Barclays Investment Banking Pitch Book

Pro Forma KMI Discounted Cash Flows Analysis

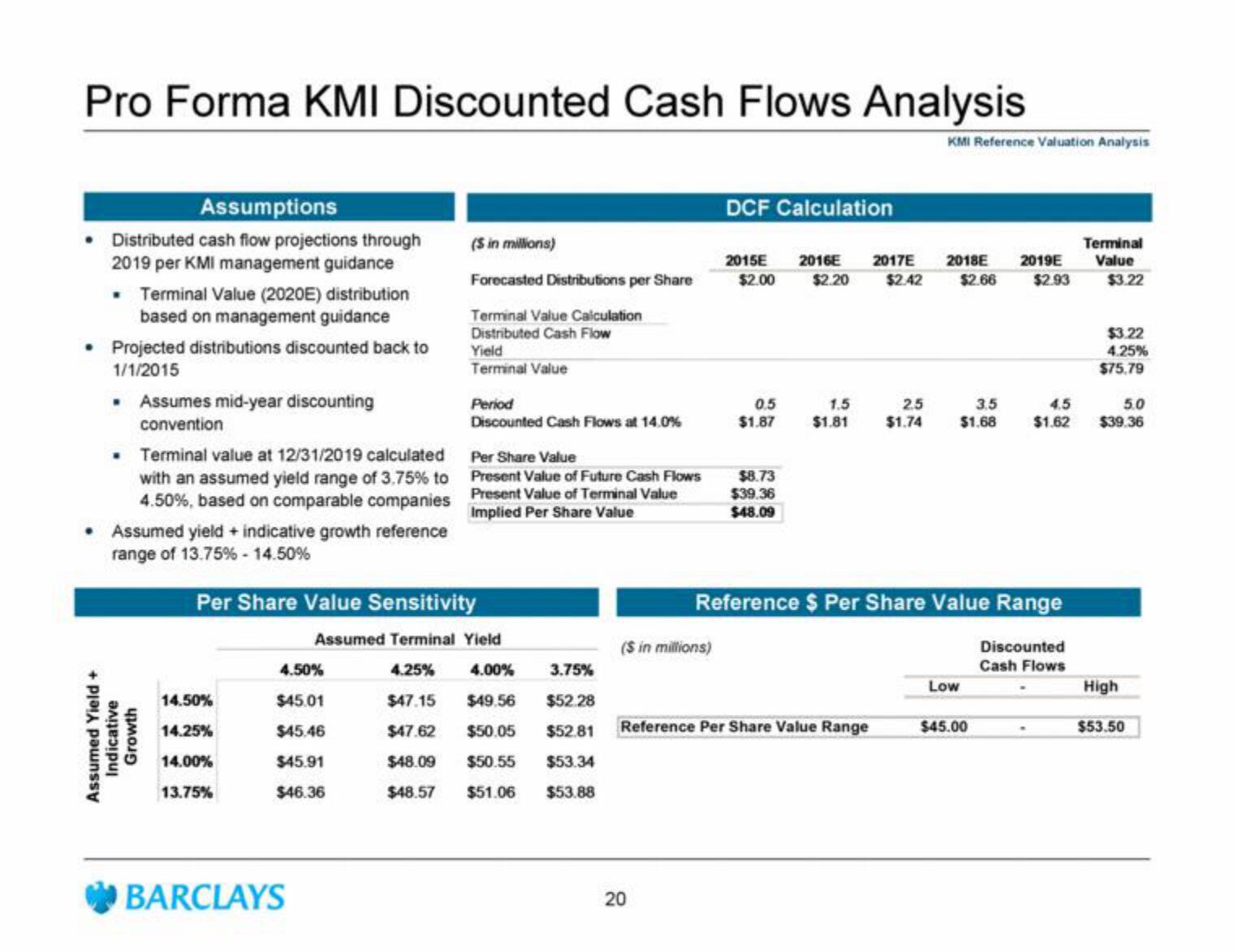

Assumptions

Distributed cash flow projections through

2019 per KMI management guidance

• Terminal Value (2020E) distribution

based on management guidance

• Projected distributions discounted back to

1/1/2015

. Assumes mid-year discounting

convention

. Terminal value at 12/31/2019 calculated

with an assumed yield range of 3,75% to

4.50%, based on comparable companies

• Assumed yield + indicative growth reference

range of 13.75% -14.50%

Assumed Yield +

Indicative

Growth

14.50%

14.25%

14.00%

13.75%

4.50%

$45.01

$45.46

$45.91

$46.36

(S in millions)

Forecasted Distributions per Share

Terminal Value Calculation

Distributed Cash Flow

BARCLAYS

Yield

Terminal Value

Per Share Value Sensitivity

Assumed Terminal Yield

4.25% 4.00%

3.75%

$47.15 $49.56

$52.28

$47.62 $50.05 $52.81

$48.09 $50.55 $53.34

$48.57 $51.06 $53.88

Period

Discounted Cash Flows at 14.0%

Per Share Value

Present Value of Future Cash Flows

Present Value of Terminal Value

Implied Per Share Value

($ in millions)

DCF Calculation

20

2015E 2016E 2017E

$2.00 $2.20 $2.42

0.5

$1.87

$8.73

$39.36

$48.09

1.5

$1.81

Reference Per Share Value Range

2.5

$1.74

KMI Reference Valuation Analysis

2018E 2019E

$2.66

$2.93

Reference $ Per Share Value Range

3.5

$1.68

Low

4.5

$1.62

$45.00

Discounted

Cash Flows

Terminal

Value

$3.22

$3.22

4.25%

$75.79

5.0

$39.36

High

$53.50View entire presentation