Acquisition of ECM Transport Group

DISCIPLINED CAPITAL ALLOCATION

Continual and Consistent Investment in the 5Ts + S

▪ Reinvestments in new, feature rich trucks and trailers, including the latest

safety technology, that extend sustainable competitive advantages for

customers and drivers

▪ Werner Edge enhanced IT (better, faster, less expensive, more secure)

Priorities

Committed to Returning Cash to Shareholders

▪ 130K shares purchased for $5.5M in 1Q21, average price per share of $42

▪ Continued quarterly dividends since July 1987; raised quarterly dividend by

11% in 1Q21 and another 20% in 2Q21

▪ Will continue to consider bolt-on strategic acquisitions

■

Maintain a Strong and Flexible Financial Position

▪ Debt of $175M, Equity of $1.228B (as of 3/31/21)

▪ New loan borrowing of $100M for ECM acquisition 6/30/21

Long-term goal of net debt to EBITDA of 0.5x to 1.0x

WERNER

WE KEEP AMERICA MOVINGⓇ

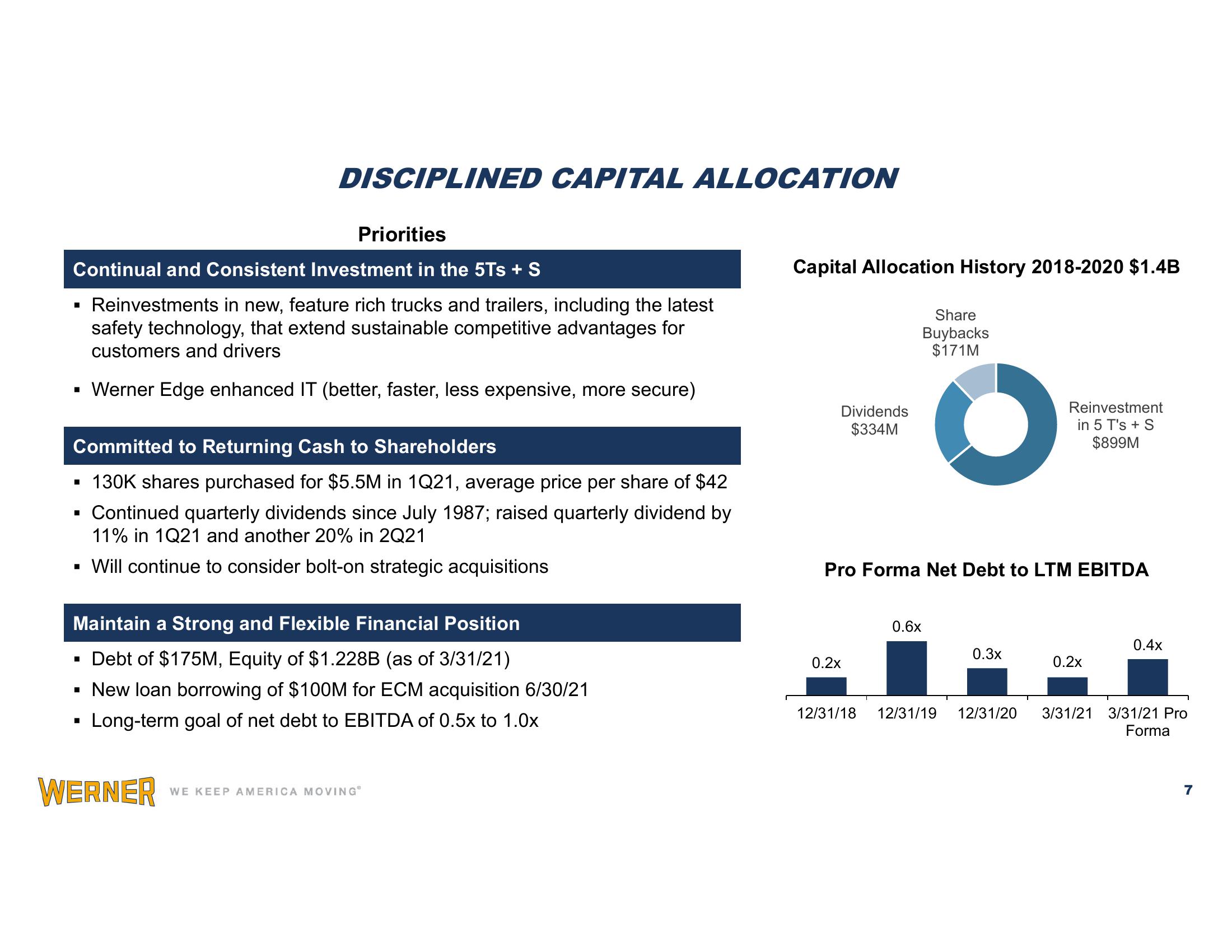

Capital Allocation History 2018-2020 $1.4B

Dividends

$334M

0.2x

Share

Buybacks

$171M

Pro Forma Net Debt to LTM EBITDA

0.6x

0.3x

Reinvestment

in 5 T's + S

$899M

12/31/18 12/31/19 12/31/20

0.2x

0.4x

3/31/21 3/31/21 Pro

Forma

7View entire presentation