Antofagasta Results Presentation Deck

TCFD

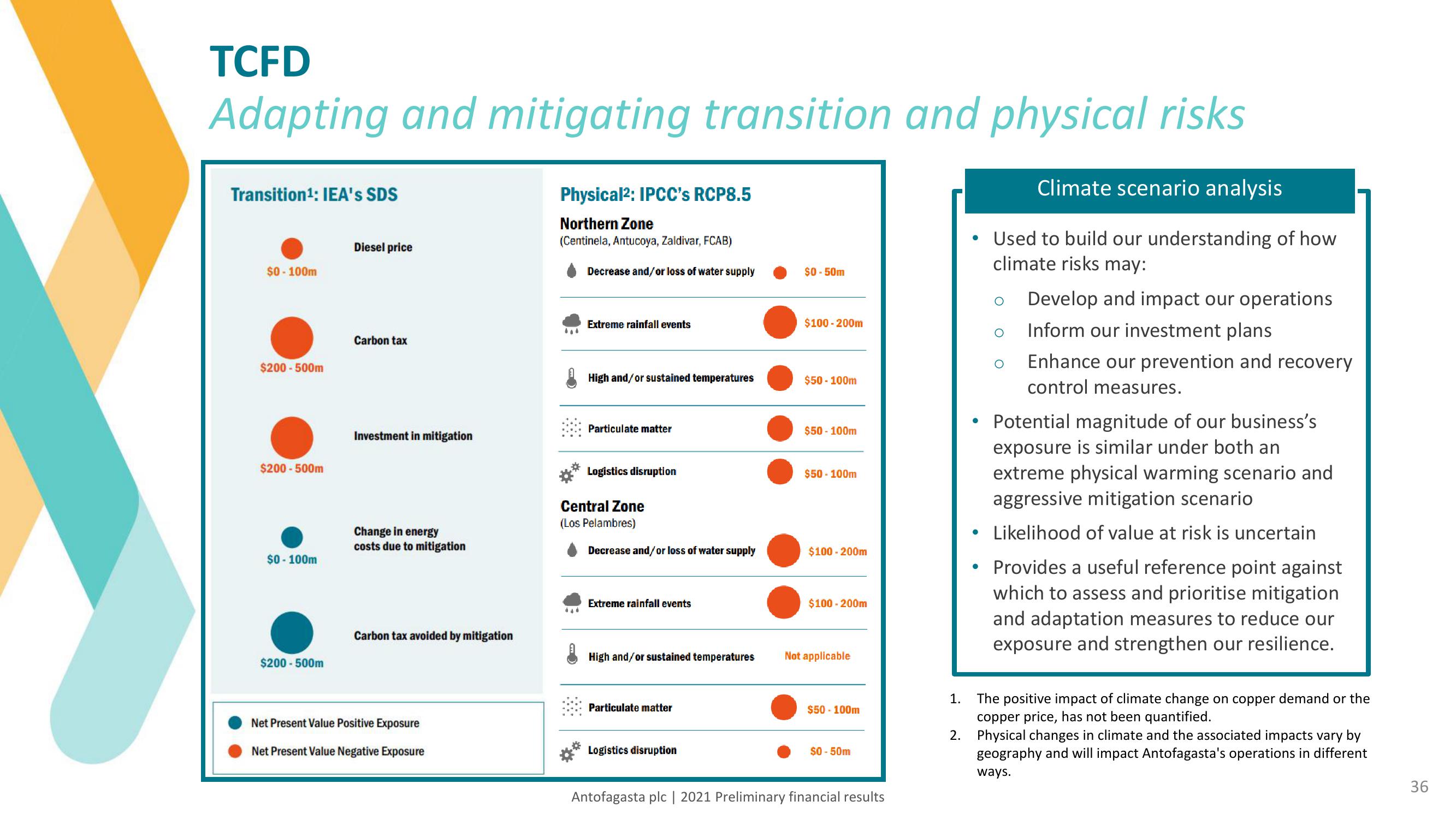

Adapting and mitigating transition and physical risks

Transition¹: IEA's SDS

$0-100m

$200-500m

$200-500m

$0-100m

$200-500m

Diesel price

Carbon tax

Investment in mitigation

Change in energy

costs due to mitigation

Carbon tax avoided by mitigation

Net Present Value Positive Exposure

Net Present Value Negative Exposure

Physical²: IPCC's RCP8.5

Northern Zone

(Centinela, Antucoya, Zaldivar, FCAB)

Decrease and/or loss of water supply

440

Extreme rainfall events

High and/or sustained temperatures

Particulate matter

Logistics disruption

Central Zone

(Los Pelambres)

Decrease and/or loss of water supply

Extreme rainfall events

High and/or sustained temperatures

Particulate matter

Logistics disruption

$0 - 50m

$100-200m

$50 - 100m

$50 - 100m

$50 - 100m

$100-200m

$100-200m

Not applicable

$50 - 100m

$0 - 50m

Antofagasta plc | 2021 Preliminary financial results

Climate scenario analysis

• Used to build our understanding of how

climate risks may:

O Develop and impact our operations

Inform our investment plans

O Enhance our prevention and recovery

control measures.

1.

●

Potential magnitude of our business's

exposure is similar under both an

extreme physical warming scenario and

aggressive mitigation scenario

Likelihood of value at risk is uncertain

Provides a useful reference point against

which to assess and prioritise mitigation

and adaptation measures to reduce our

exposure and strengthen our resilience.

The positive impact of climate change on copper demand or the

copper price, has not been quantified.

2. Physical changes in climate and the associated impacts vary by

geography and will impact Antofagasta's operations in different

ways.

36View entire presentation