Advent SPAC Presentation Deck

Transaction Summary

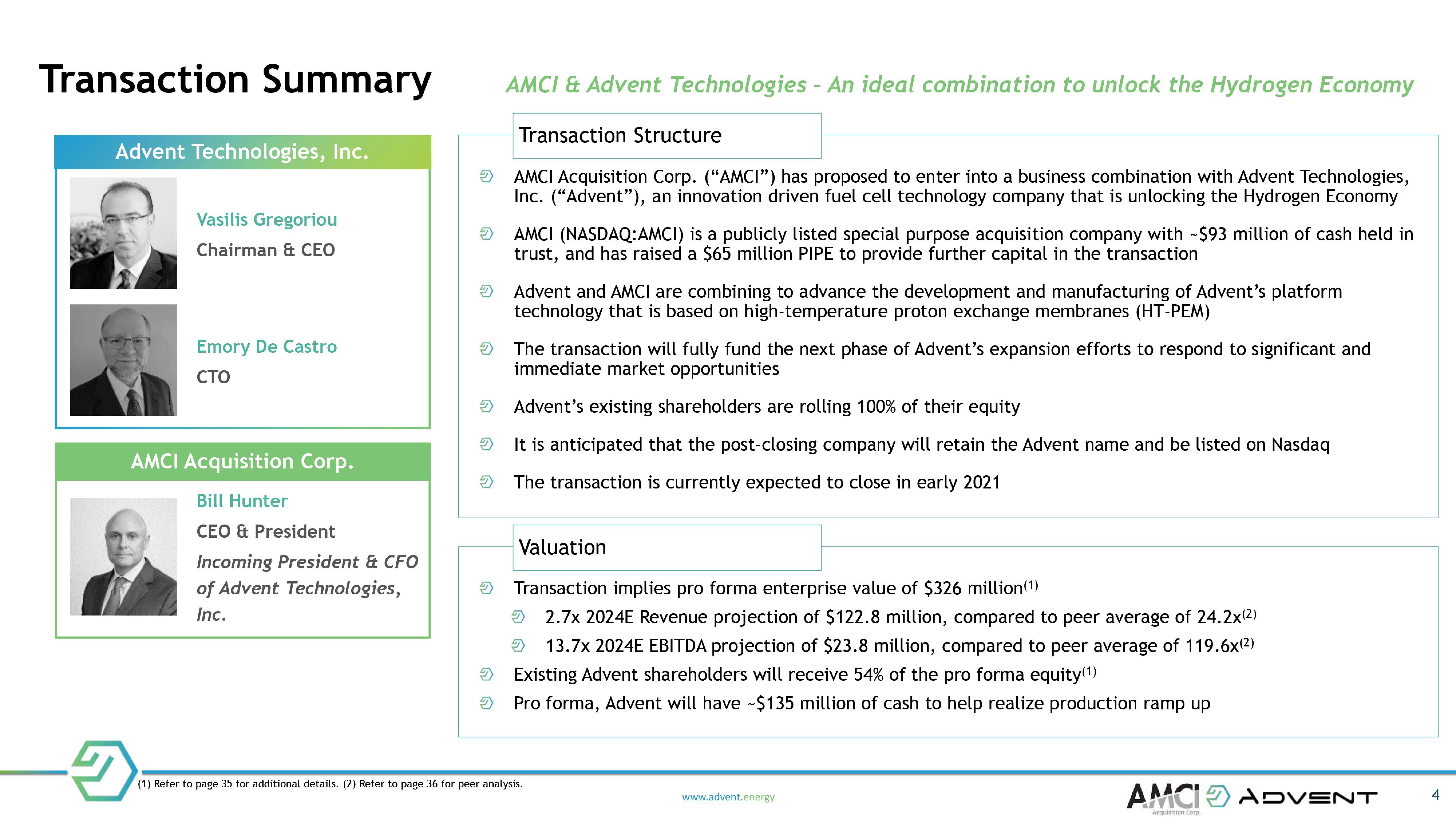

Advent Technologies, Inc.

Vasilis Gregoriou

Chairman & CEO

7

Emory De Castro

CTO

AMCI Acquisition Corp.

Bill Hunter

CEO & President

Incoming President & CFO

of Advent Technologies,

Inc.

2

AMCI & Advent Technologies - An ideal combination to unlock the Hydrogen Economy

Transaction Structure

AMCI Acquisition Corp. ("AMCI") has proposed to enter into a business combination with Advent Technologies,

Inc. ("Advent"), an innovation driven fuel cell technology company that is unlocking the Hydrogen Economy

AMCI (NASDAQ:AMCI) is a publicly listed special purpose acquisition company with -$93 million of cash held in

trust, and has raised a $65 million PIPE to provide further capital in the transaction

Advent and AMCI are combining to advance the development and manufacturing of Advent's platform

technology that is based on high-temperature proton exchange membranes (HT-PEM)

The transaction will fully fund the next phase of Advent's expansion efforts to respond to significant and

immediate market opportunities

Advent's existing shareholders are rolling 100% of their equity

It is anticipated that the post-closing company will retain the Advent name and be listed on Nasdaq

The transaction is currently expected to close in early 2021

Valuation

Transaction implies pro forma enterprise value of $326 million (1)

2 2.7x 2024E Revenue projection of $122.8 million, compared to peer average of 24.2x(²)

2 13.7x 2024E EBITDA projection of $23.8 million, compared to peer average of 119.6x(2)

Existing Advent shareholders will receive 54% of the pro forma equity(1)

Pro forma, Advent will have -$135 million of cash to help realize production ramp up

(1) Refer to page 35 for additional details. (2) Refer to page 36 for peer analysis.

www.advent.energy

AMCI ADVENT

Acquisition Corp.

4View entire presentation