Marti Results Presentation Deck

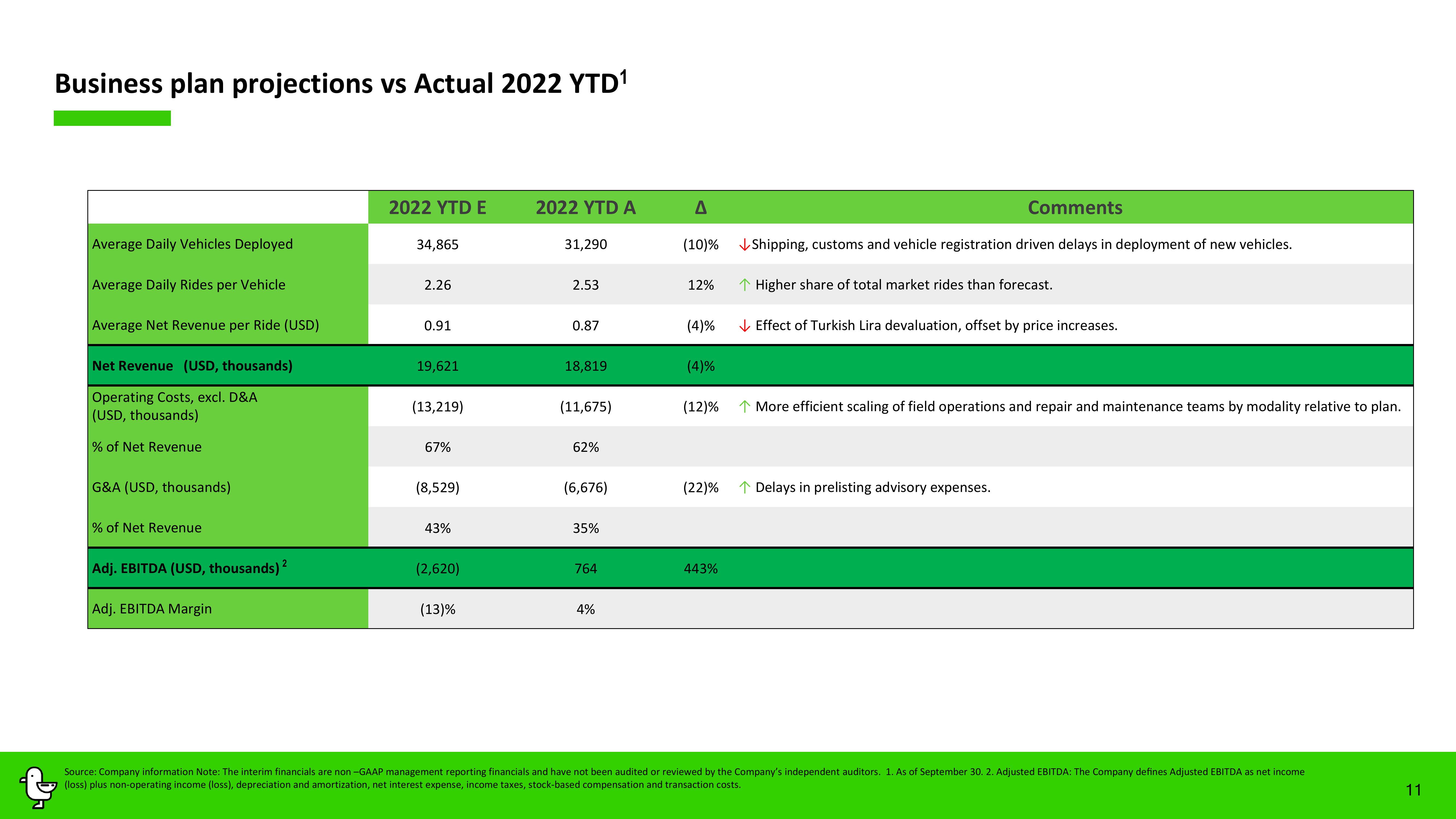

Business plan projections vs Actual 2022 YTD¹

Average Daily Vehicles Deployed

Average Daily Rides per Vehicle

Average Net Revenue per Ride (USD)

Net Revenue (USD, thousands)

Operating Costs, excl. D&A

(USD, thousands)

% of Net Revenue

G&A (USD, thousands)

% of Net Revenue

Adj. EBITDA (USD, thousands) ²

Adj. EBITDA Margin

2022 YTD E

34,865

2.26

0.91

19,621

(13,219)

67%

(8,529)

43%

(2,620)

(13)%

2022 YTD A

31,290

2.53

0.87

18,819

(11,675)

62%

(6,676)

35%

764

4%

A

(10)%

12% ↑ Higher share of total market rides than forecast.

(4)% ✓ Effect of Turkish Lira devaluation, offset by price increases.

(4)%

(12)%

Comments

Shipping, customs and vehicle registration driven delays in deployment of new vehicles.

(22)%

443%

↑ More efficient scaling of field operations and repair and maintenance teams by modality relative to plan.

↑ Delays in prelisting advisory expenses.

Source: Company information Note: The interim financials are non-GAAP management reporting financials and have not been audited or reviewed by the Company's independent auditors. 1. As of September 30. 2. Adjusted EBITDA: The Company defines Adjusted EBITDA as net income

(loss) plus non-operating income (loss), depreciation and amortization, net interest expense, income taxes, stock-based compensation and transaction costs.

11View entire presentation