Evercore Investment Banking Pitch Book

Preliminary Situation Assessment

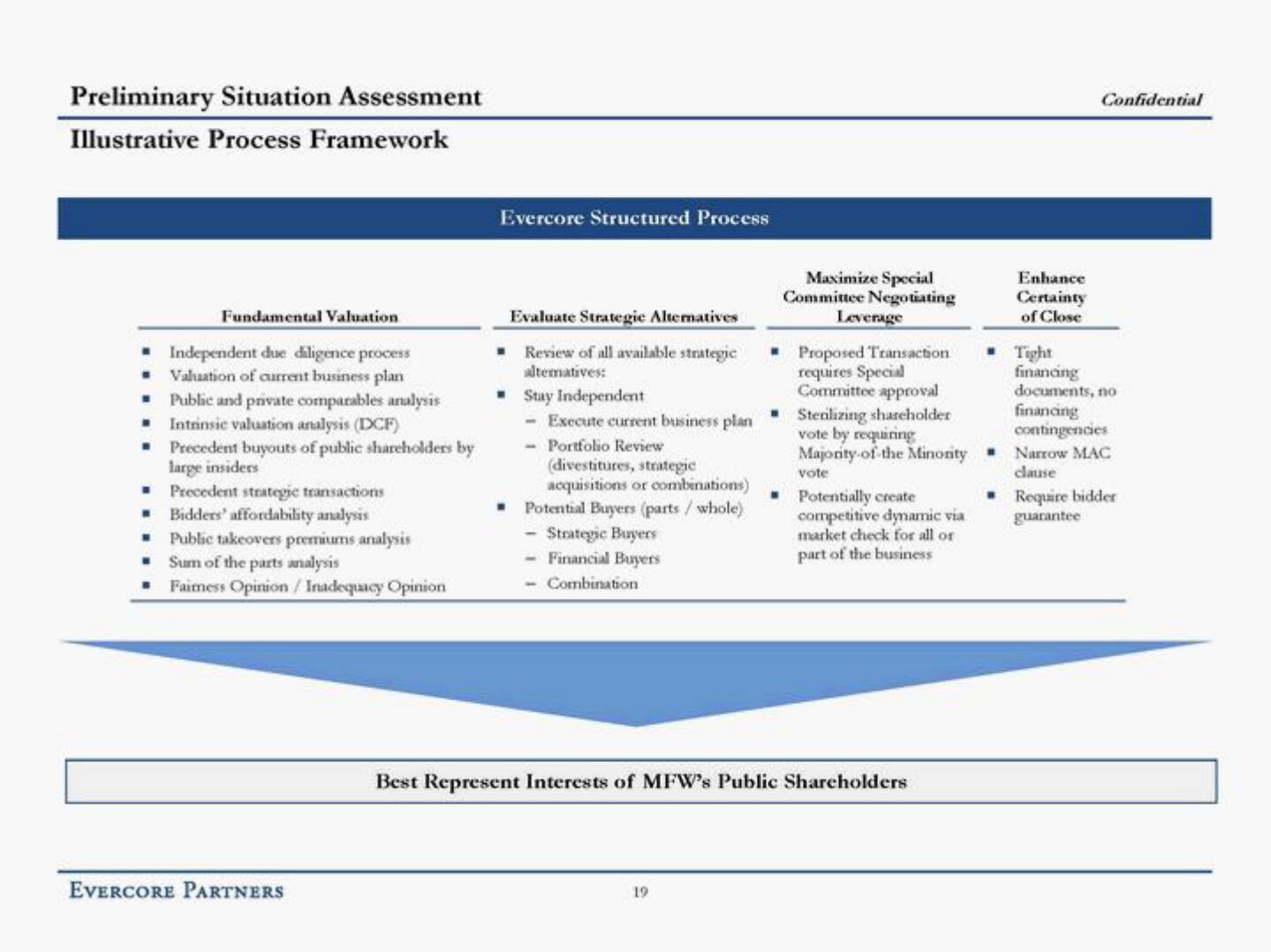

Illustrative Process Framework

Fundamental Valuation

■ Independent due diligence process

·

Valuation of current business plan

■ Public and private comparables analysis

■ Intrinsic valuation analysis (DCF)

■

Precedent buyouts of public shareholders by

large insiders

■ Precedent strategic transactions

■ Bidders' affordability analysis

■

Public takeovers premiums analysis

Sum of the parts analysis

Faimess Opinion / Inadequacy Opinion

EVERCORE PARTNERS

Evercore Structured Process

Evaluate Strategic Alternatives

W Review of all available strategic

altematives:

■ Stay Independent

- Execute current business plan

- Portfolio Review

(divestitures, strategic

acquisitions or combinations)

■ Potential Buyers (parts / whole)

Strategic Buyers

- Financial Buyers

- Combination

-

19

Maximize Special

Committee Negotiating

Leverage

Proposed Transaction

requires Special

Committee approval

Stenlizing shareholder

vote by requiring

Majority of the Minority

vote

Potentially create

competitive dynamic via

market check for all or

part of the business

Best Represent Interests of MFW's Public Shareholders

Enhance

Certainty

of Close

Confidential

Tight

financing

documents, no

financing

contingencies

Narrow MAC

clause

Require bidder

guaranteeView entire presentation