Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

APM SHIPPING

SERVICES

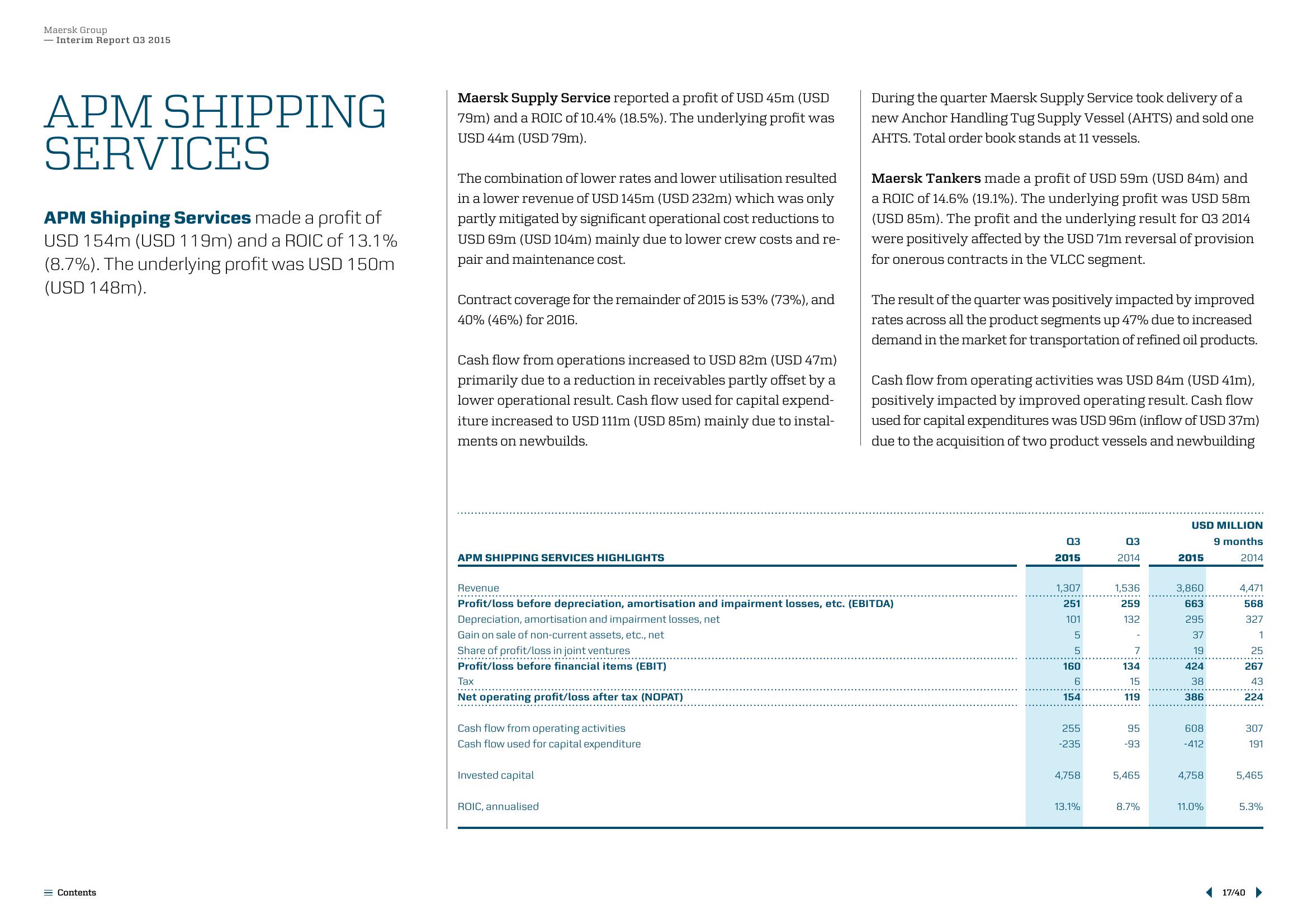

APM Shipping Services made a profit of

USD 154m (USD 119m) and a ROIC of 13.1%

(8.7%). The underlying profit was USD 150m

(USD 148m).

Contents

Maersk Supply Service reported a profit of USD 45m (USD

79m) and a ROIC of 10.4% (18.5%). The underlying profit was

USD 44m (USD 79m).

The combination of lower rates and lower utilisation resulted

in a lower revenue of USD 145m (USD 232m) which was only

partly mitigated by significant operational cost reductions to

USD 69m (USD 104m) mainly due to lower crew costs and re-

pair and maintenance cost.

Contract coverage for the remainder of 2015 is 53% (73%), and

40% (46%) for 2016.

Cash flow from operations increased to USD 82m (USD 47m)

primarily due to a reduction in receivables partly offset by a

lower operational result. Cash flow used for capital expend-

iture increased to USD 111m (USD 85m) mainly due to instal-

ments on newbuilds.

APM SHIPPING SERVICES HIGHLIGHTS

Revenue

***********

.……..….….…..….

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Profit/loss before financial items (EBIT)

Invested capital

During the quarter Maersk Supply Service took delivery of a

new Anchor Handling Tug Supply Vessel (AHTS) and sold one

AHTS. Total order book stands at 11 vessels.

ROIC, annualised

Maersk Tankers made a profit of USD 59m (USD 84m) and

a ROIC of 14.6% (19.1%). The underlying profit was USD 58m

(USD 85m). The profit and the underlying result for Q3 2014

were positively affected by the USD 71m reversal of provision

for onerous contracts in the VLCC segment.

The result of the quarter was positively impacted by improved

rates across all the product segments up 47% due to increased

demand in the market for transportation of refined oil products.

Cash flow from operating activities was USD 84m (USD 41m),

positively impacted by improved operating result. Cash flow

used for capital expenditures was USD 96m (inflow of USD 37m)

due to the acquisition of two product vessels and newbuilding

03

2015

1,307

251

101

5

5

160

6

154

255

-235

4,758

13.1%

03

2014

1,536

259

132

7

134

15

119

95

-93

5,465

8.7%

USD MILLION

9 months

2014

2015

3,860

663

295

37

19

424

38

386

608

-412

4,758

11.0%

4,471

568

327

1

25

267

43

224

307

191

5,465

5.3%

17/40 ▶View entire presentation