Lumen Investor Day Presentation Deck

Lumen Consolidated Outlook

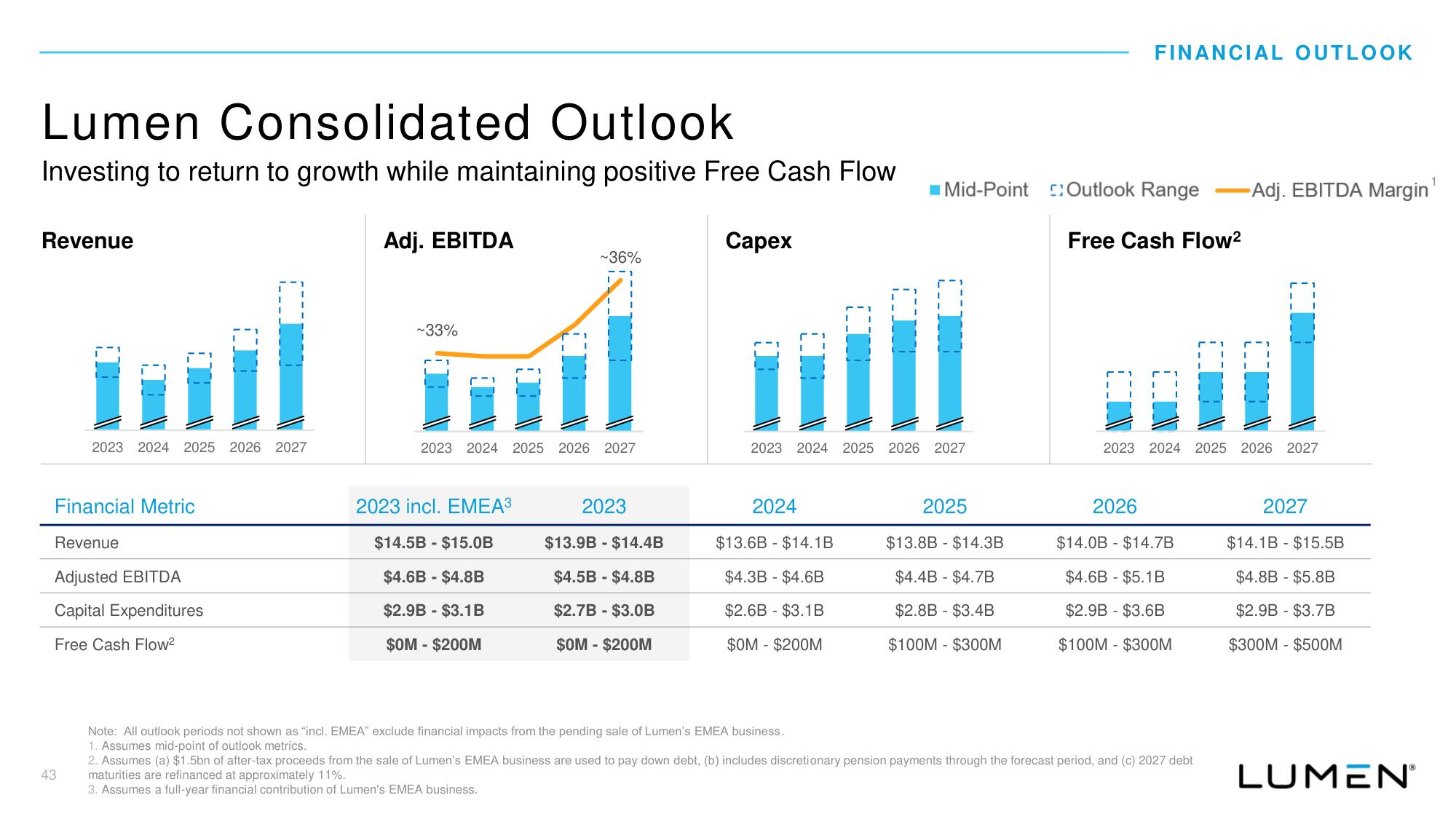

Investing to return to growth while maintaining positive Free Cash Flow

Revenue

2023 2024 2025 2026 2027

Financial Metric

Revenue

Adjusted EBITDA

Capital Expenditures

Free Cash Flow²

43

Adj. EBITDA

~33%

~36%

2023 2024 2025 2026 2027

2023 incl. EMEA³

$14.5B $15.0B

$4.6B - $4.8B

$2.9B- $3.1B

$OM - $200M

2023

$13.9B - $14.4B

$4.5B - $4.8B

$2.7B - $3.0B

$OM - $200M

Capex

2023 2024 2025 2026 2027

2024

■Mid-Point

$13.6B $14.1B

$4.3B - $4.6B

$2.6B - $3.1B

$0M - $200M

2025

$13.8B $14.3B

$4.4B - $4.7B

$2.8B - $3.4B

$100M $300M

FINANCIAL OUTLOOK

Outlook Range

Free Cash Flow²

2026

$14.0B $14.7B

$4.6B - $5.1B

$2.9B - $3.6B

$100M $300M

I

2023 2024 2025 2026 2027

Note: All outlook periods not shown as "incl. EMEA" exclude financial impacts from the pending sale of Lumen's EMEA business.

1. Assumes mid-point of outlook metrics.

2. Assumes (a) $1.5bn of after-tax proceeds from the sale of Lumen's EMEA business are used to pay down debt, (b) includes discretionary pension payments through the forecast period, and (c) 2027 debt

maturities are refinanced at approximately 11%.

3. Assumes a full-year financial contribution of Lumen's EMEA business.

1

I

-Adj. EBITDA Margin

2027

$14.1B $15.5B

$4.8B - $5.8B

$2.9B - $3.7B

$300M $500M

LUMENⓇ

1View entire presentation