternative strategy that plays a risk-reducing role in broader portfolios

Adding GLSC Reduced Duration and Volatility

Hypothetical portfolio characteristics (9/30/11 - 3/31/8)

5.90 years

3.10%

2.13%

0.73

-5.00

100%

Traditional Fixed

Income Portfolio

Duration

Annualized volatility

Return

Sharpe

Max Drawdown

4.23 years

2.64%

2.35%

1.15

-4.92

70%

Traditional

Fixed Income

30%

GLSC

●

●

Allocated to credit opportunities in

a less volatile strategy

Reduced portfolio sensitivity to

interest rate risk

Source: Morningstar and BlackRock as of 3/31/18. Past performance is no guarantee of future results. The hypotheticals are for illustrative purposes only. These results are not

based on actual investments. Not a recommended allocation. This is an illustration of a traditional fixed income portfolio consisting of a 100% allocation to iShares Core U.S. Aggregate

Bond ETF. The new portfolio is an illustration of a 30% allocation to BlackRock Global Long/Short Credit Fund Institutional share and 70% to iShares Core U.S. Aggregate Bond ETF.

Volatility calculated using annualized standard deviation based on weekly returns. Returns are annualized, including reinvestment of dividends and capital gains.

BLACKROCK®

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

USR0418U-470515-1498457

13View entire presentation