jetBlue Results Presentation Deck

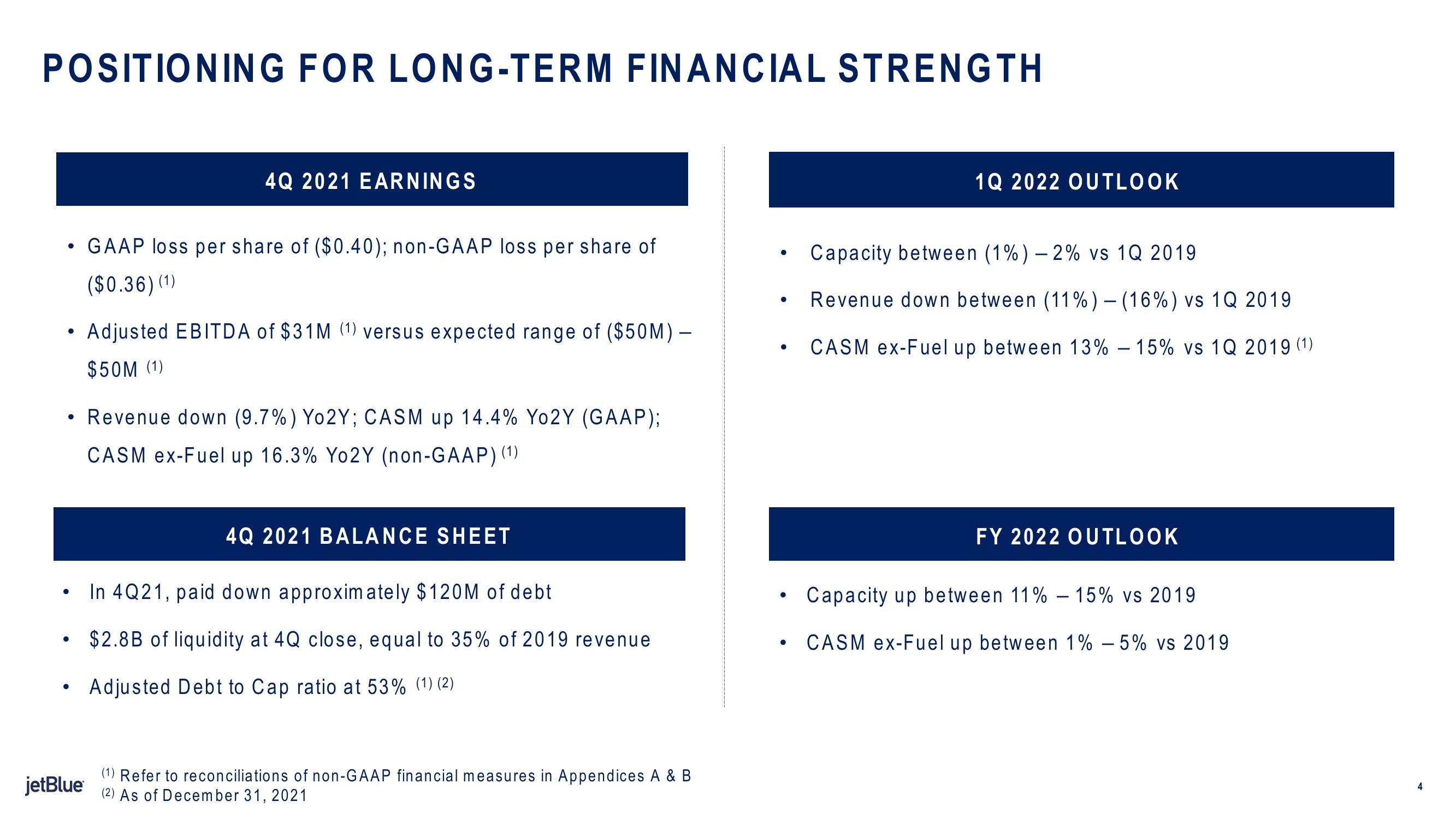

POSITIONING FOR LONG-TERM FINANCIAL STRENGTH

●

●

4Q 2021 EARNINGS

jetBlue

GAAP loss per share of ($0.40); non-GAAP loss per share of

($0.36) (1)

• Revenue down (9.7%) Yo2Y; CASM up 14.4% Yo2Y (GAAP);

CASM ex-Fuel up 16.3% Yo2Y (non-GAAP) (1)

Adjusted EBITDA of $31M (1) versus expected range of ($50M) -

$50M (1)

4Q 2021 BALANCE SHEET

In 4Q21, paid down approximately $120M of debt

$2.8B of liquidity at 4Q close, equal to 35% of 2019 revenue

Adjusted Debt to Cap ratio at 53% (1) (2)

(1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B

(2) As of December 31, 2021

●

●

●

●

●

1Q 2022 OUTLOOK

Capacity between (1%) -2% vs 1Q 2019

Revenue down between (11%) - (16%) vs 1Q 2019

CASM ex-Fuel up between 13% - 15% vs 1Q 2019 (1)

FY 2022 OUTLOOK

Capacity up between 11% -15% vs 2019

CASM ex-Fuel up between 1% 5% vs 2019

4View entire presentation