SoftBank Results Presentation Deck

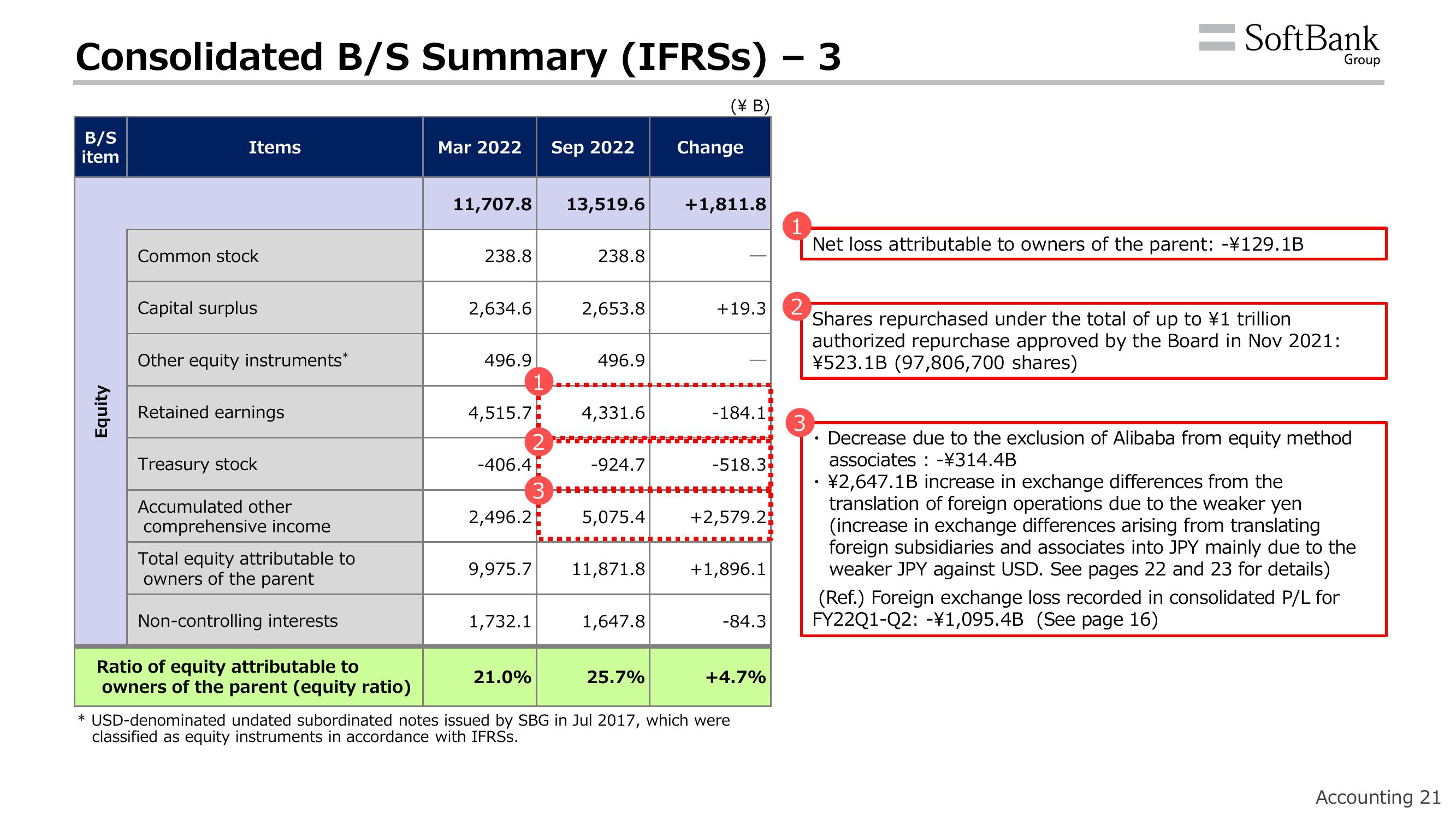

Consolidated B/S Summary (IFRSs) - 3

B/S

item

Equity

Items

Common stock

Capital surplus

Other equity instruments*

Retained earnings

Treasury stock

Accumulated other

comprehensive income

Total equity attributable to

owners of the parent

Non-controlling interests

Ratio of equity attributable to

owners of the parent (equity ratio)

Mar 2022

11,707.8

238.8

2,634.6

496.9

4,515.7

-406.4

2

2,496.2

9,975.7

1,732.1

21.0%

1

3

Sep 2022

13,519.6

238.8

2,653.8

496.9

4,331.6

-924.7

5,075.4

11,871.8

1,647.8

25.7%

(\B)

Change

+1,811.8

+19.3

-184.1

-518.3

+2,579.2

+1,896.1

-84.3

+4.7%

* USD-denominated undated subordinated notes issued by SBG in Jul 2017, which were

classified as equity instruments in accordance with IFRSs.

1

Net loss attributable to owners of the parent: -¥129.1B

=SoftBank

2

Shares repurchased under the total of up to ¥1 trillion

authorized repurchase approved by the Board in Nov 2021:

¥523.1B (97,806,700 shares)

3

.

Group

Decrease due to the exclusion of Alibaba from equity method

associates: -¥314.4B

¥2,647.1B increase in exchange differences from the

translation of foreign operations due to the weaker yen

(increase in exchange differences arising from translating

foreign subsidiaries and associates into JPY mainly due to the

weaker JPY against USD. See pages 22 and 23 for details)

(Ref.) Foreign exchange loss recorded in consolidated P/L for

FY22Q1-Q2: -¥1,095.4B (See page 16)

Accounting 21View entire presentation