HSBC Results Presentation Deck

Corporate Centre

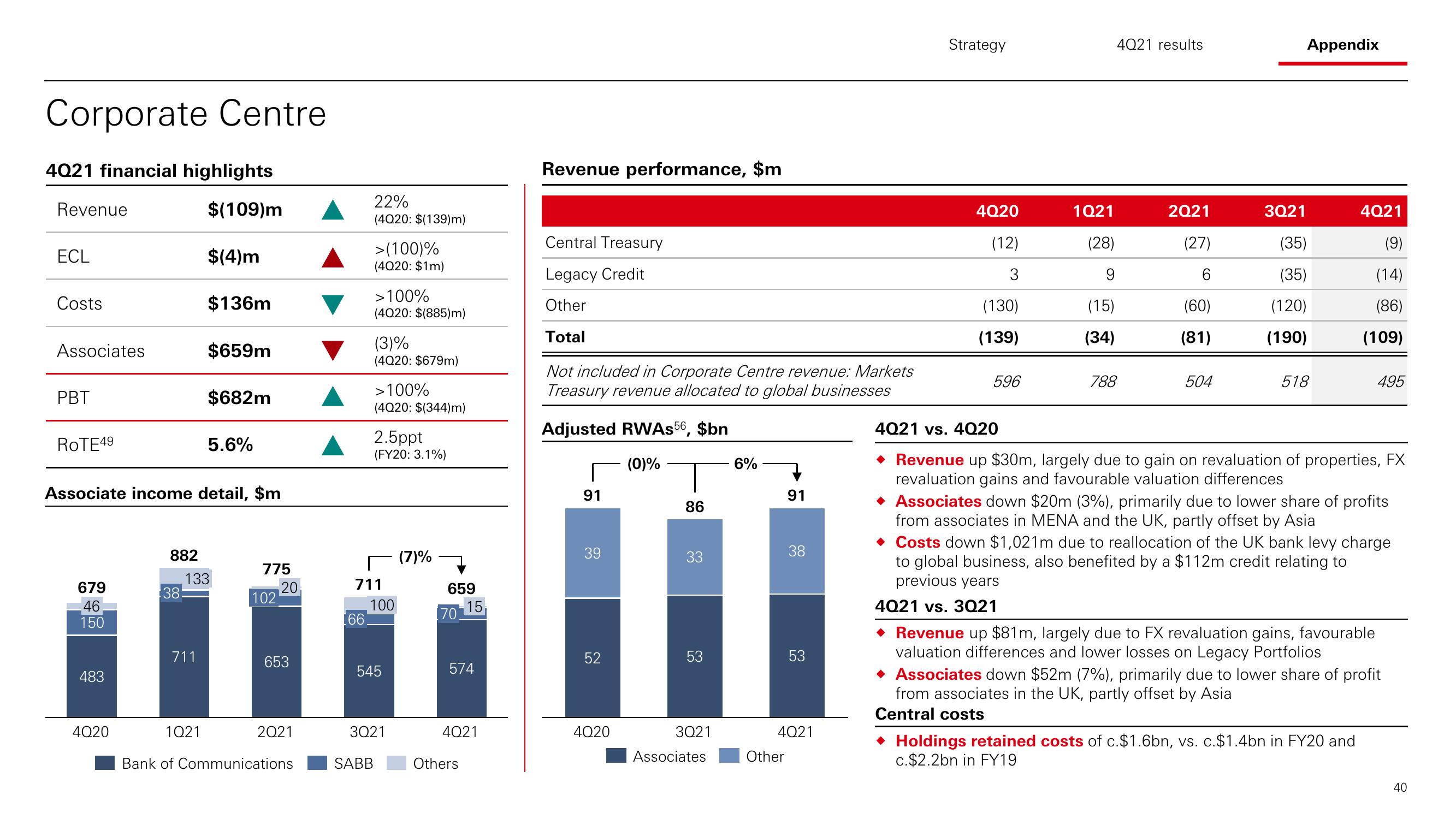

4021 financial highlights

$(109)m

$(4)m

$136m

$659m

Revenue

ECL

Costs

Associates

PBT

ROTE4⁹

679

46

150

Associate income detail, $m

483

4Q20

882

38

$682m

711

5.6%

133

1Q21

775

102

20

653

2Q21

Bank of Communications

[66

22%

(4020: $(139)m)

>(100)%

(4020: $1m)

>100%

(4020: $(885)m)

(3)%

(4020: $679m)

SABB

>100%

(4020: $(344)m)

711

2.5ppt

(FY20: 3.1%)

100

545

3Q21

(7)%

659

70

15

574

4021

Others

Revenue performance, $m

Central Treasury

Legacy Credit

Other

Total

Not included in Corporate Centre revenue: Markets

Treasury revenue allocated to global businesses

Adjusted RWAS 56, $bn

(0)%

91

39

52

4020

86

33

53

3Q21

Associates

6%

91

Other

38

53

4Q21

Strategy

4Q20

(12)

3

(130)

(139)

596

1Q21

(28)

9

(15)

(34)

4021 results

788

2Q21

(27)

6

(60)

(81)

504

Appendix

3Q21

(35)

(35)

(120)

(190)

518

4Q21

(9)

(14)

(86)

(109)

4021 vs. 4Q20

◆ Revenue up $30m, largely due to gain on revaluation of properties, FX

revaluation gains and favourable valuation differences

495

◆ Associates down $20m (3%), primarily due to lower share of profits

from associates in MENA and the UK, partly offset by Asia

Costs down $1,021m due to reallocation of the UK bank levy charge

to global business, also benefited by a $112m credit relating to

previous years

4021 vs. 3021

◆ Revenue up $81m, largely due to FX revaluation gains, favourable

valuation differences and lower losses on Legacy Portfolios

Holdings retained costs of c.$1.6bn, vs. c.$1.4bn in FY20 and

c.$2.2bn in FY19

◆ Associates down $52m (7%), primarily due to lower share of profit

from associates in the UK, partly offset by Asia

Central costs

40View entire presentation