Evercore Investment Banking Pitch Book

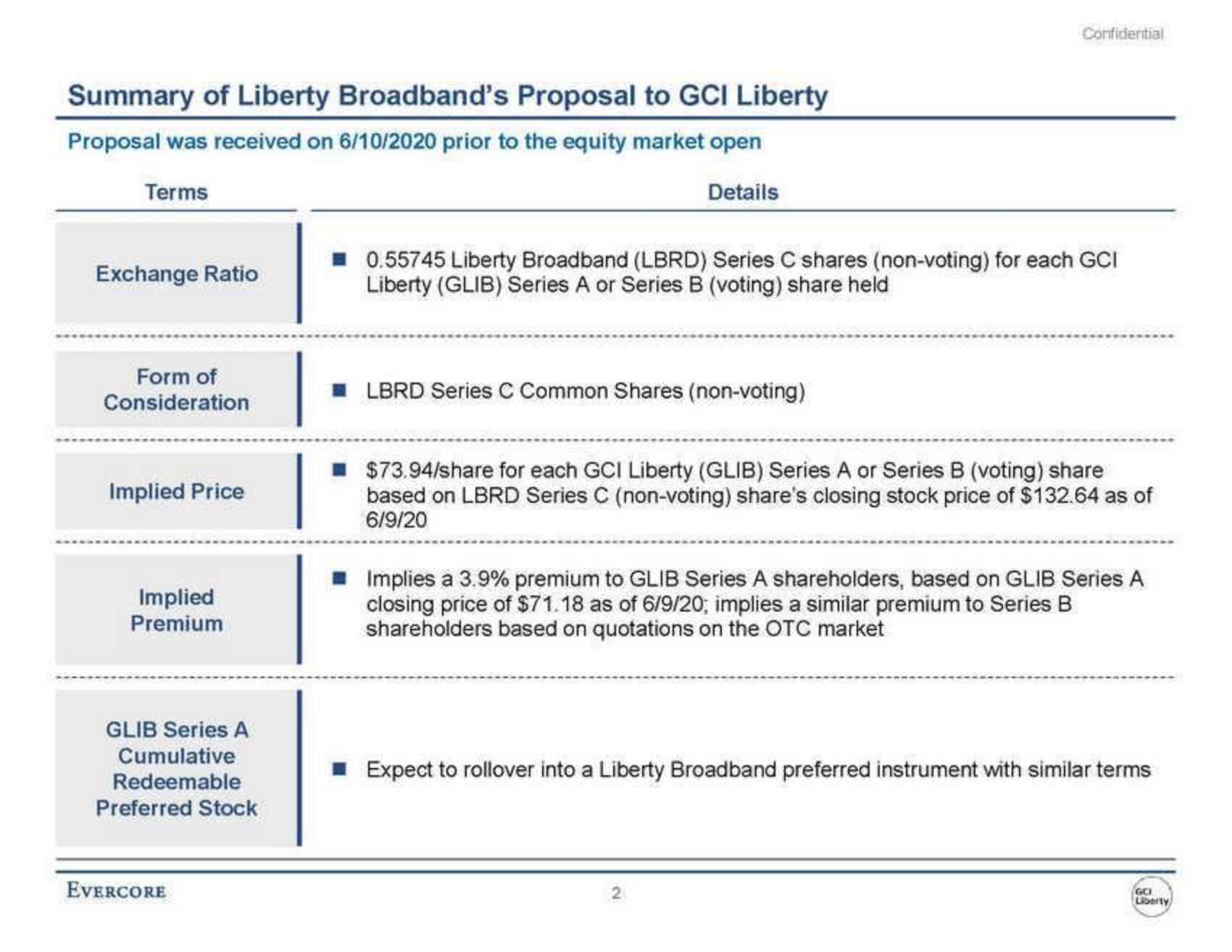

Summary of Liberty Broadband's Proposal to GCI Liberty

Proposal was received on 6/10/2020 prior to the equity market open

Terms

Details

Exchange Ratio

Form of

Consideration

Implied Price

Implied

Premium

GLIB Series A

Cumulative

Redeemable

Preferred Stock

EVERCORE

Confidential

0.55745 Liberty Broadband (LBRD) Series C shares (non-voting) for each GCI

Liberty (GLIB) Series A or Series B (voting) share held

LBRD Series C Common Shares (non-voting)

$73.94/share for each GCI Liberty (GLIB) Series A or Series B (voting) share

based on LBRD Series C (non-voting) share's closing stock price of $132.64 as of

6/9/20

Implies a 3.9% premium to GLIB Series A shareholders, based on GLIB Series A

closing price of $71.18 as of 6/9/20; implies a similar premium to Series B

shareholders based on quotations on the OTC market

☐ Expect to rollover into a Liberty Broadband preferred instrument with similar terms

GCI

LibertyView entire presentation