View SPAC Presentation Deck

Pro forma equity ownership

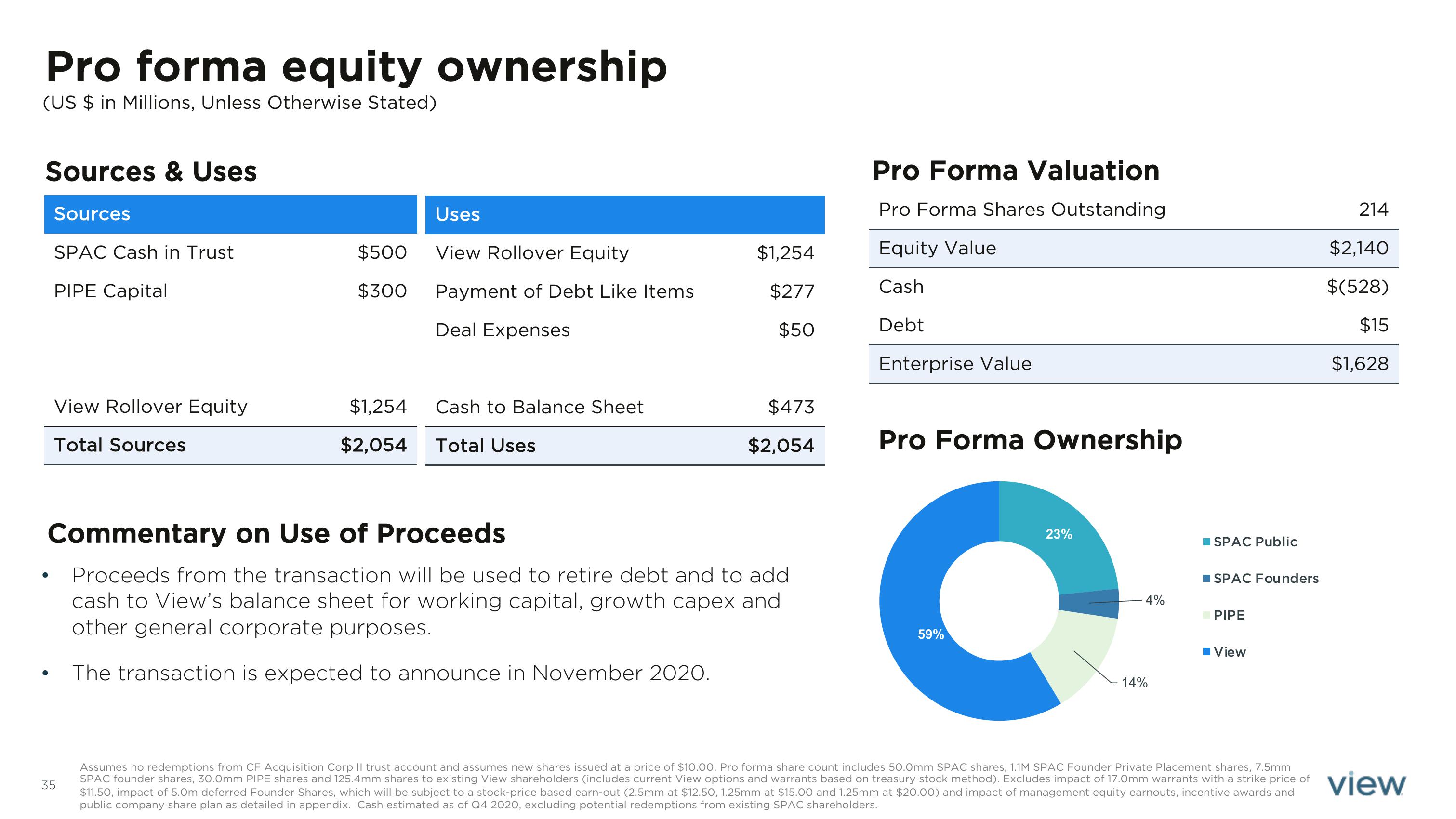

(US $ in Millions, Unless Otherwise Stated)

Sources & Uses

Sources

SPAC Cash in Trust

PIPE Capital

View Rollover Equity

Total Sources

●

Uses

$500 View Rollover Equity

$300

35

$1,254

$2,054

Payment of Debt Like Items

Deal Expenses

Cash to Balance Sheet

Total Uses

$1,254

$277

$50

Commentary on Use of Proceeds

Proceeds from the transaction will be used to retire debt and to add

cash to View's balance sheet for working capital, growth capex and

other general corporate purposes.

The transaction is expected to announce in November 2020.

$473

$2,054

Pro Forma Valuation

Pro Forma Shares Outstanding

Equity Value

Cash

Debt

Enterprise Value

Pro Forma Ownership

59%

23%

4%

14%

SPAC Public

SPAC Founders

PIPE

View

214

$2,140

$(528)

$15

$1,628

Assumes no redemptions from CF Acquisition Corp II trust account and assumes new shares issued at a price of $10.00. Pro forma share count includes 50.0mm SPAC shares, 1.1M SPAC Founder Private Placement shares, 7.5mm

SPAC founder shares, 30.0mm PIPE shares and 125.4mm shares to existing View shareholders (includes current View options and warrants based on treasury stock method). Excludes impact of 17.0mm warrants with a strike price of

$11.50, impact of 5.0m deferred Founder Shares, which will be subject to a stock-price based earn-out (2.5mm at $12.50, 1.25mm at $15.00 and 1.25mm at $20.00) and impact of management equity earnouts, incentive awards and

public company share plan as detailed in appendix. Cash estimated as of Q4 2020, excluding potential redemptions from existing SPAC shareholders.

viewView entire presentation