Tempo SPAC Presentation Deck

Tempo Highlights: Defining the Opportunity vs. Peer Groups

1

2

3

4

5

Differentiated tech-enabled focus on fragmented $290B

electronics prototyping and on-demand production market¹

Proprietary software platform, with Al that learns from every order,

redefines the customer journey and accelerates time-to-market

High growth, high margin business

3

Expected upside from further inorganic growth

Broad customer base and track record of customer expansion

Source: Management Projections.

IPC 2012-2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; company estimates.

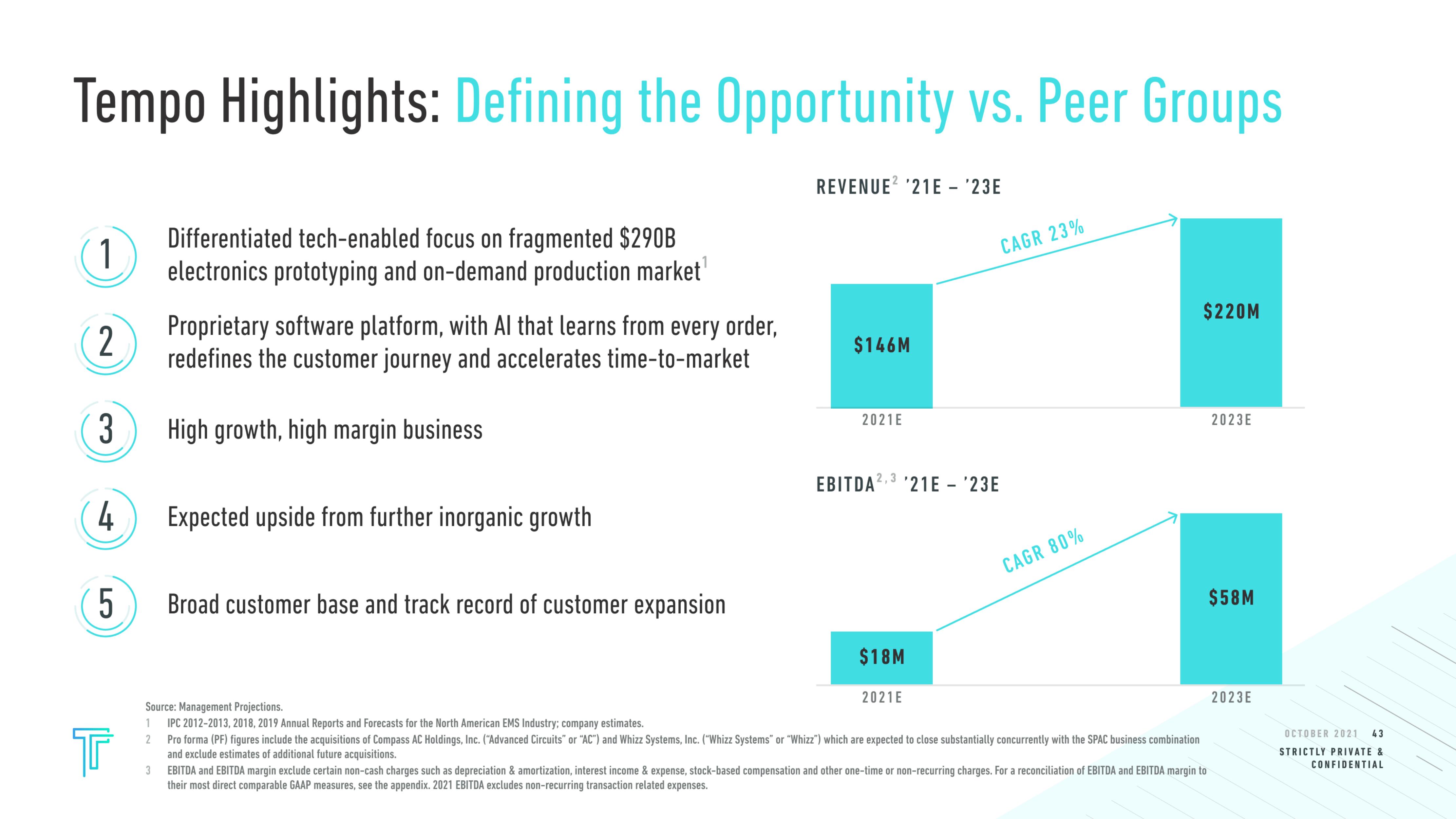

REVENUE '21E - '23E

$146M

2021E

EBITDA²,3'21E - '23E

$18M

CAGR 23%

2021E

CAGR 80%

$220M

1

Tr

2 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

EBITDA and EBITDA margin exclude certain non-cash charges such as depreciation & amortization, interest income & expense, stock-based compensation and other one-time or non-recurring charges. For a reconciliation of EBITDA and EBITDA margin to

their most direct comparable GAAP measures, see the appendix. 2021 EBITDA excludes non-recurring transaction related expenses.

2023E

$58M

2023E

OCTOBER 2021 43

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation