HSBC ESG Presentation Deck

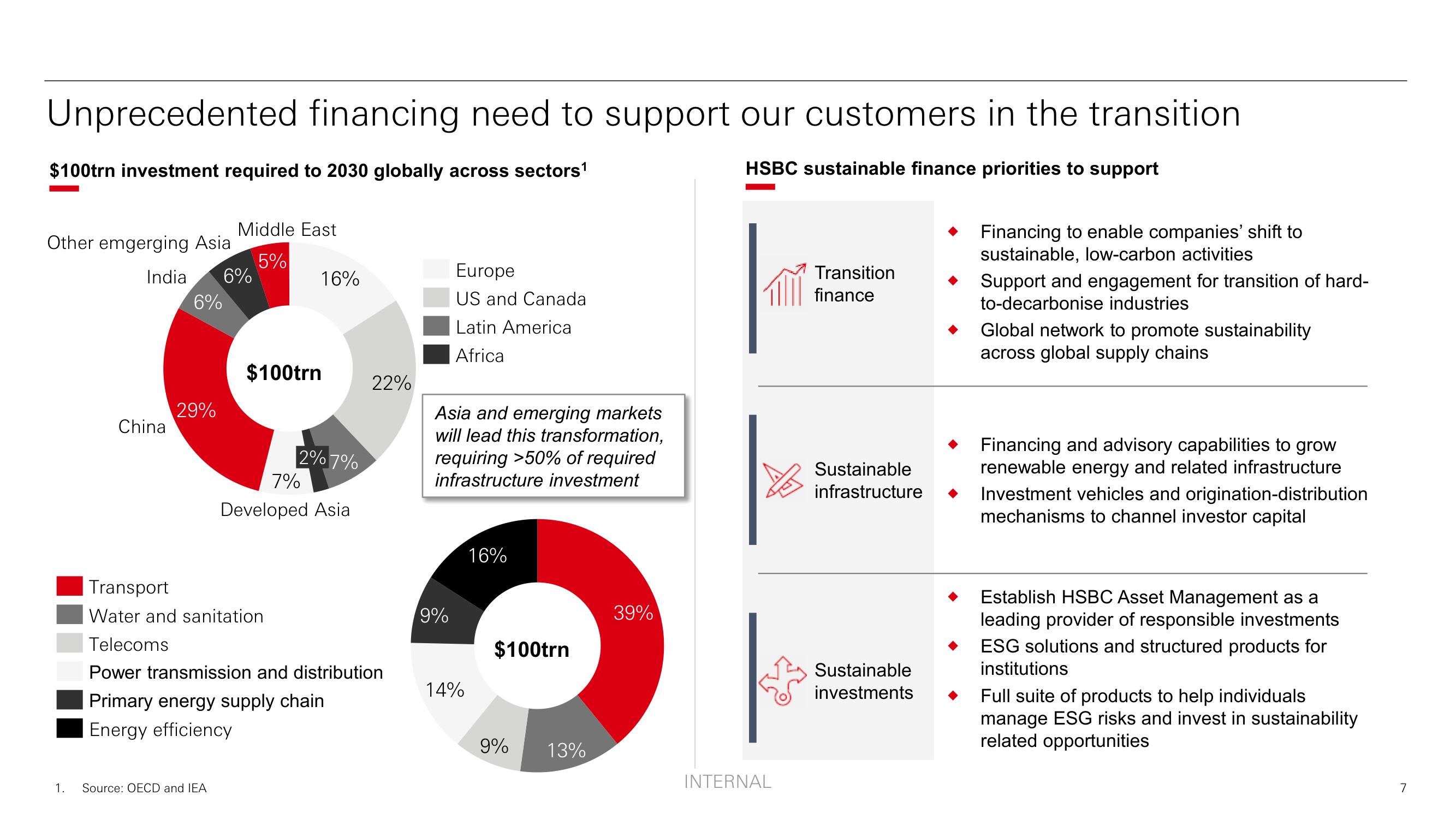

Unprecedented financing need to support our customers in the transition

$100trn investment required to 2030 globally across sectors¹

HSBC sustainable finance priorities to support

Other emgerging Asia

1.

India 6%

6%

China

29%

Middle East

5%

Source: OECD and IEA

16%

$100trn

2% 7%

7%

Developed Asia

22%

Transport

Water and sanitation

Telecoms

Power transmission and distribution

Primary energy supply chain

Energy efficiency

Europe

US and Canada

Latin America

Africa

Asia and emerging markets

will lead this transformation,

requiring >50% of required

infrastructure investment

9%

14%

16%

$100trn

9%

13%

39%

INTERNAL

Transition

finance

Sustainable

infrastructure

Sustainable

investments

Financing to enable companies' shift to

sustainable, low-carbon activities

Support and engagement for transition of hard-

to-decarbonise industries

Global network to promote sustainability

across global supply chains

Financing and advisory capabilities to grow

renewable energy and related infrastructure

Investment vehicles and origination-distribution

mechanisms to channel investor capital

Establish HSBC Asset Management as a

leading provider of responsible investments

ESG solutions and structured products for

institutions

Full suite of products to help individuals

manage ESG risks and invest in sustainability

related opportunities

7View entire presentation