flyExclusive Investor Presentation Deck

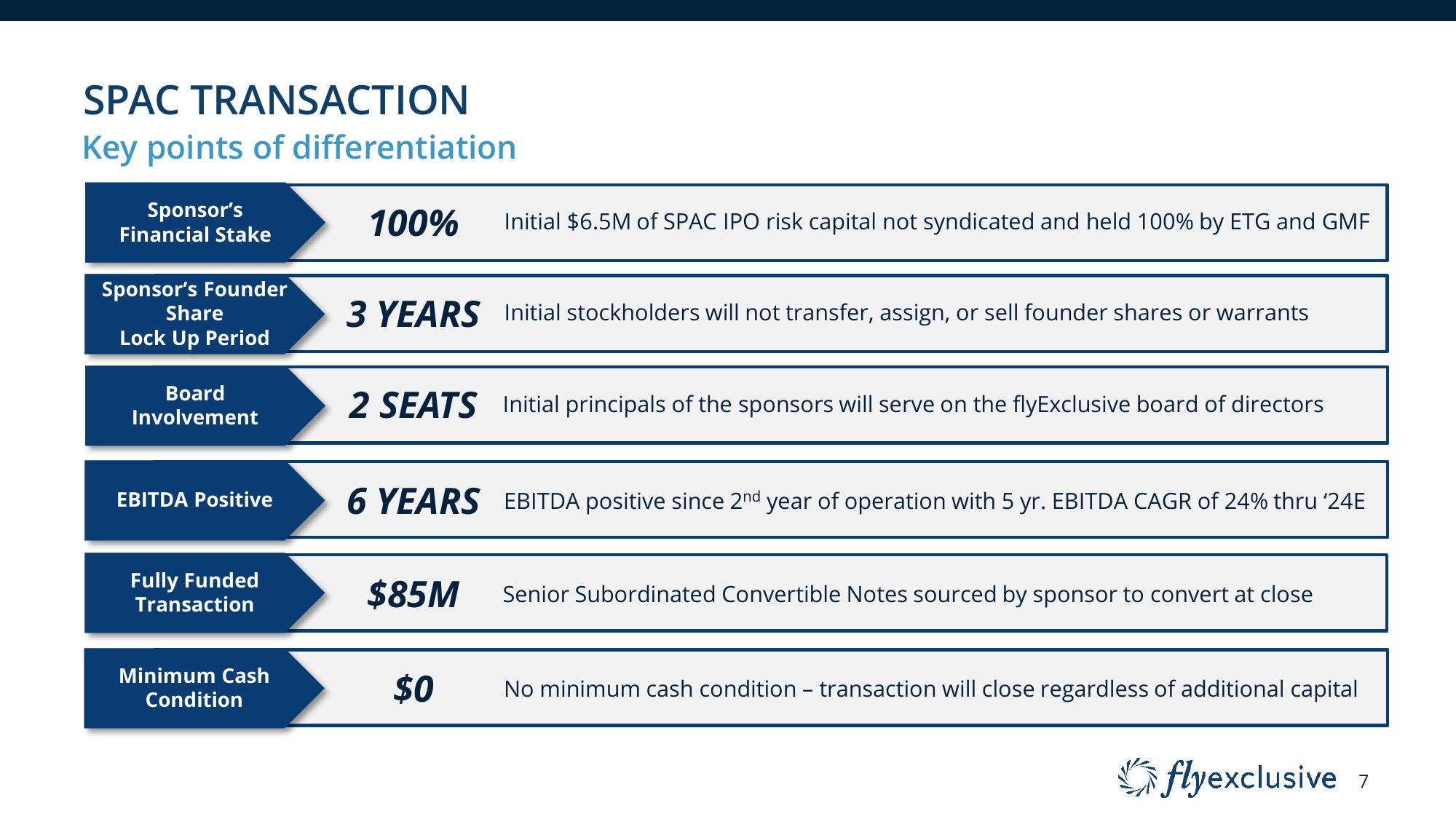

SPAC TRANSACTION

Key points of differentiation

Sponsor's

Financial Stake

Sponsor's Founder

Share

Lock Up Period

Board

Involvement

EBITDA Positive

Fully Funded

Transaction

Minimum Cash

Condition

100% Initial $6.5M of SPAC IPO risk capital not syndicated and held 100% by ETG and GMF

3 YEARS Initial stockholders will not transfer, assign, or sell founder shares or warrants

2 SEATS Initial principals of the sponsors will serve on the flyExclusive board of directors

6 YEARS EBITDA positive since 2nd year of operation with 5 yr. EBITDA CAGR of 24% thru '24E

$85M Senior Subordinated Convertible Notes sourced by sponsor to convert at close

$0

No minimum cash condition - transaction will close regardless of additional capital

flyexclusive 7View entire presentation