Goldman Sachs Results Presentation Deck

Platform Solutions

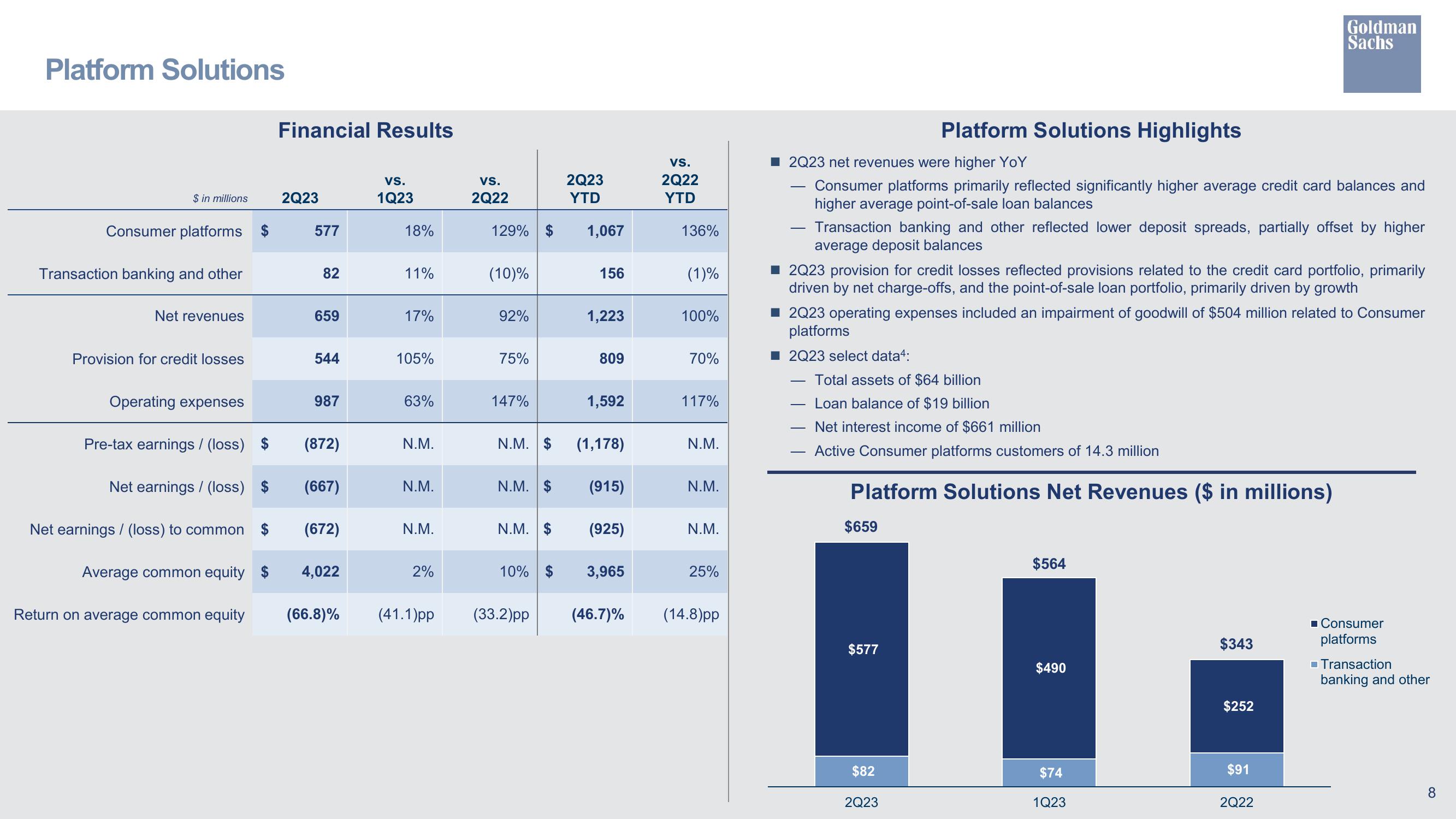

$ in millions

Consumer platforms

Transaction banking and other

Net revenues

Provision for credit losses

Operating expenses

Pre-tax earnings / (loss)

Net earnings / (loss) $

Net earnings / (loss) to common $

Average common equity $

Return on average common equity

Financial Results

2Q23

577

82

659

544

987

(872)

(667)

(672)

4,022

(66.8)%

VS.

1Q23

18%

11%

17%

105%

63%

N.M.

N.M.

N.M.

2%

VS.

2Q22

129% $

(10)%

92%

75%

147%

N.M. $

N.M. $

N.M. $

2Q23

YTD

(41.1)pp (33.2)pp

1,067

156

1,223

809

1,592

(1,178)

(915)

(925)

10% $ 3,965

(46.7)%

VS.

2Q22

YTD

136%

(1)%

100%

70%

117%

N.M.

N.M.

N.M.

25%

(14.8)pp

■2Q23 net revenues were higher YoY

Consumer platforms primarily reflected significantly higher average credit card balances and

higher average point-of-sale loan balances

Platform Solutions Highlights

Transaction banking and other reflected lower deposit spreads, partially offset by higher

average deposit balances

■2Q23 provision for credit losses reflected provisions related to the credit card portfolio, primarily

driven by net charge-offs, and the point-of-sale loan portfolio, primarily driven by growth

2Q23 operating expenses included an impairment of goodwill of $504 million related to Consumer

platforms

2Q23 select data4:

Total assets of $64 billion

Loan balance of $19 billion

Net interest income of $661 million

Active Consumer platforms customers of 14.3 million

Platform Solutions Net Revenues ($ in millions)

$659

$577

$82

2Q23

$564

$490

$74

1Q23

Goldman

Sachs

$343

$252

$91

2Q22

Consumer

platforms

☐Transaction

banking and other

8View entire presentation