Netstreit IPO Presentation Deck

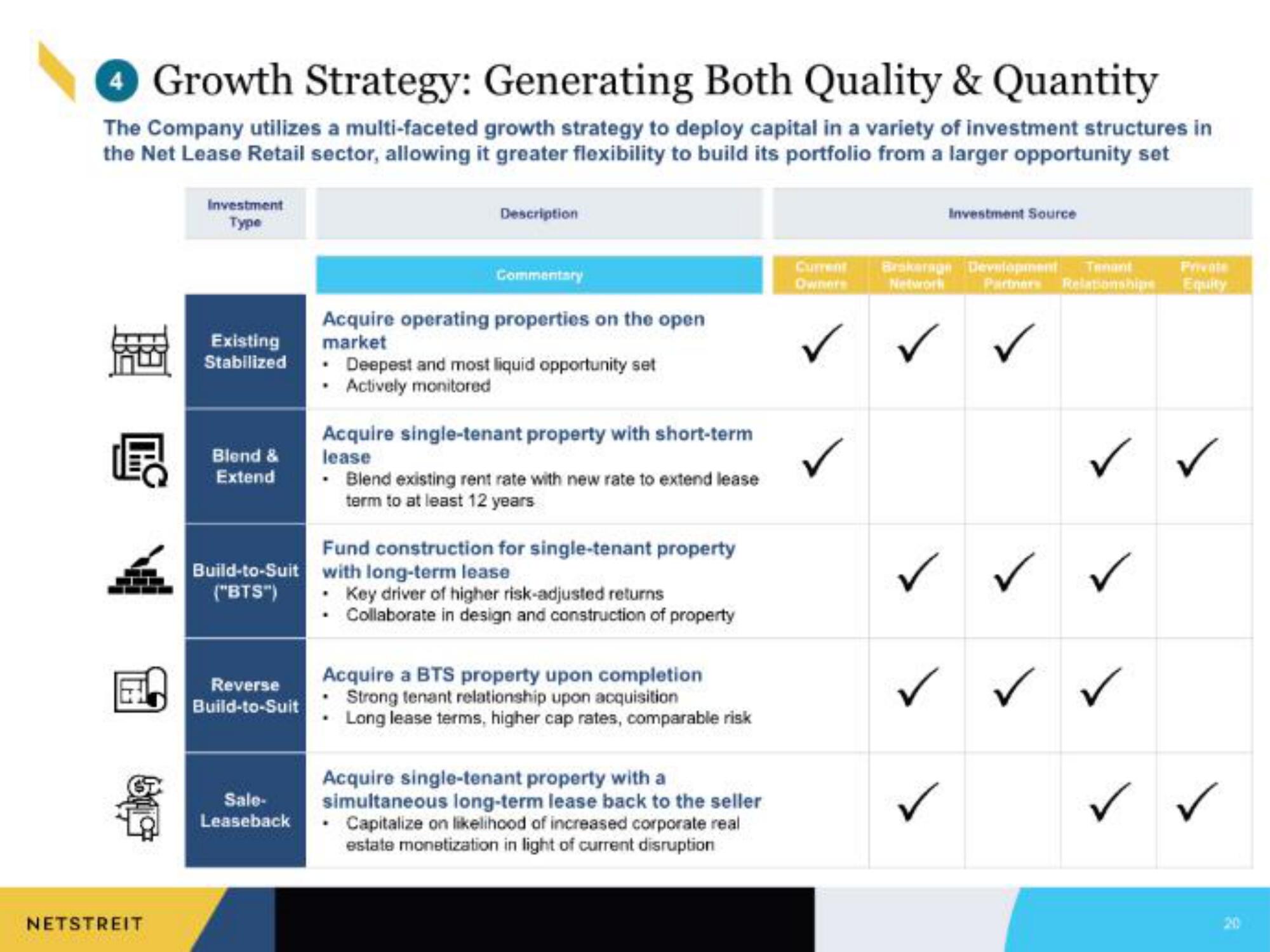

4 Growth Strategy: Generating Both Quality & Quantity

The Company utilizes a multi-faceted growth strategy to deploy capital in a variety of investment structures in

the Net Lease Retail sector, allowing it greater flexibility to build its portfolio from a larger opportunity set

聰

big

NETSTREIT

Investment

Type

Existing

Stabilized

Blend &

Extend

Build-to-Suit

("BTS")

Reverse

Build-to-Suit

Sale-

Leaseback

Description

Commentary

Acquire operating properties on the open

market

• Deepest and most liquid opportunity set

• Actively monitored

Acquire single-tenant property with short-term

lease

• Blend existing rent rate with new rate to extend lease

term to at least 12 years

Fund construction for single-tenant property

with long-term lease

• Key driver of higher risk-adjusted returns

Collaborate in design and construction of property

Acquire a BTS property upon completion

. Strong tenant relationship upon acquisition

• Long lease terms, higher cap rates, comparable risk

Acquire single-tenant property with a

simultaneous long-term lease back to the seller

Capitalize on likelihood of increased corporate real

estate monetization in light of current disruption

Current

Owners

✓ ✓

✓

Brokerage Development Tenant

Network

✓

Investment Source

✓

Private

Partners Relationship Equity

✓

✓ ✓

20View entire presentation