Summit Hotel Properties Investor Presentation Deck

22

●

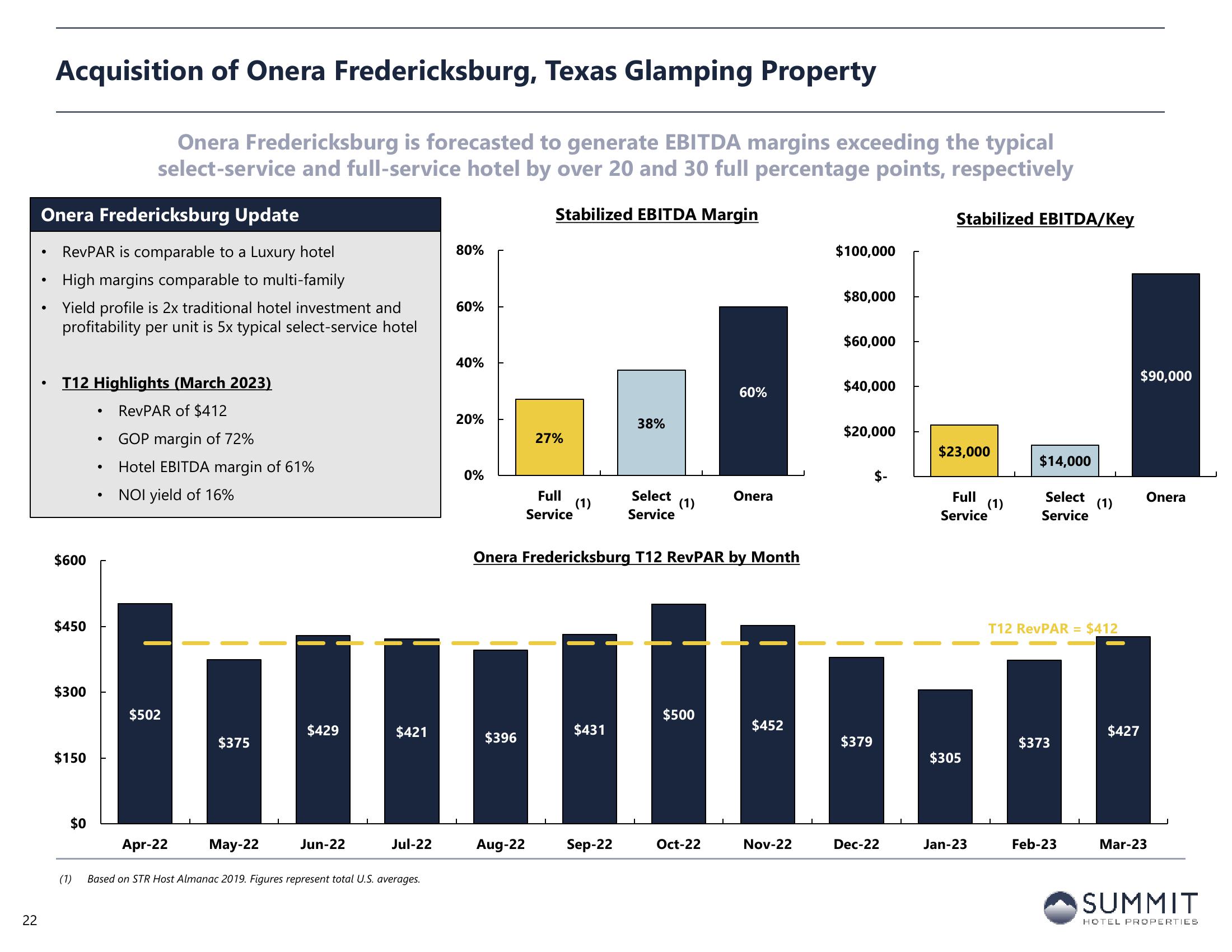

Acquisition of Onera Fredericksburg, Texas Glamping Property

Onera Fredericksburg Update

RevPAR is comparable to a Luxury hotel

High margins comparable to multi-family

Yield profile is 2x traditional hotel investment and

profitability per unit is 5x typical select-service hotel

●

T12 Highlights (March 2023)

RevPAR of $412

GOP margin of 72%

Hotel EBITDA margin of 61%

NOI yield of 16%

$600

$450

$300

$150

$0

●

Onera Fredericksburg is forecasted to generate EBITDA margins exceeding the typical

select-service and full-service hotel by over 20 and 30 full percentage points, respectively

Stabilized EBITDA Margin

●

●

$502

$375

$429

Jun-22

$421

Apr-22

May-22

(1) Based on STR Host Almanac 2019. Figures represent total U.S. averages.

Jul-22

80%

60%

40%

20%

0%

$396

27%

Aug-22

Full

Service

(1)

$431

38%

Sep-22

Select

Service

Onera Fredericksburg T12 RevPAR by Month

(1)

$500

60%

Oct-22

Onera

$452

Nov-22

$100,000

$80,000

$60,000

$40,000

$20,000

$379

$-

Dec-22

Stabilized EBITDA/Key

$23,000

Full

(1)

Service

$305

Jan-23

I

$14,000

Select

Service

T12 RevPAR = $412

$373

(1)

Feb-23

$90,000

$427

Onera

Mar-23

SUMMIT

HOTEL PROPERTIESView entire presentation