DraftKings Investor Day Presentation Deck

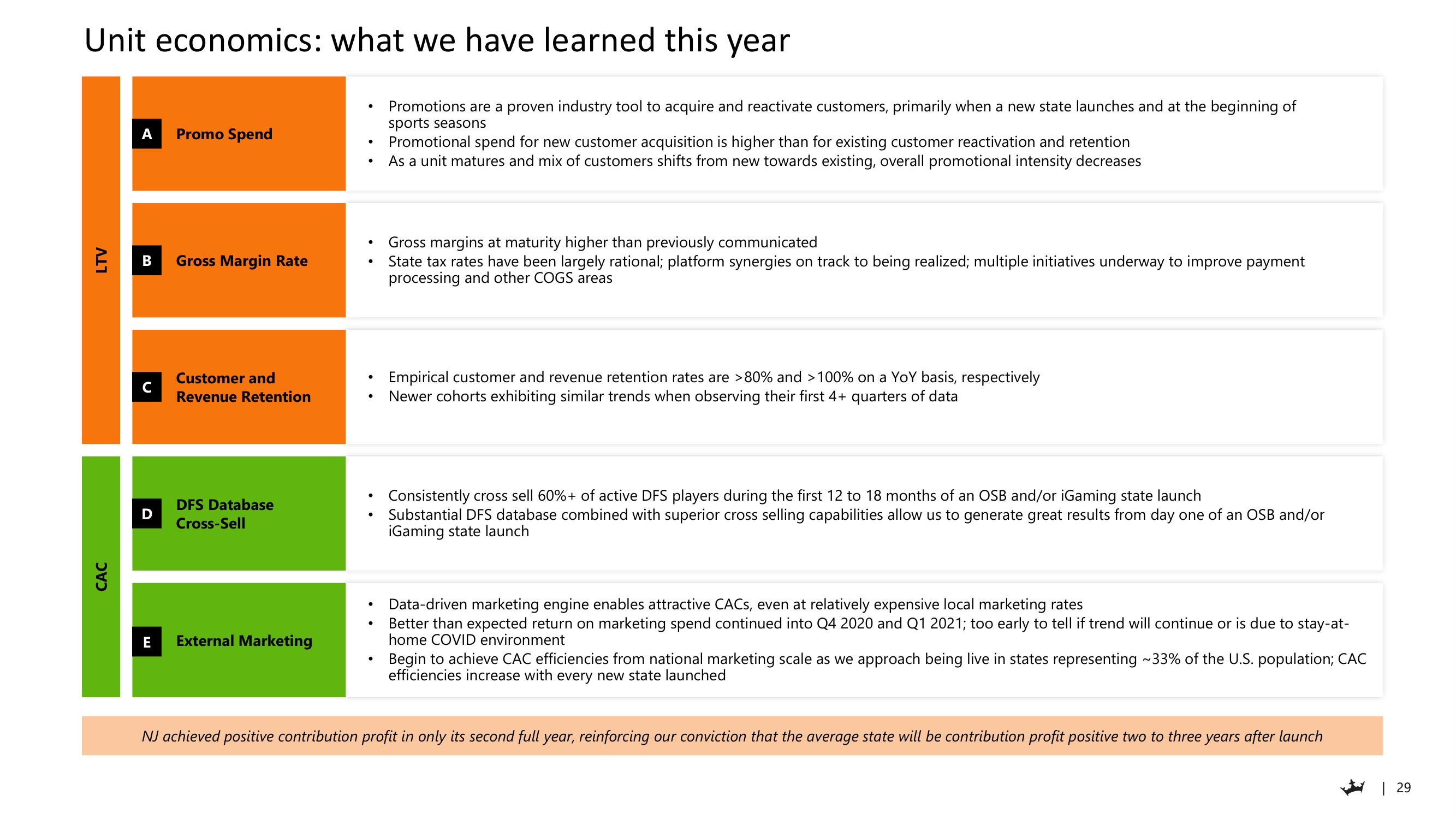

Unit economics: what we have learned this year

LTV

CAC

A Promo Spend

B Gross Margin Rate

D

E

Customer and

Revenue Retention

DFS Database

Cross-Sell

External Marketing

●

●

●

●

●

●

●

•

Promotions are a proven industry tool to acquire and reactivate customers, primarily when a new state launches and at the beginning of

sports seasons

Promotional spend for new customer acquisition is higher than for existing customer reactivation and retention

As a unit matures and mix of customers shifts from new towards existing, overall promotional intensity decreases

Gross margins at maturity higher than previously communicated

State tax rates have been largely rational; platform synergies on track to being realized; multiple initiatives underway to improve payment

processing and other COGS areas

Empirical customer and revenue retention rates are >80% and > 100% on a YoY basis, respectively

Newer cohorts exhibiting similar trends when observing their first 4+ quarters of data

Consistently cross sell 60%+ of active DFS players during the first 12 to 18 months of an OSB and/or iGaming state launch

Substantial DFS database combined with superior cross selling capabilities allow us to generate great results from day one of an OSB and/or

iGaming state launch

Data-driven marketing engine enables attractive CACS, even at relatively expensive local marketing rates

Better than expected return on marketing spend continued into Q4 2020 and Q1 2021; too early to tell if trend will continue or is due to stay-at-

home COVID environment

Begin to achieve CAC efficiencies from national marketing scale as we approach being live in states representing ~33% of the U.S. population; CAC

efficiencies increase with every new state launched

NJ achieved positive contribution profit in only its second full year, reinforcing our conviction that the average state will be contribution profit positive two to three years after launch

| 29View entire presentation