Boxed SPAC Presentation Deck

Model Overview

COMMENTARY

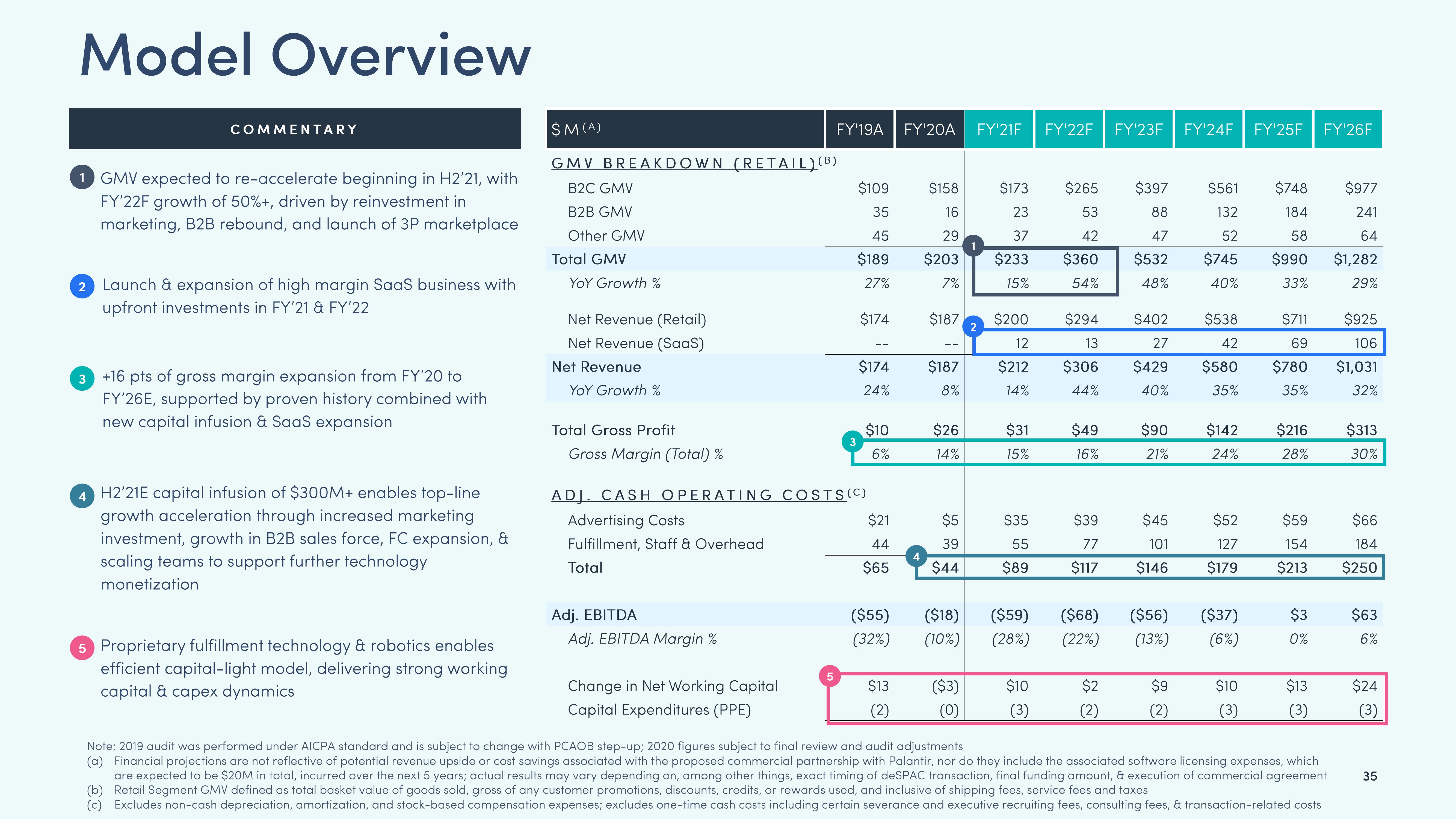

1 GMV expected to re-accelerate beginning in H2'21, with

FY'22F growth of 50%+, driven by reinvestment in

marketing, B2B rebound, and launch of 3P marketplace

2 Launch & expansion of high margin SaaS business with

upfront investments in FY'21 & FY'22

3 +16 pts of gross margin expansion from FY'20 to

FY'26E, supported by proven history combined with

new capital infusion & SaaS expansion

4

H2'21E capital infusion of $300M+ enables top-line

growth acceleration through increased marketing

investment, growth in B2B sales force, FC expansion, &

scaling teams to support further technology

monetization

5 Proprietary fulfillment technology & robotics enables

efficient capital-light model, delivering strong working

capital & capex dynamics

$M(A)

GMV BREAKDOWN (RETAIL) (B)

B2C GMV

B2B GMV

Other GMV

Total GMV

YOY Growth %

Net Revenue (Retail)

Net Revenue (SaaS)

Net Revenue

YOY Growth %

Total Gross Profit

Gross Margin (Total) %

Adj. EBITDA

Adj. EBITDA Margin %

Change in Net Working Capital

Capital Expenditures (PPE)

FY'19A

5

$109

35

45

$189

27%

3

ADJ. CASH OPERATING COSTS (C)

Advertising Costs

Fulfillment, Staff & Overhead

Total

$174

$174

24%

$10

6%

$21

44

$65

FY'20A

$13

(2)

$158

$173

23

37

$203 $233

16

29

7%

15%

$187

$187

8%

$26

14%

FY¹21F FY¹22F FY¹23F FY¹24F FY'25F FY¹26F

$5

39

$44

$200

12

$212

14%

$31

15%

$35

55

$89

($55) ($18) ($59)

(32%)

(10%)

(28%)

($3) $10

(0)

$265

53

42

$360

54%

$294

13

$306

44%

$49

16%

($68)

(22%)

$397

88

47

$532

48%

$2

$402

27

$429

40%

$39

$45

77

101

$117 $146

$90

21%

($56)

(13%)

$9

$561

132

52

$745

40%

$538

42

$580

35%

$142

24%

$52

127

$179

($37)

(6%)

$10

(3)

$748

184

58

$990

33%

69

$780

35%

$711 $925

106

$59

154

$213

$3

0%

$977

241

64

$216 $313

28%

30%

$13

(3)

$1,282

29%

Note: 2019 audit was performed under AICPA standard and is subject to change with PCAOB step-up; 2020 figures subject to final review and audit adjustments

(a) Financial projections are not reflective of potential revenue upside or cost savings associated with the proposed commercial partnership with Palantir, nor do they include the associated software licensing expenses, which

are expected to be $20M in total, incurred over the next 5 years; actual results may vary depending on, among other things, exact timing of deSPAC transaction, final funding amount, & execution of commercial agreement

(b) Retail Segment GMV defined as total basket value of goods sold, gross of any customer promotions, discounts, credits, or rewards used, and inclusive of shipping fees, service fees and taxes

(c) Excludes non-cash depreciation, amortization, and stock-based compensation expenses; excludes one-time cash costs including certain severance and executive recruiting fees, consulting fees, & transaction-related costs

$1,031

32%

$66

184

$250

$63

6%

$24

(3)

35View entire presentation