J.P.Morgan Shareholder Engagement Presentation Deck

B Executive Compensation

The CMDC reviews and sets ROTCE thresholds each year for that year's

PSU award with a focus on rigor

Since PSUs were first introduced, we have received ongoing positive shareholder support for this aspect of our executive compensation program. The CMDC

reviews the design and associated metrics of the PSU program with each grant with a focus on rigor and have periodically made changes in design,

including those responsive to shareholder feedback.

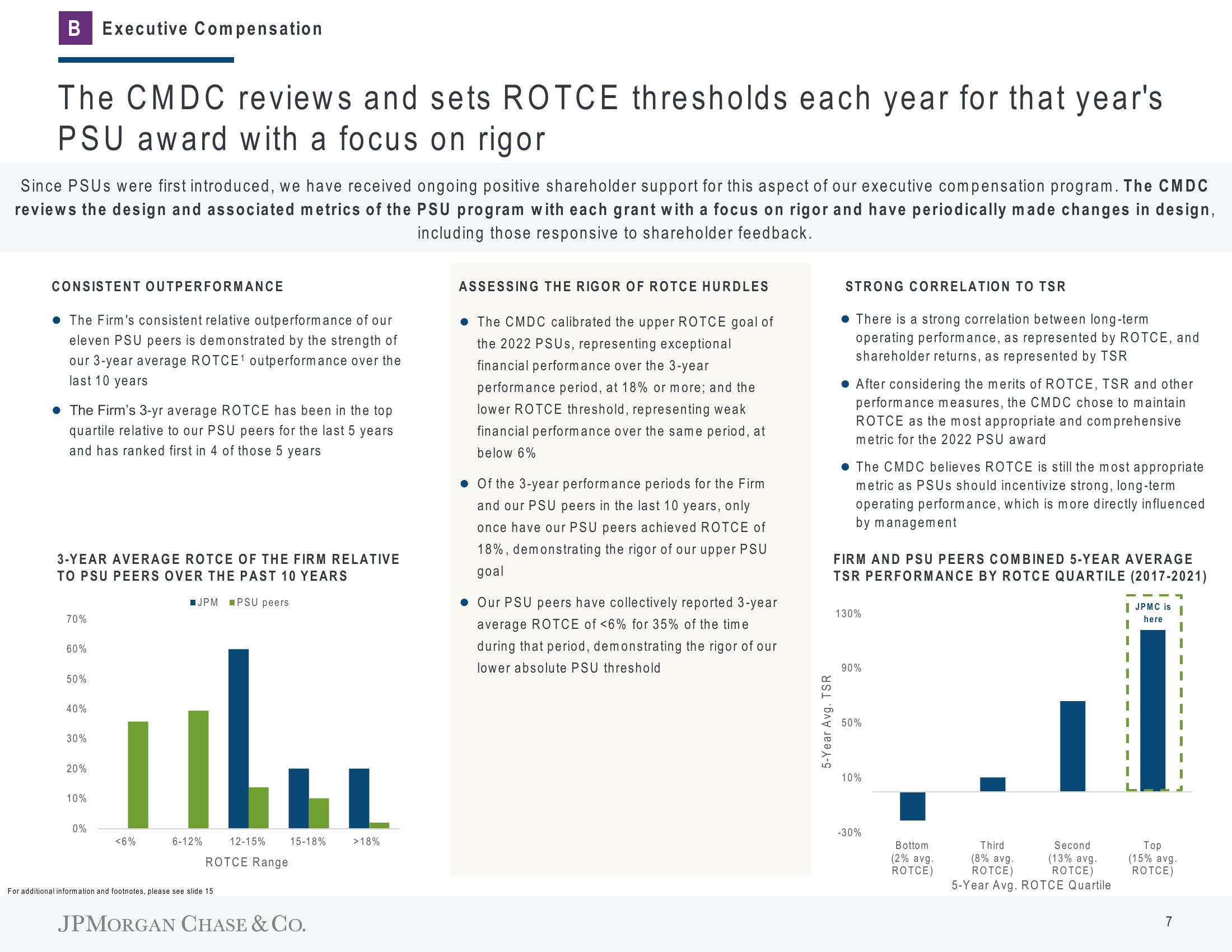

CONSISTENT OUTPERFORMANCE

The Firm's consistent relative outperformance of our

eleven PSU peers is demonstrated by the strength of

our 3-year average ROTCE¹ outperformance over the

last 10 years

The Firm's 3-yr average ROTCE has been in the top

quartile relative to our PSU peers for the last 5 years

and has ranked first in 4 of those 5 years

3-YEAR AVERAGE ROTCE OF THE FIRM RELATIVE

TO PSU PEERS OVER THE PAST 10 YEARS

JPM

PSU peers

70%

60%

50%

40%

30%

20%

10%

0%

Th

<6%

6-12%

LL

> 18%

For additional information and footnotes, please see slide 15

12-15% 15-18%

ROTCE Range

JPMORGAN CHASE & CO.

ASSESSING THE RIGOR OF ROTCE HURDLES

The CMDC calibrated the upper ROTCE goal of

the 2022 PSUs, representing exceptional

financial performance over the 3-year

performance period, at 18% or more; and the

lower ROTCE threshold, representing weak

financial performance over the same period, at

below 6%

. Of the 3-year performance periods for the Firm

and our PSU peers in the last 10 years, only

once have our PSU peers achieved ROTCE of

18%, demonstrating the rigor of our upper PSU

goal

• Our PSU peers have collectively reported 3-year

average ROTCE of <6% for 35% of the time

during that period, demonstrating the rigor of our

lower absolute PSU threshold

STRONG CORRELATION TO TSR

5-Year Avg. TSR

There is a strong correlation between long-term

operating performance, as represented by ROTCE, and

shareholder returns, as represented by TSR

. After considering the merits of ROTCE, TSR and other

performance measures, the CMDC chose to maintain

ROTCE as the most appropriate and comprehensive

metric for the 2022 PSU award

The CMDC believes ROTCE is still the most appropriate

metric as PSUs should incentivize strong, long-term

operating performance, which is more directly influenced

by management

FIRM AND PSU PEERS COMBINED 5-YEAR AVERAGE

TSR PERFORMANCE BY ROTCE QUARTILE (2017-2021)

130%

90%

50%

10%

-30%

Bottom

(2% avg.

ROTCE)

I JPMC is

here

il

Second

(13% avg.

ROTCE)

Third

(8% avg.

ROTCE)

5-Year Avg. ROTCE Quartile

Top

(15% avg.

ROTCE)

7View entire presentation