Kore SPAC Presentation Deck

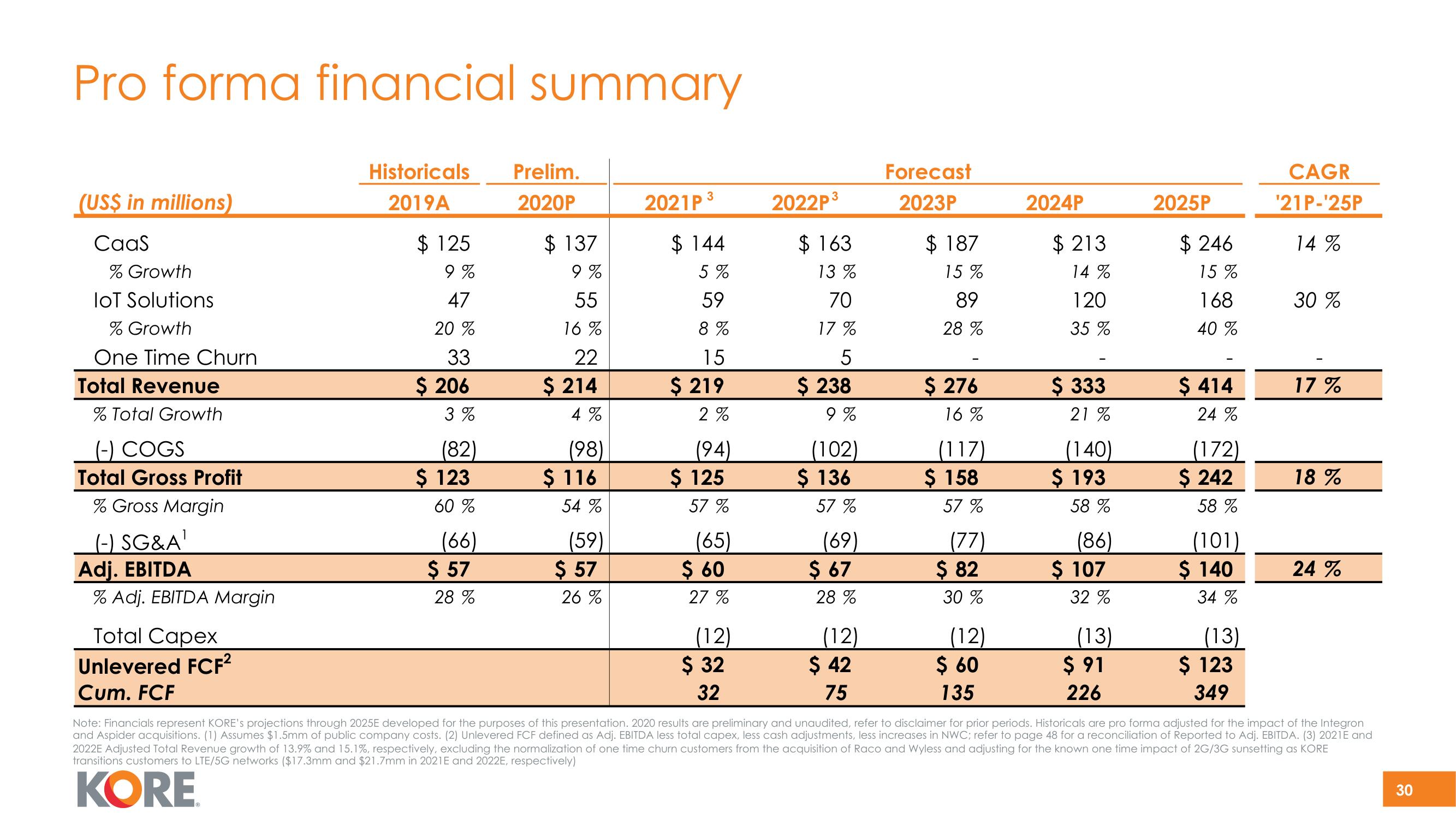

Pro forma financial summary

(US$ in millions)

CaaS

% Growth

IoT Solutions

% Growth

One Time Churn

Total Revenue

% Total Growth

(-) COGS

Total Gross Profit

% Gross Margin

(-) SG&A¹

Adj. EBITDA

% Adj. EBITDA Margin

Total Capex

Unlevered FCF²

Cum. FCF

Historicals Prelim.

2019A

2020P

$125

9%

47

20 %

33

$ 206

3%

(82)

$ 123

60 %

(66)

$ 57

28 %

$ 137

9%

55

16 %

22

$ 214

4%

(98)

$ 116

54 %

(59)

$ 57

26%

2021P³

$ 144

5%

59

8%

15

$ 219

2%

(94)

$ 125

57 %

(65)

$ 60

27%

(12)

$ 32

32

2022P³

$ 163

13 %

70

17%

5

$ 238

9%

(102)

$ 136

57 %

(69)

$ 67

28 %

(12)

$ 42

75

Forecast

2023P

$187

15%

89

28%

$ 276

16 %

(117)

$ 158

57 %

(77)

$ 82

30 %

(12)

$ 60

135

2024P

$213

14%

120

35 %

$ 333

21 %

(140)

$ 193

58 %

(86)

$ 107

32 %

(13)

$ 91

226

2025P

$246

15 %

168

40 %

$ 414

24 %

(172)

$ 242

58 %

(101)

$ 140

34 %

(13)

$ 123

349

CAGR

¹21P-¹25P

14%

30 %

17%

18 %

24 %

Note: Financials represent KORE's projections through 2025E developed for the purposes of this presentation. 2020 results are preliminary and unaudited, refer to disclaimer for prior periods. Historicals are pro forma adjusted for the impact of the Integron

and Aspider acquisitions. (1) Assumes $1.5mm of public company costs. (2) Unlevered FCF defined as Adj. EBITDA less total capex, less cash adjustments, less increases in NWC; refer to page 48 for a reconciliation of Reported to Adj. EBITDA. (3) 2021E and

2022E Adjusted Total Revenue growth of 13.9% and 15.1%, respectively, excluding the normalization of one time churn customers from the acquisition of Raco and Wyless and adjusting for the known one time impact of 2G/3G sunsetting as KORE

transitions customers to LTE/5G networks ($17.3mm and $21.7mm in 2021E and 2022E, respectively)

KORE

30View entire presentation