Moelis & Company Investment Banking Pitch Book

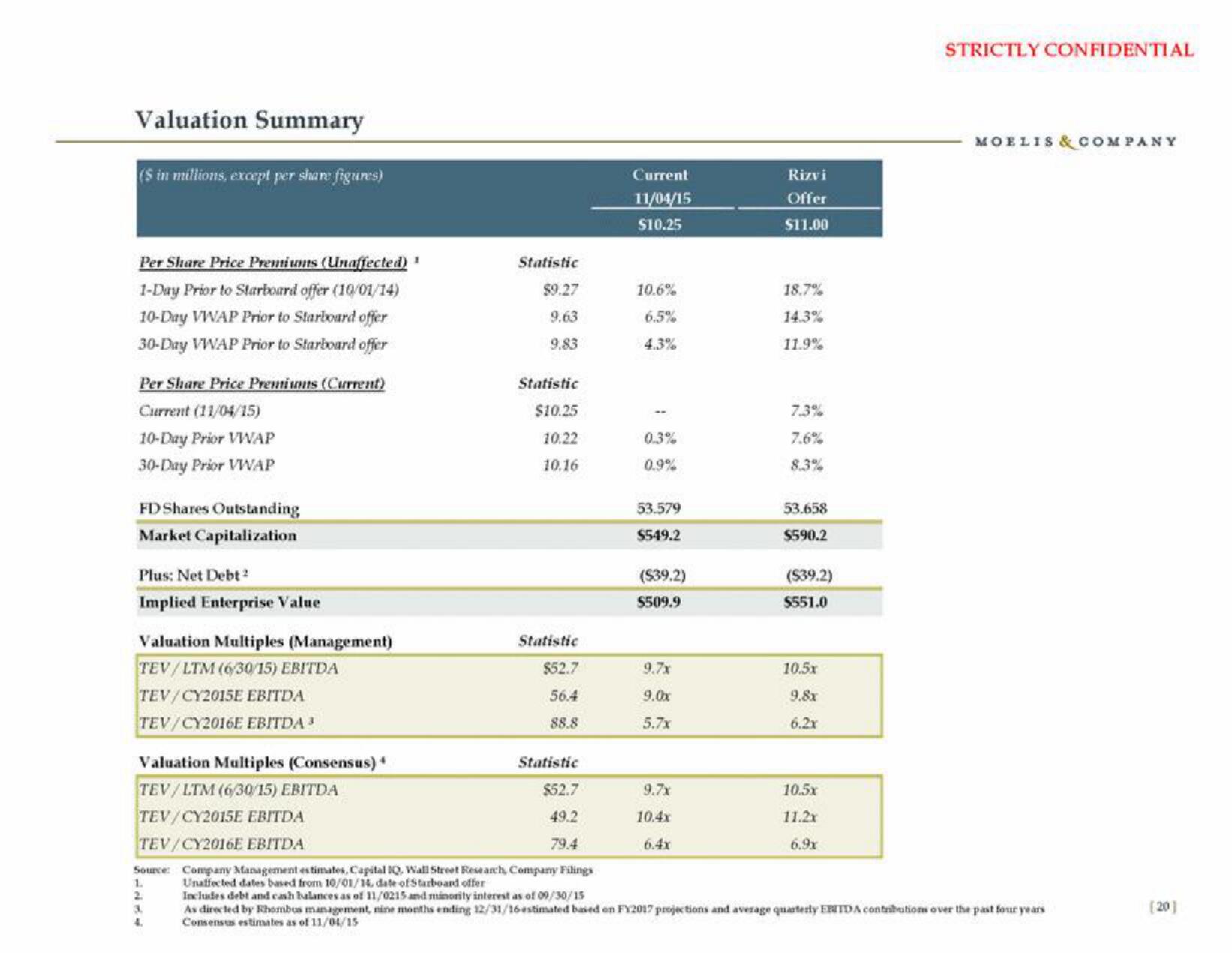

Valuation Summary

(S in millions, except per share figures)

Per Share Price Premiums (Unaffected) ¹

1-Day Prior to Starboard offer (10/01/14)

10-Day VWAP Prior to Starboard offer

30-Day VWAP Prior to Starboard offer

Per Share Price Premiums (Current)

Current (11/04/15)

10-Day Prior VWAP

30-Day Prior VWAP

FD Shares Outstanding

Market Capitalization

Plus: Net Debt 2

Implied Enterprise Value

Valuation Multiples (Management)

TEV/LTM (6/30/15) EBITDA

TEV/CY2015E EBITDA

TEV/CY2016E EBITDA 3

Valuation Multiples (Consensus)

TEV/LTM (6/30/15) EBITDA

TEV/CY2015E EBITDA

TEV/CY2016E EBITDA

Statistic

$9.27

9.63

9.83

1.

2.

3.

4.

Statistic

$10.25

10.22

10.16

Statistic

$52.7

56.4

88.8

Current

11/04/15

$10.25

10.6%

6.5%

4.3%

0.3%

0.9%

53.579

$549.2

($39.2)

$509.9

9.7x

9.0x

5.7x

Rizvi

Offer

$11.00

9.7x

10.4x

6.4x

18.7%

14.3%

11.9%

7.3%

7.6%

8.3%

53.658

$590.2

($39.2)

$551.0

1051

9.8x

6.2x

Statistic

$52.7

49.2

79.4

Source: Company Management estimates, Capital IQ, Wall Street Research, Company Filings

Unaffected dates based from 10/01/14, date of Starboard offer

Includes debt and cash balances as of 11/0215 and minority interest as of 09/30/15

As directed by Rhombus management, nine months ending 12/31/16 estimated based on FY2017 projections and average quarterly FRIIDA contributions over the past four years

Consensus estimates as of 11/04/15

STRICTLY CONFIDENTIAL

105.

11.2x

6.9x

MOELIS & COMPANY

[20]View entire presentation