Antero Midstream Partners Investor Presentation Deck

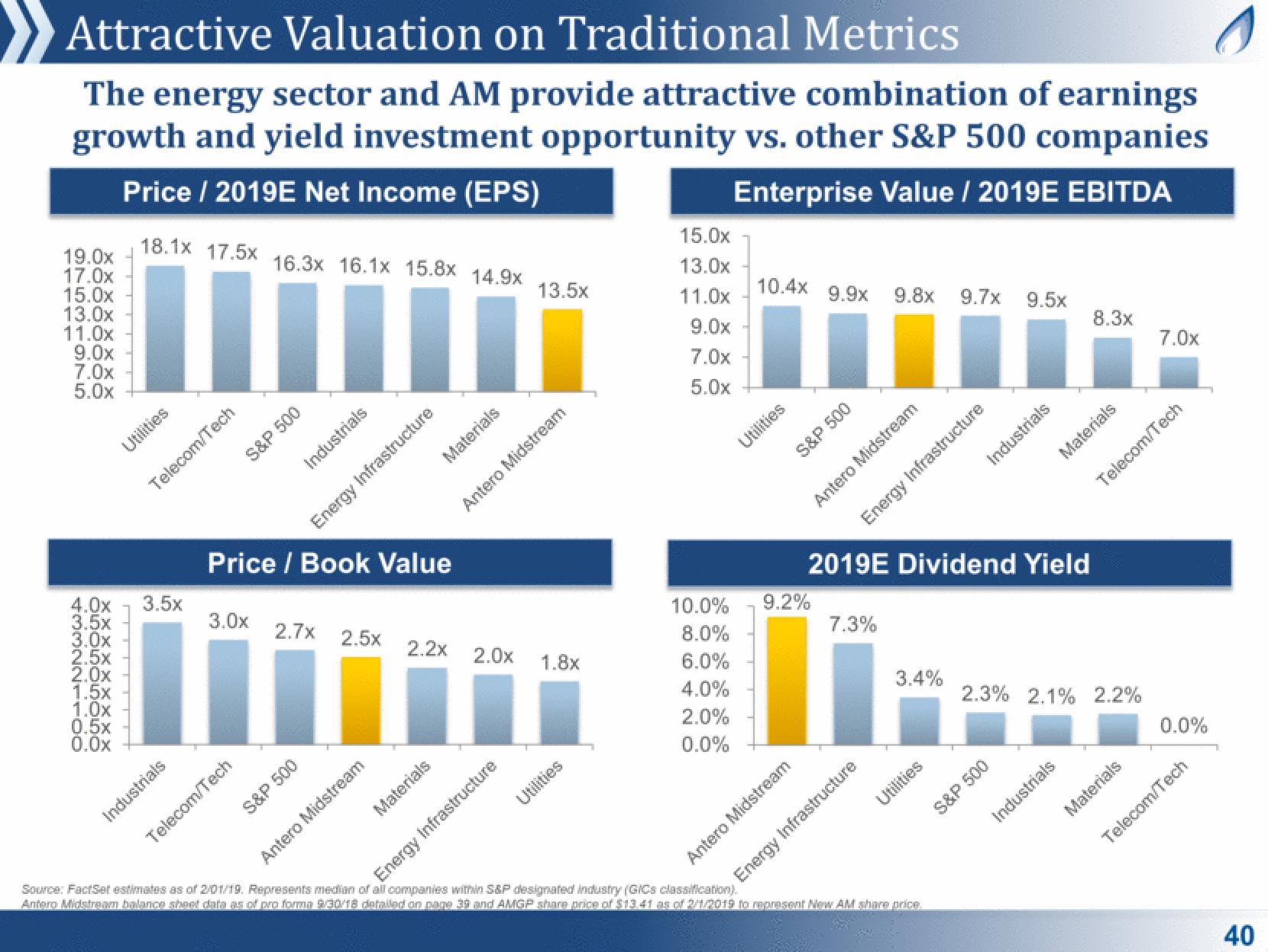

Attractive Valuation on Traditional Metrics

The energy sector and AM provide attractive combination of earnings

growth and yield investment opportunity vs. other S&P 500 companies

Price / 2019E Net Income (EPS)

Enterprise Value / 2019E EBITDA

18.1x 17.5x

19.0x

17.0x

15.0x

13.0x

11.0x

9.0x

7.0x

5.0x

Utilities

1.5x

1.0x

0.5x

0.0x

Telecom/Tech

4.0x 3.5x

3.5x -

3.0x -

2.5x

2.0x-

Industrials

3.0x

16.3x 16.1x 15.8x 14.9x

S&P 500

Telecom/Tech

Industrials

Price / Book Value

S&P 500

2.7x 2.5x

Energy Infrastructure

Materials

Antero Midstream

2.2x

Materials

13.5x

Antero Midstream

2.0x 1.8x

Utilities

Energy Infrastructure

15.0x

13.0x

11.0x

9.0x

7.0x

5.0x

10.4x 9.9x

S&P 500

10.0% 9.2%

8.0%

6.0%

4.0%

2.0%

0.0%

Antero Midstream

Antero Midstream

9.8x 9.7x 9.5x

7.3%

2019E Dividend Yield

Energy Infrastructure

3.4%

Energy Infrastructure

Source: FactSet estimates as of 2/01/19. Represents median of all companies within S&P designated industry (GICs classification).

Antero Midstream balance sheet data as of pro forma 9/30/18 detailed on page 39 and AMGP share price of $13.41 as of 2/1/2019 to represent New AM share price.

Industrials

S&P 500

Materials

8.3x

2.3% 2.1% 2.2%

Industrials

Telecom/Tech

7.0x

Materials

0.0%

Telecom/Tech

40View entire presentation