PB Bankshares Results Presentation Deck

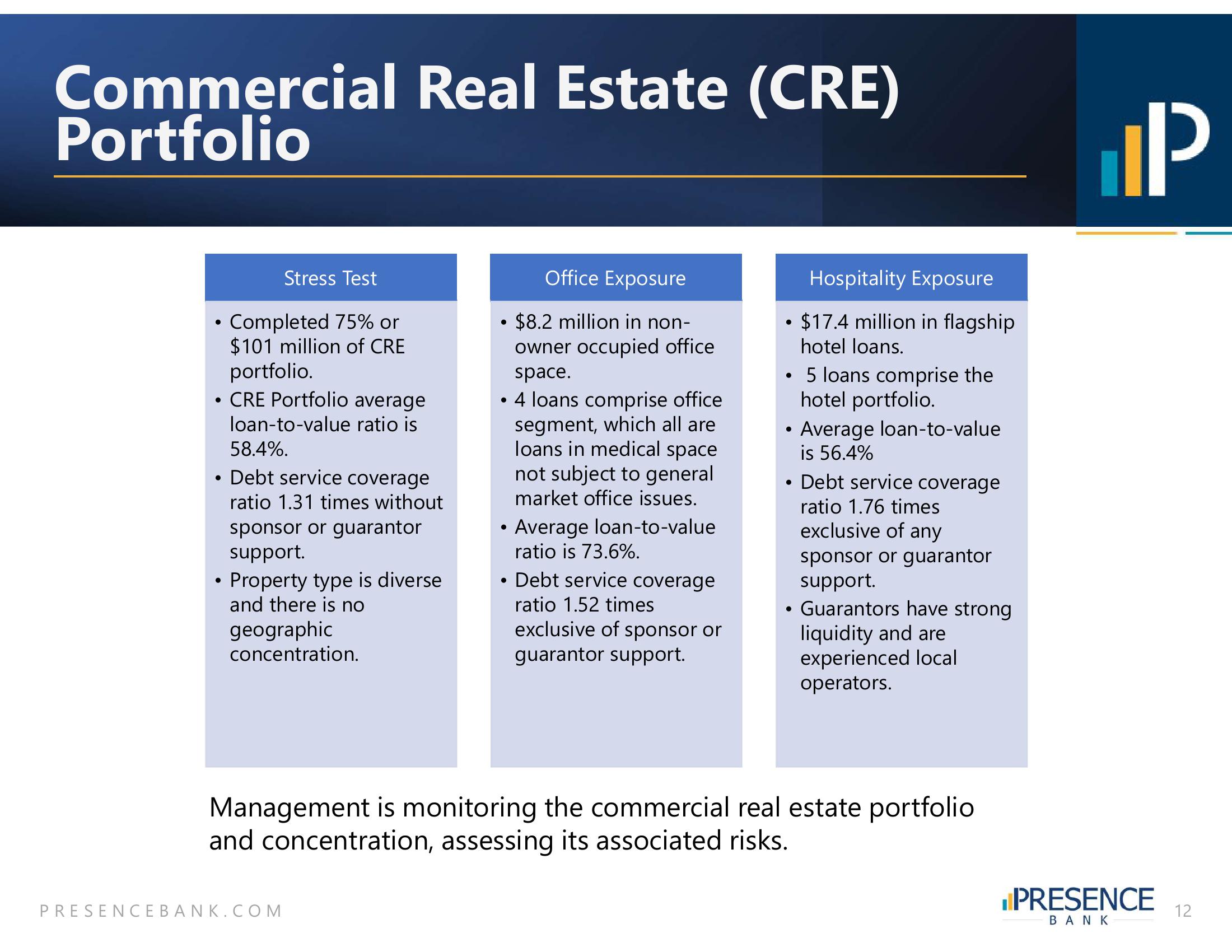

Commercial Real Estate (CRE)

Portfolio

Stress Test

Completed 75% or

$101 million of CRE

portfolio.

CRE Portfolio average

loan-to-value ratio is

58.4%.

Debt service coverage

ratio 1.31 times without

sponsor or guarantor

support.

• Property type is diverse

and there is no

●

geographic

concentration.

Office Exposure

$8.2 million in non-

owner occupied office

space.

• 4 loans comprise office

segment, which all are

loans in medical space

not subject to general

market office issues.

• Average loan-to-value

ratio is 73.6%.

• Debt service coverage

ratio 1.52 times

exclusive of sponsor or

guarantor support.

PRESENCEBANK.COM

●

Hospitality Exposure

• $17.4 million in flagship

hotel loans.

●

●

• Average loan-to-value

is 56.4%

●

5 loans comprise the

hotel portfolio.

●

Debt service coverage

ratio 1.76 times

exclusive of any

sponsor or guarantor

support.

Guarantors have strong

liquidity and are

experienced local

operators.

Management is monitoring the commercial real estate portfolio

and concentration, assessing its associated risks.

כןן.

PRESENCE

ΒΑΝΚ

12View entire presentation