Altus Power SPAC Presentation Deck

Transaction Overview

●

●

1.

2.

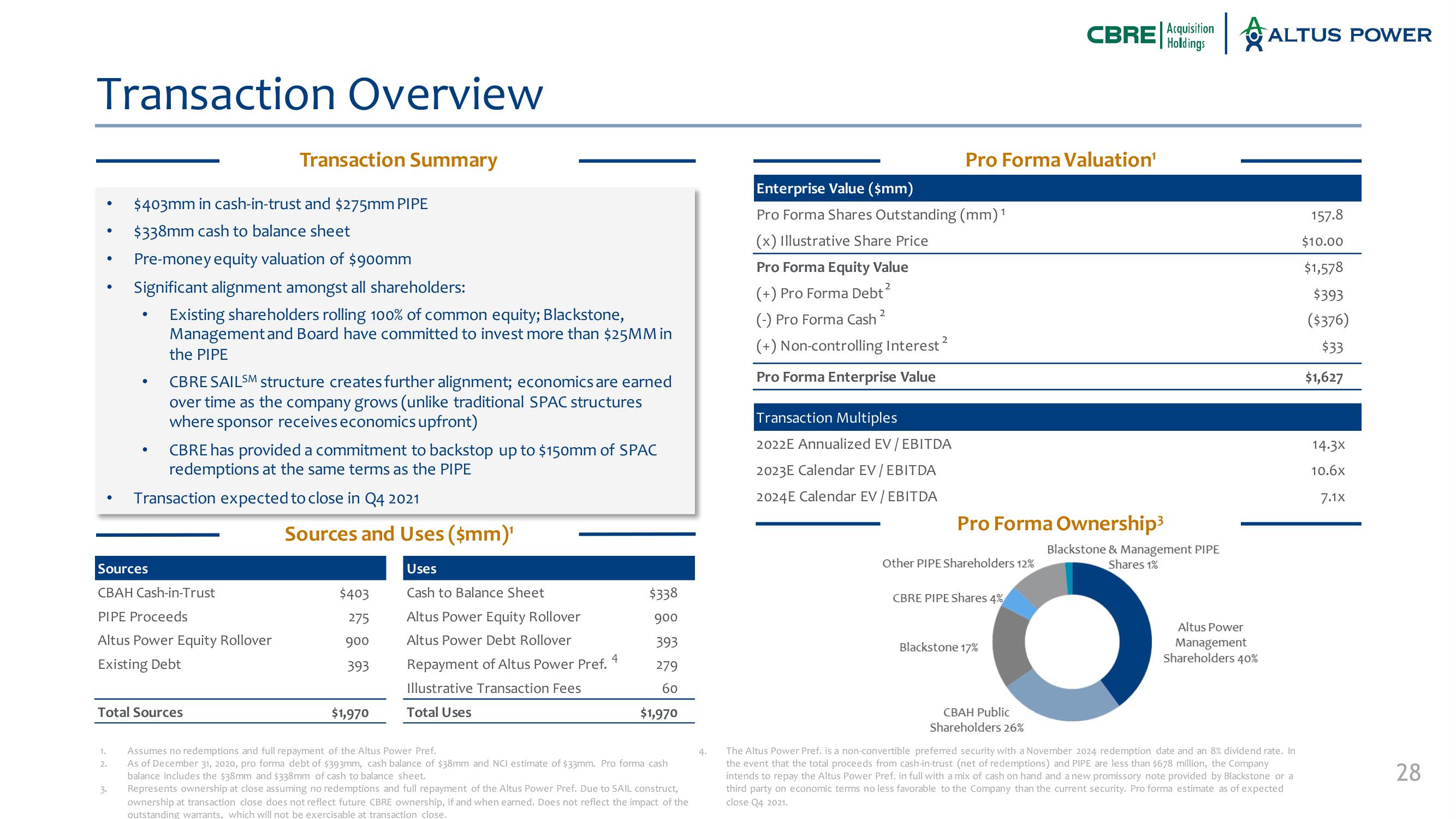

$403mm in cash-in-trust and $275mm PIPE

$338mm cash to balance sheet

Pre-money equity valuation of $900mm

Significant alignment amongst all shareholders:

Existing shareholders rolling 100% of common equity; Blackstone,

Management and Board have committed to invest more than $25MM in

the PIPE

●

3.

●

Sources

CBAH Cash-in-Trust

PIPE Proceeds

Altus Power Equity Rollover

Existing Debt

Transaction Summary

CBRE SAILSM structure creates further alignment; economics are earned

over time as the company grows (unlike traditional SPAC structures

where sponsor receives economics upfront)

CBRE has provided a commitment to backstop up to $150mm of SPAC

redemptions at the same terms as the PIPE

Transaction expected to close in Q4 2021

Total Sources

Sources and Uses ($mm)¹

$403

275

900

393

$1,970

Uses

Cash to Balance Sheet

Altus Power Equity Rollover

Altus Power Debt Rollover

4

Repayment of Altus Power Pref.

Illustrative Transaction Fees

Total Uses

$338

900

393

279

60

$1,970

Assumes no redemptions and full repayment of the Altus Power Pref.

As of December 31, 2020, pro forma debt of $393mm, cash balance of $38mm and NCI estimate of $33mm. Pro forma cash

balance includes the $38mm and $338mm of cash to balance sheet.

Represents ownership at close assuming no redemptions and full repayment of the Altus Power Pref. Due to SAIL construct,

ownership at transaction close does not reflect future CBRE ownership, if and when earned. Does not reflect the impact of the

outstanding warrants, which will not be exercisable at transaction close.

4.

Enterprise Value ($mm)

Pro Forma Shares Outstanding (mm) 1

(x) Illustrative Share Price

Pro Forma Equity Value

(+) Pro Forma Debt²

(-) Pro Forma Cash ²

2

(+) Non-controlling Interest ²

Pro Forma Enterprise Value

Transaction Multiples

2022E Annualized EV / EBITDA

2023E Calendar EV / EBITDA

2024E Calendar EV / EBITDA

Pro Forma Valuation¹

Pro Forma Ownership³

Other PIPE Shareholders 12%

CBRE PIPE Shares 4%

CBRE Acquisition

Holdings

Blackstone 17%

CBAH Public

Shareholders 26%

Blackstone & Management PIPE

Shares 1%

Altus Power

Management

Shareholders 40%

ALTUS POWER

The Altus Power Pref. is a non-convertible preferred security with a November 2024 redemption date and an 8% dividend rate. In

the event that the total proceeds from cash-in-trust (net of redemptions) and PIPE are less than $678 million, the Company

intends to repay the Altus Power Pref. in full with a mix of cash on hand and a new promissory note provided by Blackstone or a

third party on economic terms no less favorable to the Company than the current security. Pro forma estimate as of expected

close Q4 2021.

157.8

$10.00

$1,578

$393

($376)

$33

$1,627

14.3x

10.6x

7.1X

28View entire presentation