BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

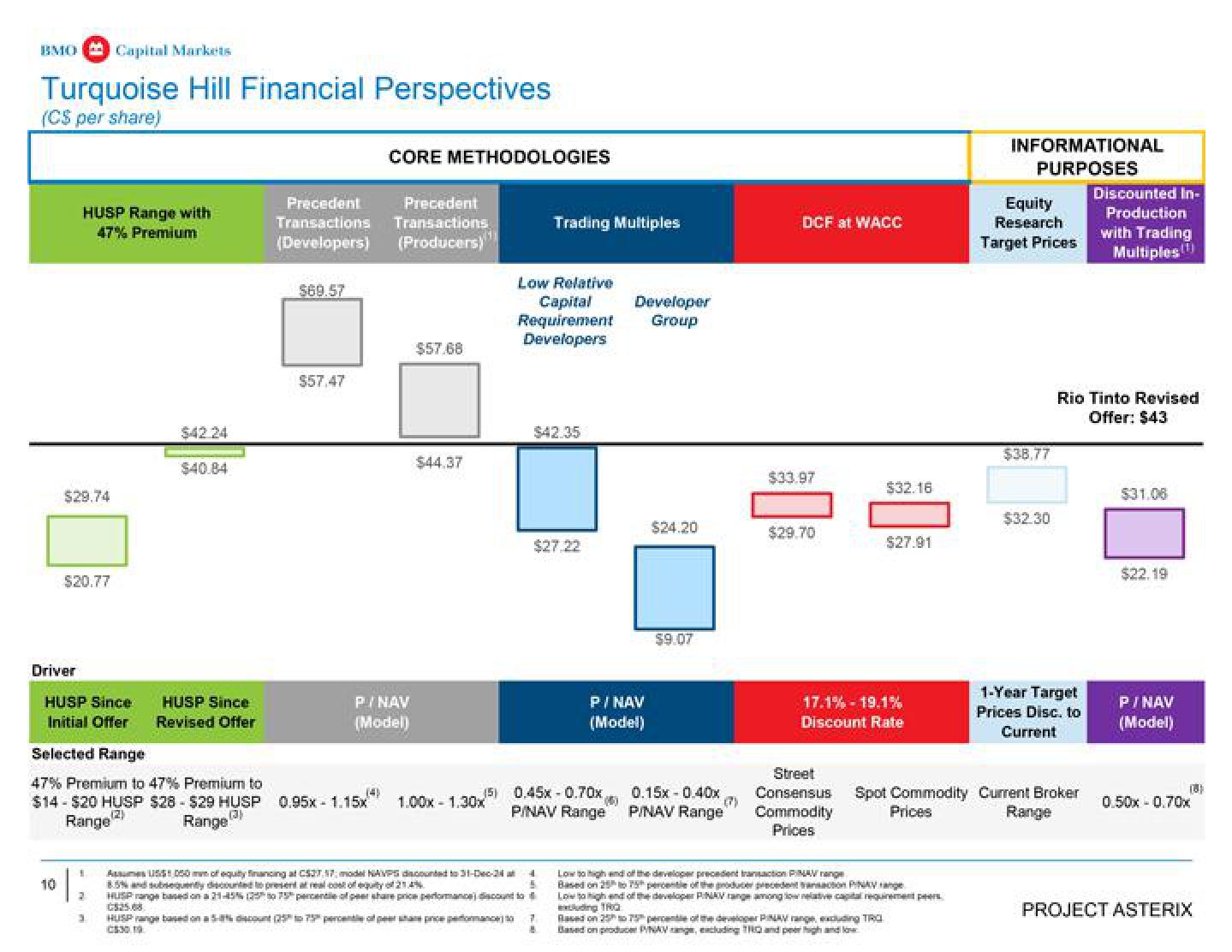

Turquoise Hill Financial Perspectives

(C$ per share)

HUSP Range with

47% Premium

$29.74

Driver

10

$20.77

2

3

$40.84

HUSP Since

HUSP Since

Initial Offer Revised Offer

Selected Range

47% Premium to 47% Premium to

$14- $20 HUSP $28-$29 HUSP 0.95x-1.15x

(2)

(3)

Range

Range

C$30.9

Precedent

Precedent

Transactions Transactions

(Developers)

(Producers)

$69.57

$57.47

CORE METHODOLOGIES

P/NAV

(Model)

(4)

$57.68

$44.37

(5)

1.00x 1.30x

Low Relative

Capital

Requirement

Developers

AUS$1050 of equity financing at CS37, 17; model NAVPS discounted to 31-Dec-24

8.5% and subsequently decounted to present at real cost of yo21.4%

HUSP range based on a 21-45% (25 to 75 percentile of per share price performance) discount to

C$25.08

$42.35

Trading Multiples

$27.22

0.45x -0.70x

P/NAV Range

A

A

7

B

P/NAV

(Model)

Developer

Group

(5)

$24.20

$9.07

0.15x -0.40x

P/NAV Range

(7)

DCF at WACC

$33.97

$29.70

Street

Consensus

Commodity

Prices

$32.16

17.1% -19.1%

Discount Rate

$27.91

Spot Commodity

Prices

Based on 3575 percent of the developer PINAV range, excluding TRO

Based on producer PVNAV range,excluding TQ and perhigh and low

Low to high and off the developer precedent transaction FINAW range

Based on 2575 percent of the producer precedent transaction PINAY

Low to high end of the developer PNAV range among low relative capital requirement pers

uding TR

INFORMATIONAL

PURPOSES

Equity

Research

Target Prices

$38.77

$32.30

1-Year Target

Prices Disc. to

Current

Discounted In-

Production

Rio Tinto Revised

Offer: $43

Current Broker

Range

with Trading

Multiples (¹)

$31.06

$22.19

P/NAV

(Model)

(3)

0.50x -0.70x

PROJECT ASTERIXView entire presentation