UBS Results Presentation Deck

Global Wealth Management

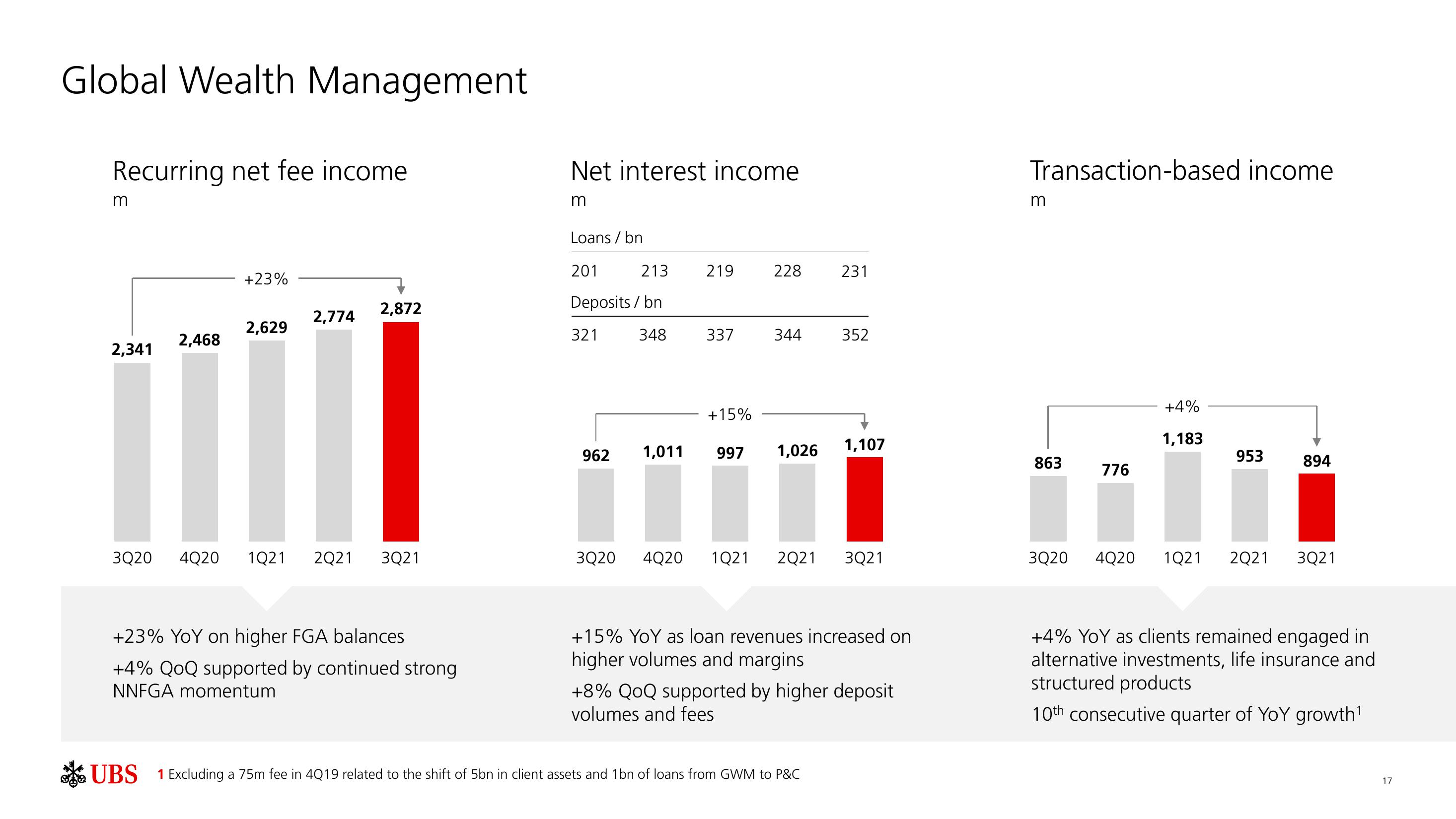

Recurring net fee income

m

2,341

2,468

+23%

2,629

2,774

2,872

3Q20 4Q20 1Q21 2Q21 3Q21

+23% YoY on higher FGA balances

+4% QoQ supported by continued strong

NNFGA momentum

Net interest income

m

Loans / bn

201

213

Deposits/bn

321

348

962 1,011

219

337

+15%

228

344

1,026

997

I

3Q20 4Q20 1Q21 2Q21

231

352

UBS 1 Excluding a 75m fee in 4Q19 related to the shift of 5bn in client assets and 1bn of loans from GWM to P&C

1,107

3Q21

+15% YoY as loan revenues increased on

higher volumes and margins

+8% QOQ supported by higher deposit

volumes and fees

Transaction-based income

m

863

776

+4%

1,183

953

3Q20 4Q20 1Q21 2Q21

894

3Q21

+4% YoY as clients remained engaged in

alternative investments, life insurance and

structured products

10th consecutive quarter of YoY growth¹

17View entire presentation