Zegna SPAC Presentation Deck

5. Transaction structure and valuation

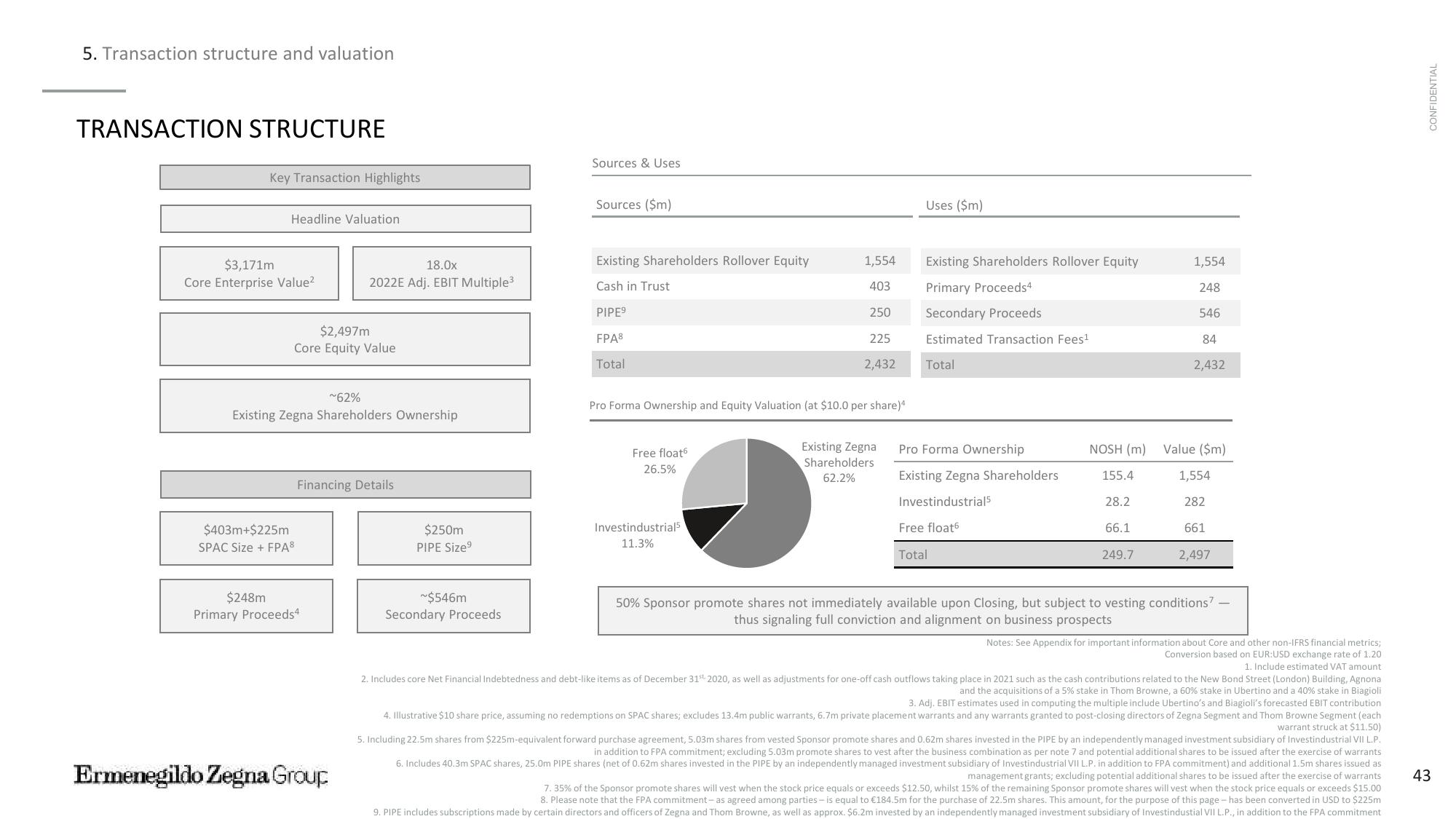

TRANSACTION STRUCTURE

Key Transaction Highlights

Headline Valuation

$3,171m

Core Enterprise Value²

$2,497m

Core Equity Value

~62%

Existing Zegna Shareholders Ownership

$403m+$225m

SPAC Size + FPA8

18.0x

2022E Adj. EBIT Multiple³

Financing Details

$248m

Primary Proceeds4

Ermenegildo Zegna Group

$250m

PIPE Size9

~$546m

Secondary Proceeds

Sources & Uses

Sources ($m)

Existing Shareholders Rollover Equity

Cash in Trust

PIPE⁹

FPA8

Total

Free float

26.5%

1,554

403

Investindustrial5

11.3%

250

Pro Forma Ownership and Equity Valuation (at $10.0 per share)4

225

2,432

Existing Zegna

Shareholders

62.2%

Uses ($m)

Existing Shareholders Rollover Equity

Primary Proceeds4

Secondary Proceeds

Estimated Transaction Fees¹

Total

Pro Forma Ownership

Existing Zegna Shareholders

Investindustrial5

Free float

Total

NOSH (m)

155.4

28.2

66.1

249.7

1,554

248

546

84

2,432

Value ($m)

1,554

282

661

2,497

50% Sponsor promote shares not immediately available upon Closing, but subject to vesting conditions7 -

thus signaling full conviction and alignment on business prospects

Notes: See Appendix for important information about Core and other non-IFRS financial metrics;

Conversion based on EUR:USD exchange rate of 1.20

1. Include estimated VAT amount

2. Includes core Net Financial Indebtedness and debt-like items as of December 31st 2020, as well as adjustments for one-off cash outflows taking place in 2021 such as the cash contributions related to the New Bond Street (London) Building, Agnona

and the acquisitions of a 5% stake in Thom Browne, a 60% stake in Ubertino and a 40% stake in Biagioli

3. Adj. EBIT estimates used in computing the multiple include Ubertino's and Biagioli's forecasted EBIT contribution

4. Illustrative $10 share price, assuming no redemptions on SPAC shares; excludes 13.4m public warrants, 6.7m private placement warrants and any warrants granted to post-closing directors of Zegna Segment and Thom Browne Segment (each

warrant struck at $11.50)

5. Including 22.5m shares from $225m-equivalent forward purchase agreement, 5.03m shares from vested Sponsor promote shares and 0.62m shares invested in the PIPE by an independently managed investment subsidiary of Investindustrial VII L.P.

in addition to FPA commitment; excluding 5.03m promote shares to vest after the business combination as per note 7 and potential additional shares to be issued after the exercise of warrants

6. Includes 40.3m SPAC shares, 25.0m PIPE shares (net of 0.62m shares invested in the PIPE by an independently managed investment subsidiary of Investindustrial VII L.P. in addition to FPA commitment) and additional 1.5m shares issued as

management grants; excluding potential additional shares to be issued after the exercise of warrants.

7.35% of the Sponsor promote shares will vest when the stock price equals or exceeds $12.50, whilst 15% of the remaining Sponsor promote shares will vest when the stock price equals or exceeds $15.00

8. Please note that the FPA commitment -as agreed among parties is equal to €184.5m for the purchase of 22.5m shares. This amount, for the purpose of this page has been converted in USD to $225m

9. PIPE includes subscriptions made by certain directors and officers of Zegna and Thom Browne, as well as approx. $6.2m invested by an independently managed investment subsidiary of Investindustial VII L.P., in addition to the FPA commitment

CONFIDENTIAL

43View entire presentation