Barclays Investment Banking Pitch Book

Overview of the Proposed Transaction

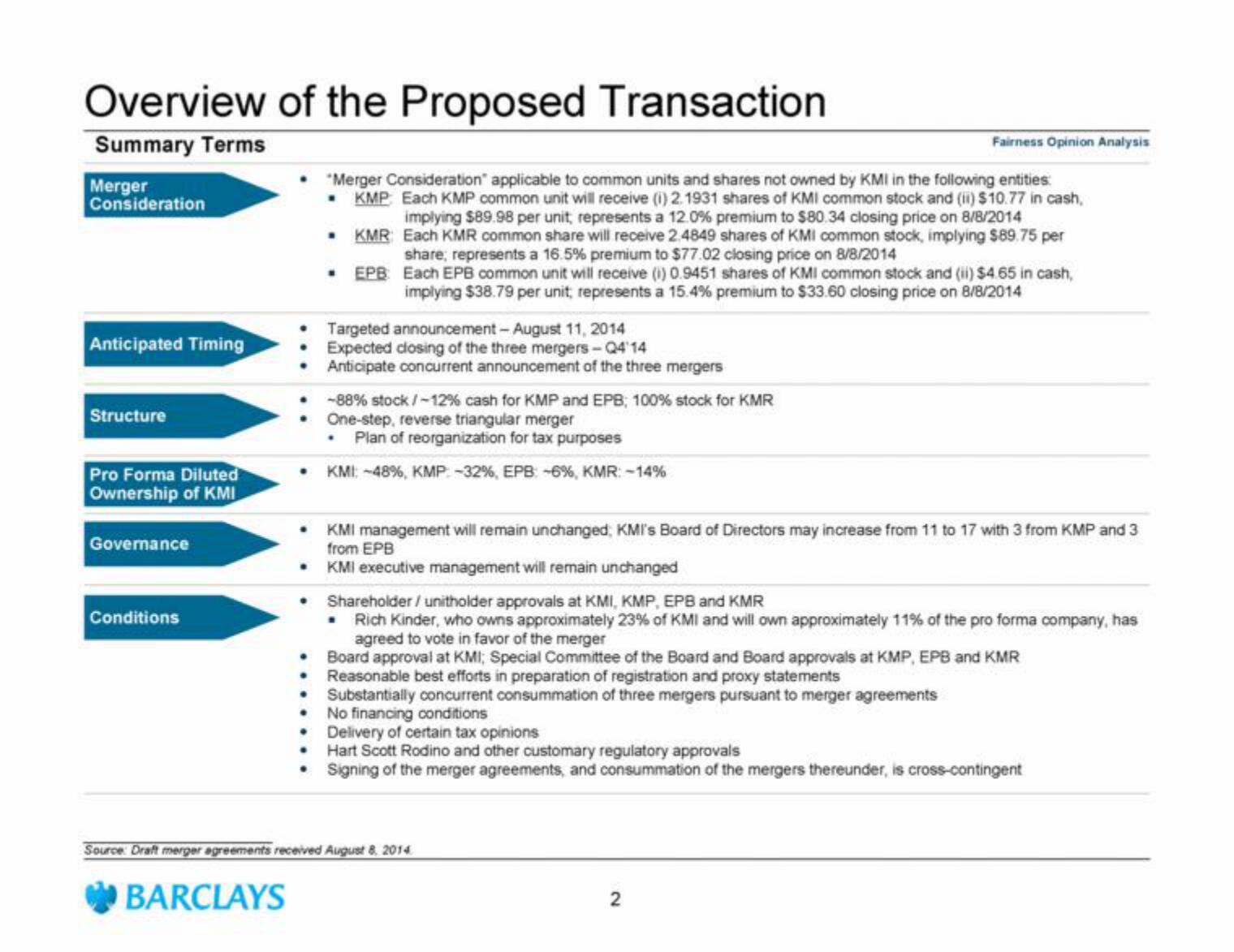

Summary Terms

Merger

Consideration

Anticipated Timing

Structure

Pro Forma Diluted

Ownership of KMI

Governance

Conditions

Fairness Opinion Analysis

• "Merger Consideration applicable to common units and shares not owned by KMI in the following entities:

KMP Each KMP common unit will receive (1) 2.1931 shares of KMI common stock and (ii) $10.77 in cash,

implying $89.98 per unit, represents a 12.0% premium to $80.34 closing price on 8/8/2014

. KMR

Each KMR common share will receive 2.4849 shares of KMI common stock, implying $89.75 per

share, represents a 16.5% premium to $77.02 closing price on 8/8/2014

. EPB

Each EPB common unit will receive () 0.9451 shares of KMI common stock and (ii) $4.65 in cash,

implying $38.79 per unit, represents a 15.4% premium to $33.60 closing price on 8/8/2014

BARCLAYS

Targeted announcement- August 11, 2014

Expected closing of the three mergers - Q4'14

Anticipate concurrent announcement of the three mergers

-88% stock / -12% cash for KMP and EPB, 100% stock for KMR

One-step, reverse triangular merger

Plan of reorganization for tax purposes

KMI: -48%, KMP: -32% , EPB: -6%, KMR: -14%

KMI management will remain unchanged, KMI's Board of Directors may increase from 11 to 17 with 3 from KMP and 3

from EPB

KMI executive management will remain unchanged

Shareholder / unitholder approvals at KMI, KMP, EPB and KMR

Rich Kinder, who owns approximately 23% of KMI and will own approximately 11% of the pro forma company, has

agreed to vote in favor of the merger

Board approval at KMI; Special Committee of the Board and Board approvals at KMP, EPB and KMR

Reasonable best efforts in preparation of registration and proxy statements

Substantially concurrent consummation of three mergers pursuant to merger agreements

• No financing conditions

Delivery of certain tax opinions

Hart Scott Rodino and other customary regulatory approvals

Signing of the merger agreements, and consummation of the mergers thereunder, is cross-contingent

Source: Draft merger agreements received August 8, 2014

2View entire presentation