Kinnevik Results Presentation Deck

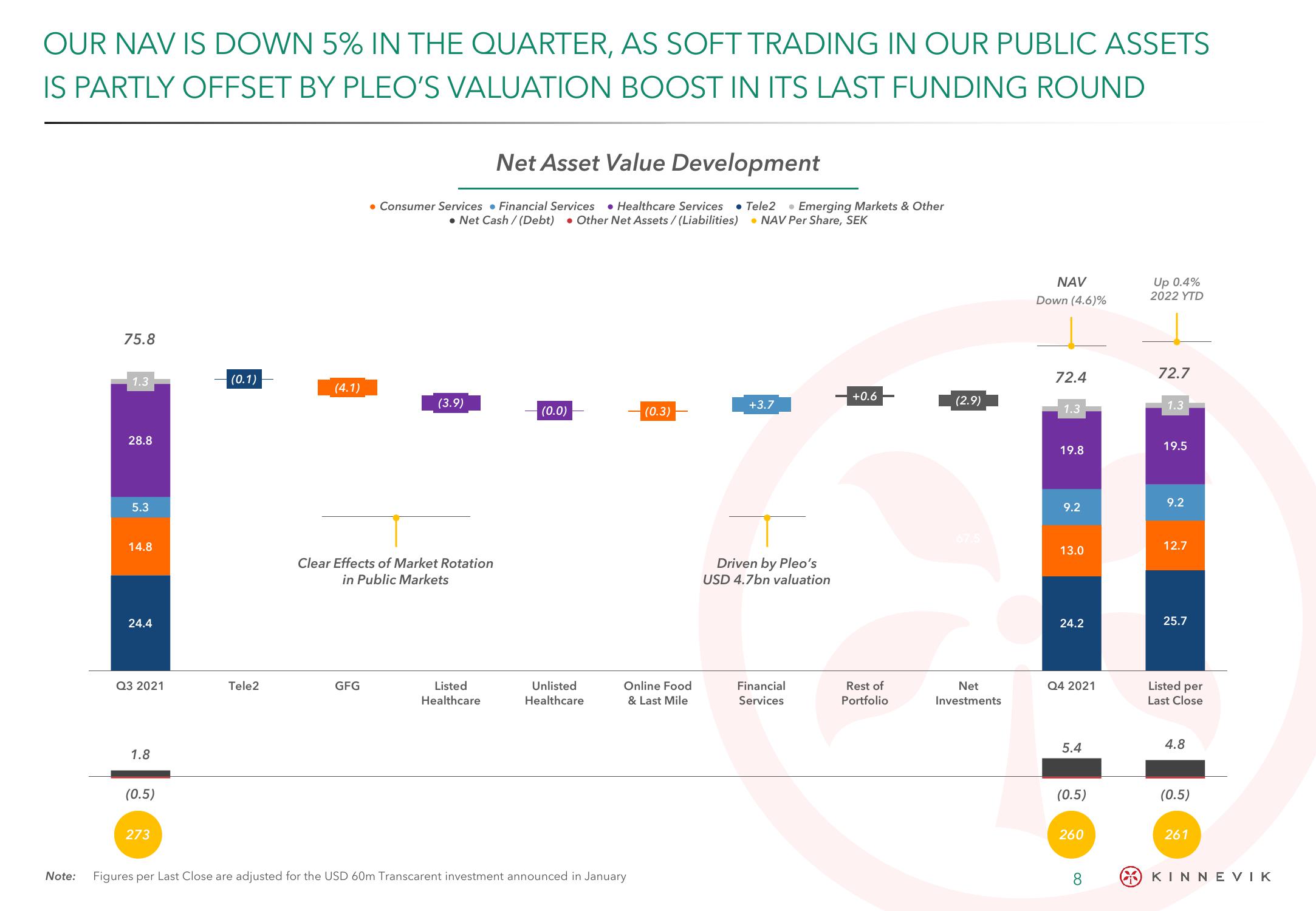

OUR NAV IS DOWN 5% IN THE QUARTER, AS SOFT TRADING IN OUR PUBLIC ASSETS

IS PARTLY OFFSET BY PLEO'S VALUATION BOOST IN ITS LAST FUNDING ROUND

Note:

75.8

1.3

28.8

5.3

14.8

24.4

Q3 2021

1.8

(0.5)

273

(0.1)

Tele2

(4.1)

Net Asset Value Development

• Consumer Services Financial Services Healthcare Services Tele2 Emerging Markets & Other

.Net Cash/(Debt) • Other Net Assets/(Liabilities) NAV Per Share, SEK

GFG

(3.9)

Clear Effects of Market Rotation

in Public Markets

Listed

Healthcare

(0.0)

Unlisted

Healthcare

(0.3)

Online Food

& Last Mile

Figures per Last Close are adjusted for the USD 60m Transcarent investment announced in January

+3.7

Driven by Pleo's

USD 4.7bn valuation

Financial

Services

+0.6

Rest of

Portfolio

(2.9)

Net

Investments

NAV

Down (4.6)%

72.4

1.3

19.8

9.2

13.0

24.2

Q4 2021

5.4

(0.5)

260

8

Up 0.4%

2022 YTD

72.7

1.3

19.5

9.2

12.7

25.7

Listed per

Last Close

4.8

(0.5)

261

(5) ΚΙΝΝΕVIKView entire presentation