J.P.Morgan Investment Banking Pitch Book

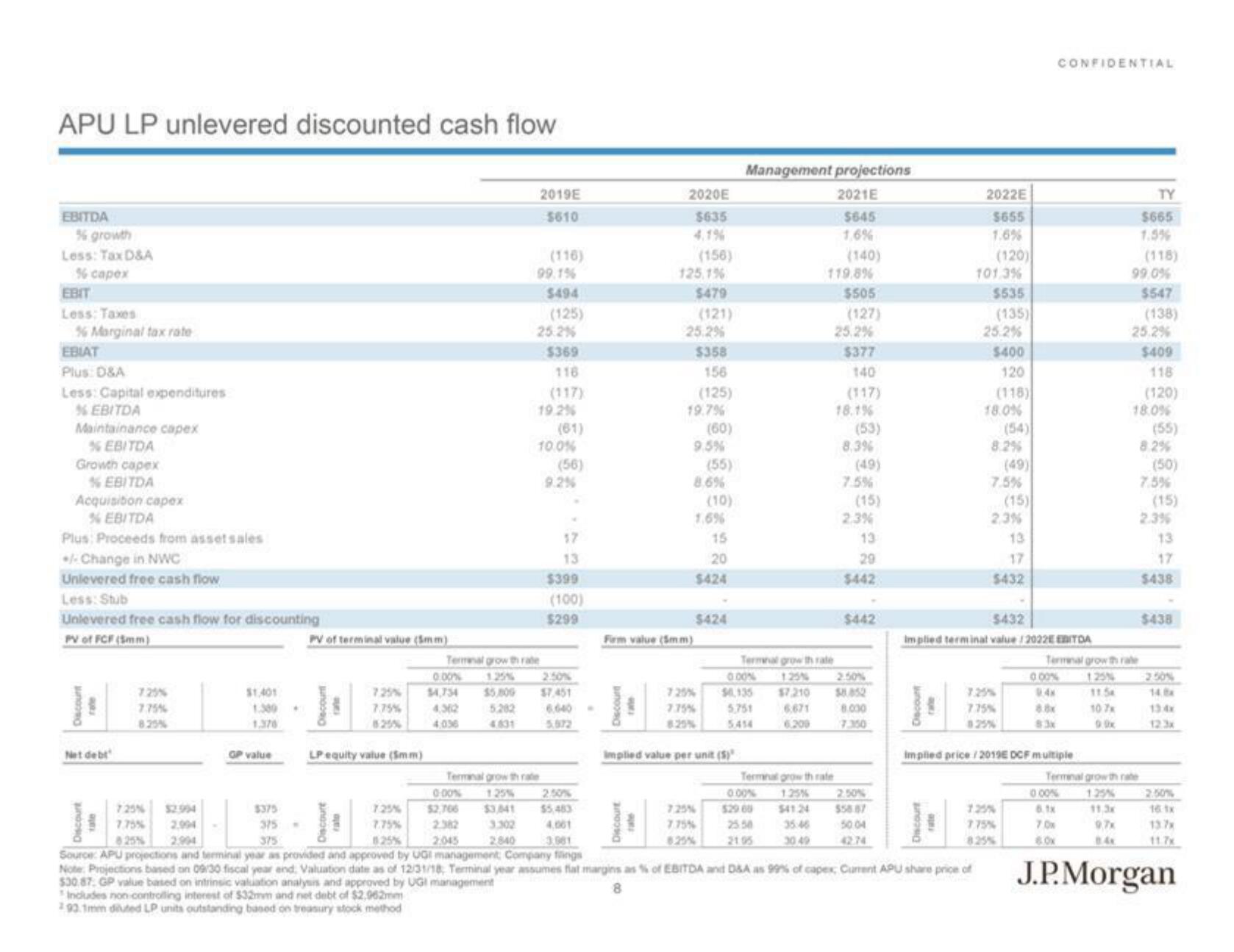

APU LP unlevered discounted cash flow

EBITDA

% growth

Less: Tax D&A

% capex

EBIT

Less: Taxes

% Marginal tax rate

EBIAT

Plus: D&A

Less: Capital expenditures

%EBITDA

Maintainance capex

%EBITDA

Growth capex

%EBITDA

Acquisition capex

%EBITDA

Plus: Proceeds from asset sales

+/- Change in NWC

Unlevered free cash flow

Less: Stub

Unlevered free cash flow for discounting

PV of FCF (5mm)

Net debt

7.25%

8.25%

7.75%

825%

$1,401

1.300

1.376

GP value

$375

PV of terminal value (5mm)

rate

LP equity value (5mm)

Discourt

7.25%

7.75%

825%

0.00%

$4,754

4,362

4.036

2019E

5610

5.202

4831

99.1%

(116)

Terminal growth rate

25.2%

$494

(125)

19.2%

Terminal grow th rate

$369

116

10.0%

(61)

(56)

9.2%

17

13

$399

(100)

$299

2.50%

$7.451

6.640

5.972

0.00%

2.50%

$2,706 $3,841 $5,483

2.382

3.302

4,061

2,840

3.901

2020E

$635

125,1%

$479

(121)

25.2%

$358

156

(125)

(156)

19.7%

9.5%

Firm value (5mm)

(60)

8.6%

7.35%

(55)

1.6%

(10)

7.25%

7.75%

15

20

$424

$424

Implied value per unit (S)

Management projections

2021E

$645

1,6%

0.00%

$4,135

5,751

5414

Terminal growth rale

0.00%

25.50

21.05

119.8%

Terminal grow th rate

125%

541.24

(140)

25.2%

30 49

$505

(127)

$377

140

(117)

18.1%

(53)

8.3%

7.5%

(15)

2.3%

13

29

$442

2.50%

$7,210 $8.852

6.671

8.000

6.200

7.350

$442

2.50%

$58.87

50.04

42.74

2022E

$655

1.6%

Discourt

(120)

101.3%

375-

375

Source: APU projections and terminal year as provided and approved by UGI management Company filings

Note: Projections based on 09/30 fiscal year end. Valuation date as of 12/31/18, Terminal year assumes fiat margins as % of EBITDA and D&A as 99% of capex, Current APU share price of

$30.87. GP value based on intrinsic valuation analysis and approved by UGI management

8

Includes non-controlling interest of $32mm and net debt of $2,962mm

293.1mm diluted LP units outstanding based on treasury stock method

$535

(135)

25.2%

$400

120

(118)

18.0%

8.2%

7.5%

(49)

2.3%

7.75%

(15)

13

17

$432

$432

Implied terminal value/2022E EBITDA

7.25%

7.75%

CONFIDENTIAL

Impiled price/2019E DCF multiple

000%

9.4x

0.00%

6.1x

7.0x

10 7x

90x

TY

$665

1.5%

99,0%

$547

(138)

25.2%

Terminal growth rale

125%

11.5k

(118)

Terminal growth rate

125%

11,3x

9,7x

8.4

$409

118

18.0%

(120)

(55)

8.2%

7.5%

(50)

2.3%

(15)

13

$438

$438

2.50%

14.8

13:4x

16 1x

11.7x

J.P. MorganView entire presentation