Baird Investment Banking Pitch Book

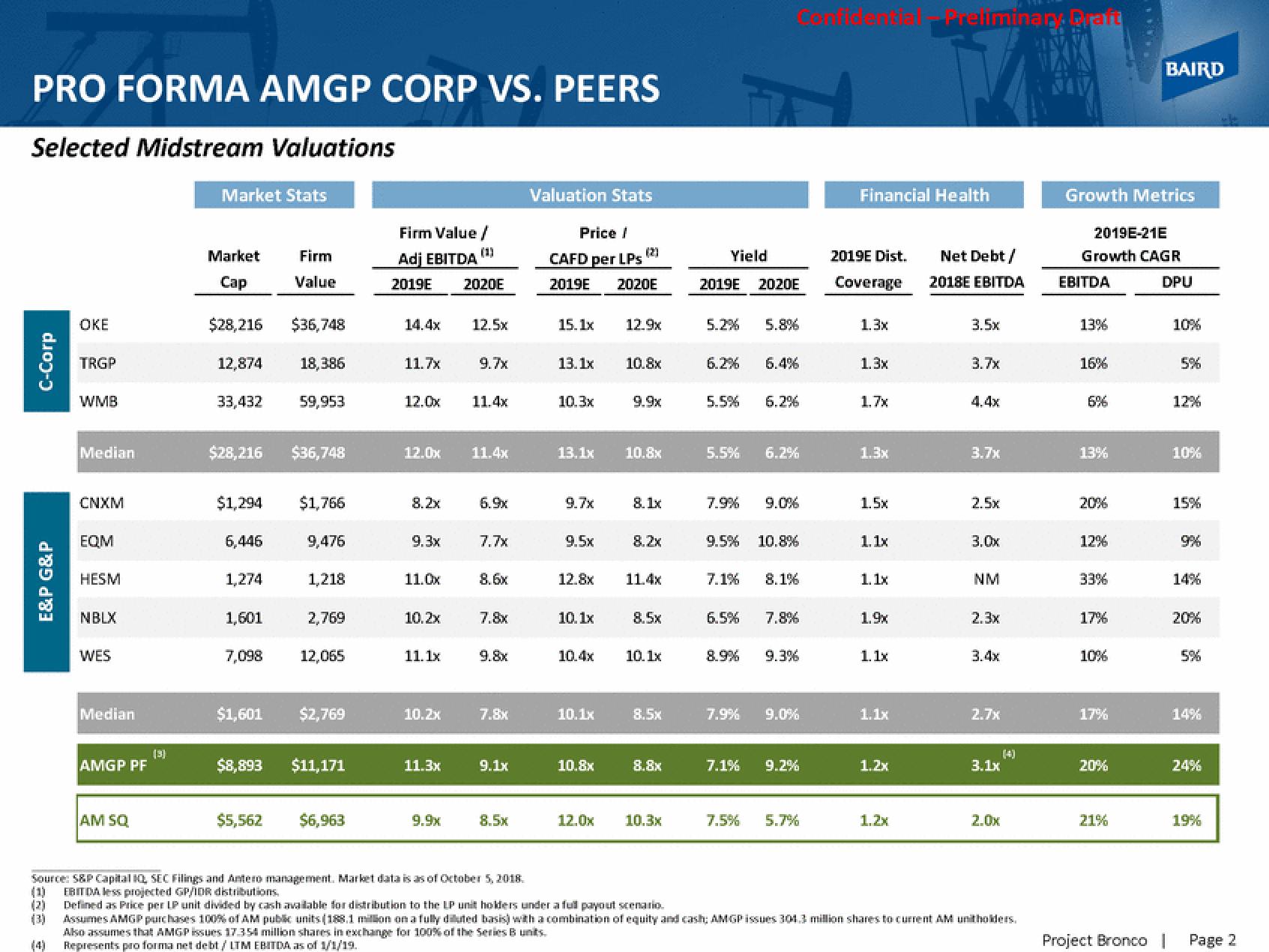

PRO FORMA AMGP CORP VS. PEERS

Selected Midstream Valuations

C-Corp

E&P G&P

OKE

(1)

(2)

(3)

TRGP

WMB

Median

CNXM

EQM

HESM

NBLX

WES

Median

AMGP PF

AM SQ

Market Stats

Market

Cap

$28,216

12,874

33,432

$28,216

$1,294

6,446

1,274

1,601

7,098

$1,601

Firm

Value

$5,562

$36,748

18,386

59,953

$36,748

$1,766

9,476

1,218

2,769

12,065

$2,769

$8,893 $11,171

$6,963

Firm Value /

Adj EBITDA

2019E

14.4x

11.7x

12.0x

8.2x

9.3x

11.0x

12.0x 11.4x

10.2x

11.1x

10,2x

11.3x

2020E

9.9x

125x

9.7x

11.4x

6.9x

7.7x

8.6x

7.8x

9.8x

7.8x

9.1x

8.5x

Source: S&P Capital 10 SEC Filings and Antero management, Market data is as of October 5, 2018

EBITDA less projected GP/IDR distributions.

Valuation Stats

Price /

(2)

CAFD per LPs

2019E 2020E

15.1x

13.1x

10.3x

9.7x

9.5x

13.1x 10.8x

10.1x

10.4x

10.1x

12.9x

10.8x

10.8x

12.8x 11.4x

12.0x

9.9x

8.1x

8.2x

8.5x

10.1x

8.5x

8.8x

10.3x

Yield

2019E

5.2% 5.8%

6.2%

5.5%

5.5% 6.2%

7.9%

9.5%

7.1%

6.5%

8.9%

2020E

7.9%

7.1%

6.4%

6.2%

9.0%

10.8%

8.1%

7.8%

9.3%

9.0%

9.2%

7.5% 5.7%

Financial Health

2019E Dist.

Coverage

1.3x

1.3x

1.7x

1.3x

1.5x

1.1x

1.1x

1.9x

1.1x

1.1x

1.2x

Preliminary Draft

1.2x

Net Debt /

2018E EBITDA

3.5x

3.7x

4.4x

3.7x

2.5x

3.0x

NM

2.3x

3.4x

2.7x

3.1x

2.0x

(4)

Defined as Price per LP unit divided by cash available for distribution to the LP unit holders under a full payout scenario.

Assumes AMGP purchases 100% of AM public units (188.1 million on a fully diluted basis) with a combination of equity and cash; AMGP issues 301.3 million shares to current AM unitholders.

Also assumes that AMGP issues 17.354 million shares in exchange for 100% of the Series B units.

Represents pro forma net debt/ LTM EBITDA as of 1/1/19.

Growth Metrics

2019E-21E

Growth CAGR

EBITDA

13%

16%

6%

13%

20%

12%

33%

17%

10%

17%

20%

BAIRD

21%

Project Bronco

DPU

10%

5%

12%

10%

15%

9%

14%

20%

5%

14%

24%

19%

Page 2View entire presentation