Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

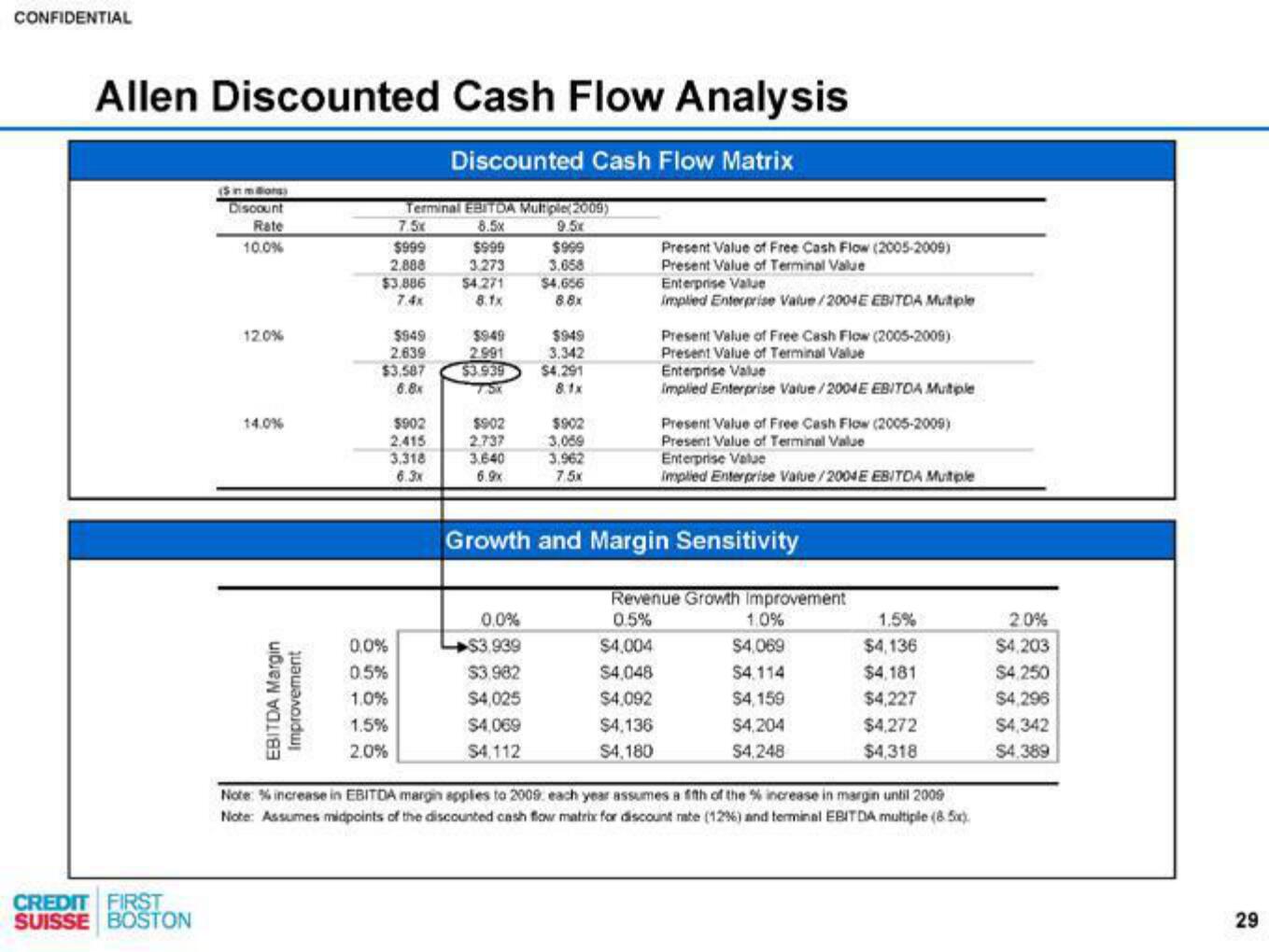

Allen Discounted Cash Flow Analysis

Discounted Cash Flow Matrix

CREDIT FIRST

SUISSE BOSTON

(5 inm Bons)

Discount

Rate

10.0%

12.0%

14.0%

EBITDA Margin

Improvement

7.5x

$999

2.888

$3,886

7.4x

Terminal EBITDA Multiple(2009)

8.5x

9.5x

$949

2.639

$3.587

6.8x

0.0%

0.5%

1.0%

1.5%

2.0%

$902

2.415

3.318

6.3x

$999

3.273

$4.271

8.1x

$949

2.991

$3.939

7.5x

$902

2.737

3.640

6.9x

$999

3.658

$4.656

8.8x

0.0%

$3.939

$3,982

$4,025

$4,069

$4,112

$949

3.342

$4,291

8.1x

$902

3,059

3.962

7.5x

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

implied Enterprise Value/2004E EBITDA Mutiple

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004E EBITDA Multiple

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004E EBITDA Multiple

Growth and Margin Sensitivity

Revenue Growth Improvement

1.0%

0.5%

$4,004

$4,069

$4,048

$4.114

$4,092

$4,159

$4,136

$4,180

$4,204

$4,248

1.5%

$4,136

$4,181

$4,227

$4,272

$4,318

Note: % increase in EBITDA margin applies to 2009. each year assumes a fifth of the % increase in margin until 2009

Note: Assumes midpoints f the discounted cash flow matrix for scount nate (12%) and terminal i BITDA multiple (8.5xx)

2.0%

$4,203

$4,250

$4,296

$4,342

$4,389

29View entire presentation