Affirm Results Presentation Deck

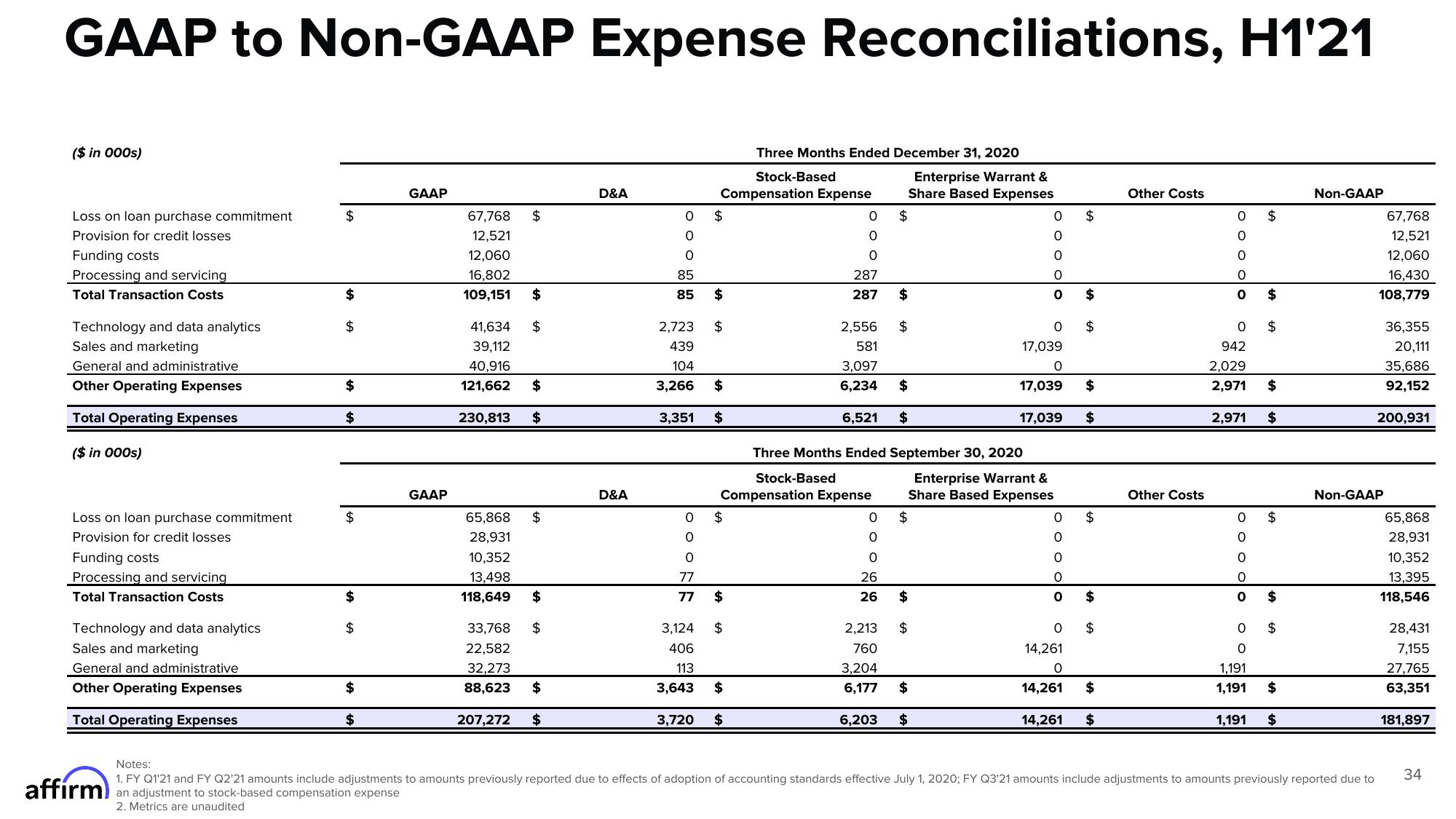

GAAP to Non-GAAP

($ in 000s)

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Other Operating Expenses

Total Operating Expenses

($ in 000s)

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Other Operating Expenses

Total Operating Expenses

Non-GAAP Expense Reconciliations, H1'21

$

$

$

$

$

$

$

$

$

$

GAAP

GAAP

67,768 $

12,521

12,060

16,802

109,151

$

41,634 $

39,112

40,916

121,662 $

230,813 $

65,868 $

28,931

10,352

13,498

118,649 $

33,768 $

22,582

32,273

88,623

$

207,272 $

D&A

D&A

சு எ 0 0 0

85

85

O

O

0

77

77

Compensation Expense

$

$

2,723

439

104

3,266 $

3,351 $

$

Three Months Ended December 31, 2020

Stock-Based

$

$

3,124 $

406

113

3,643 $

3,720 $

0

0

O

Stock-Based

287

287

2,556

581

3,097

6,234

6,521

Compensation Expense

Enterprise Warrant &

Share Based Expenses

$

0

0

0

26

26

$

$

Three Months Ended September 30, 2020

$

$

$

$

O O O O O

Enterprise Warrant &

Share Based Expenses

$

2,213

760

3,204

6,177

$

6,203 $

0 $

17,039

0

17,039

17,039

$

lo

tA

$

14,261

$

0 $

0

$

tA

$

0 $

14,261

0

14,261

$

$

Other Costs

Other Costs

0 $

O O O O O

0 $

942

2,029

2,971 $

2,971 $

O O O OC

$

0 $

0

LA

$

$

LA

1,191

1,191

1,191 $

$

Non-GAAP

67,768

12,521

12,060

16,430

108,779

affirm)

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020; FY Q3'21 amounts include adjustments to amounts previously reported due to

an adjustment to stock-based compensation expense

2. Metrics are unaudited

Non-GAAP

36,355

20,111

35,686

92,152

200,931

65,868

28,931

10,352

13,395

118,546

28,431

7,155

27,765

63,351

181,897

34View entire presentation