Paya SPAC Presentation Deck

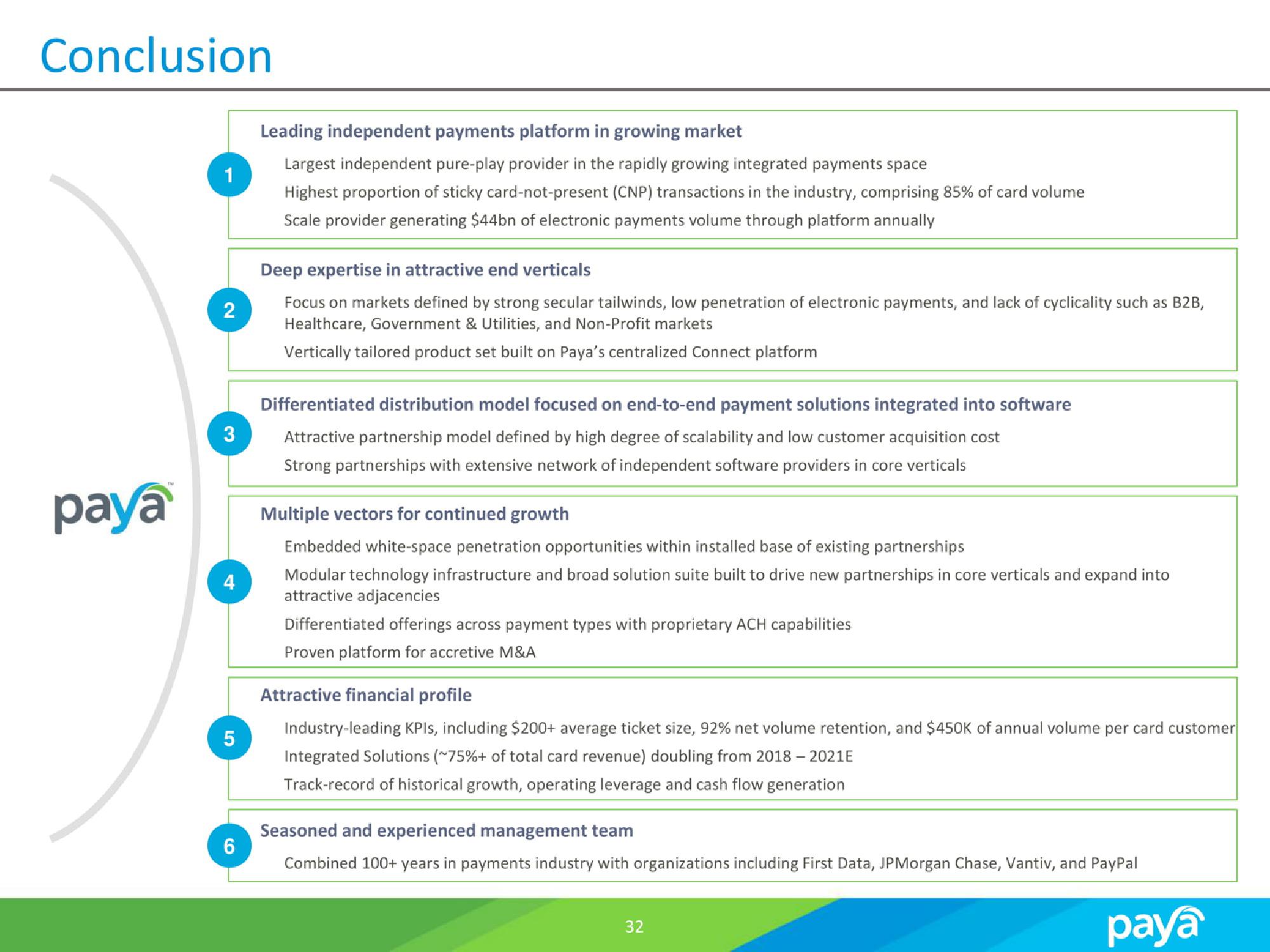

Conclusion

paya

1

2

3

4

5

6

Leading independent payments platform in growing market

Largest independent pure-play provider in the rapidly growing integrated payments space

Highest proportion of sticky card-not-present (CNP) transactions in the industry, comprising 85% of card volume

Scale provider generating $44bn of electronic payments volume through platform annually

Deep expertise in attractive end verticals

Focus on markets defined by strong secular tailwinds, low penetration of electronic payments, and lack of cyclicality such as B2B,

Healthcare, Government & Utilities, and Non-Profit markets

Vertically tailored product set built on Paya's centralized Connect platform

Differentiated distribution model focused on end-to-end payment solutions integrated into software

Attractive partnership model defined by high degree of scalability and low customer acquisition cost

Strong partnerships with extensive network of independent software providers in core verticals

Multiple vectors for continued growth

Embedded white-space penetration opportunities within installed base of existing partnerships

Modular technology infrastructure and broad solution suite built to drive new partnerships in core verticals and expand into

attractive adjacencies

Differentiated offerings across payment types with proprietary ACH capabilities

Proven platform for accretive M&A

Attractive financial profile

Industry-leading KPIs, including $200+ average ticket size, 92% net volume retention, and $450K of annual volume per card customer

Integrated Solutions (~75%+ of total card revenue) doubling from 2018 - 2021E

Track-record of historical growth, operating leverage and cash flow generation

Seasoned and experienced management team

Combined 100+ years in payments industry with organizations including First Data, JPMorgan Chase, Vantiv, and PayPal

32

payaView entire presentation